African Startups Secure $460M in Q1 as Fintech Leads, Gender Gap Persists | News Ghana

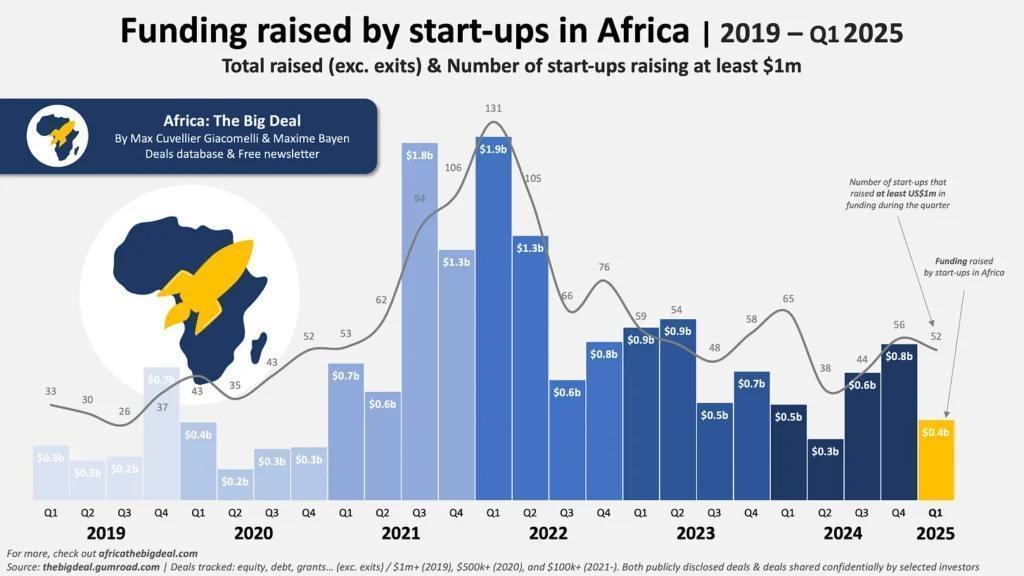

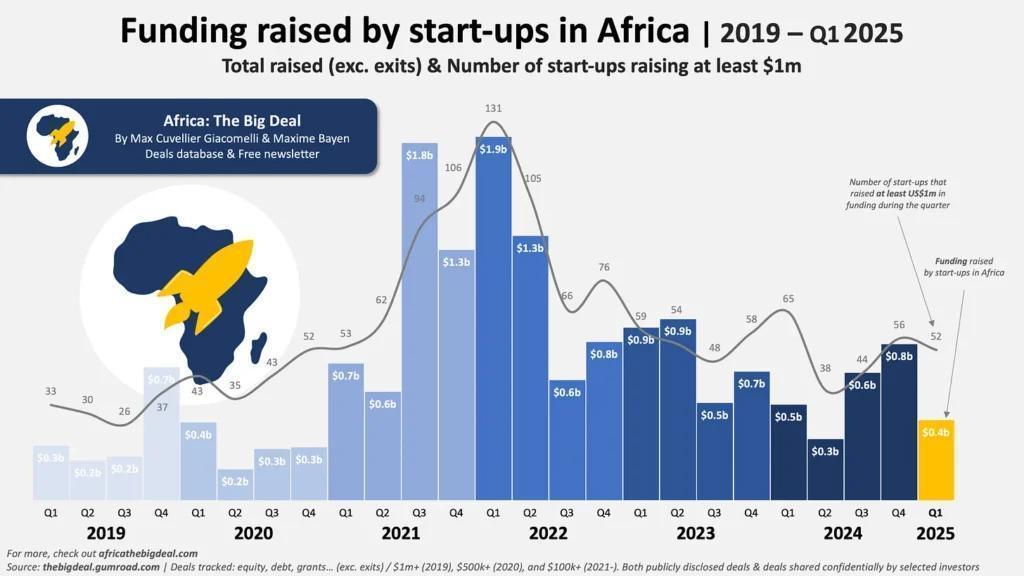

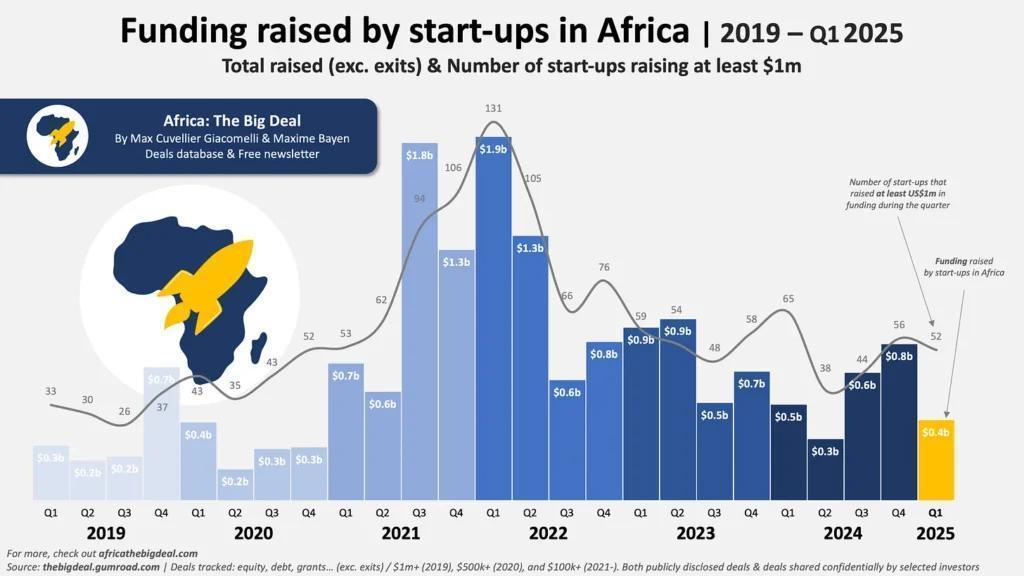

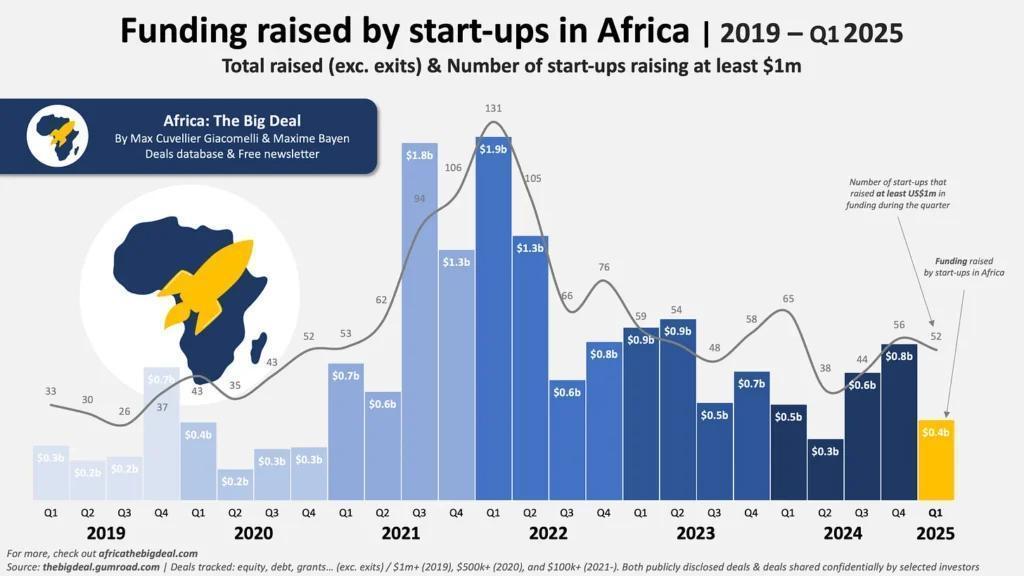

While the figure represents the second-lowest quarterly total since late 2020, investor interest in scalable ventures remained steady, with 52 startups securing deals of $1 million or more—consistent with the two-year average.

Kenya, Nigeria, South Africa, and Egypt continued to dominate fundraising, collectively attracting 83% of total investment. Kenya and Nigeria each claimed 24%, followed by South Africa (22%) and Egypt (14%). Togo emerged as an outlier, ranking fifth after mobility platform Gozem secured a $30 million Series B round, its largest single deal.

Fintech retained its position as the most funded sector, capturing 46% of total capital. Major raises included $53 million for cross-border payments firm LemFi and $38 million for South African insurtech startup Naked. Energy and logistics followed at 18% and 10%, respectively, reflecting growing investment in grid solutions and supply chain innovation.

The quarter also underscored entrenched gender disparities. Startups led by female CEOs received just 2% of total funding—approximately $10 million—with the largest allocation being a $6.2 million grant to South African biotech firm African Biologics. Excluding grants, female-led ventures accounted for a mere 0.7% of capital. Overall, all-male founding teams secured 67% of funding, while gender-diverse teams claimed 20%. Solo male founders received 11%, compared to 1% for solo female founders or all-female teams.

The persistent funding gap highlights systemic barriers facing women entrepreneurs in Africa’s tech ecosystem, despite incremental gains in gender-diverse team investments. Similar disparities have been documented since at least 2020, when female founders received 1.2% of total venture capital, per Africa: The Big Deal reports. Sectoral concentration remains another concern: fintech’s dominance—while aligned with Africa’s digital finance boom—risks overshadowing high-potential fields like climate tech and healthcare.

Geographic inequality persists as well. The “Big Four” nations have consistently captured over 75% of funding since 2021, raising questions about support for startups in smaller markets. While outliers like Togo demonstrate sporadic progress, analysts argue broader regional diversification is critical for continent-wide economic resilience. As investors eye Q2, balancing scalable returns with equitable capital distribution may determine whether Africa’s startup boom evolves into an inclusive transformation.

Follow on Google News