XRP News Today: XRP Would Have Made You Billions-Ripple Insider Breaks Down Missed Opportunity vs. Bitcoin

A former Ripple executive has reignited debate in the crypto investment community by revealing how choosing XRP over Bitcoin could have resulted in billions more in profits for institutional investors.

The bold claim, backed by data, comes as XRP gains fresh attention following its latest rally and increasing adoption across global finance.

Matt Hamilton, former Director of Developer Relations at Ripple and now with ASIMOV Protocol, recently published a striking comparison between Bitcoin and XRP investments—specifically analyzing MicroStrategy’s extensive BTC holdings.

Matt Hamilton stated that if MicroStrategy had invested in XRP instead of Bitcoin, its portfolio would be worth nearly twice as much today. Source: Matt Hamilton via X

Hamilton simulated what would have happened if MicroStrategy (now rebranded as “Strategy”) had invested the same capital into XRP rather than Bitcoin. The result? XRP would have returned nearly $129 billion, compared to the $72.2 billion valuation of its current Bitcoin portfolio. This highlights a missed opportunity of approximately $56.8 billion. “This doesn’t even account for the potential price increase XRP could have seen with the kind of institutional exposure Bitcoin got,” Hamilton noted.

This analysis adds fuel to an ongoing discussion about XRP’s underappreciated performance and utility within the crypto ecosystem.

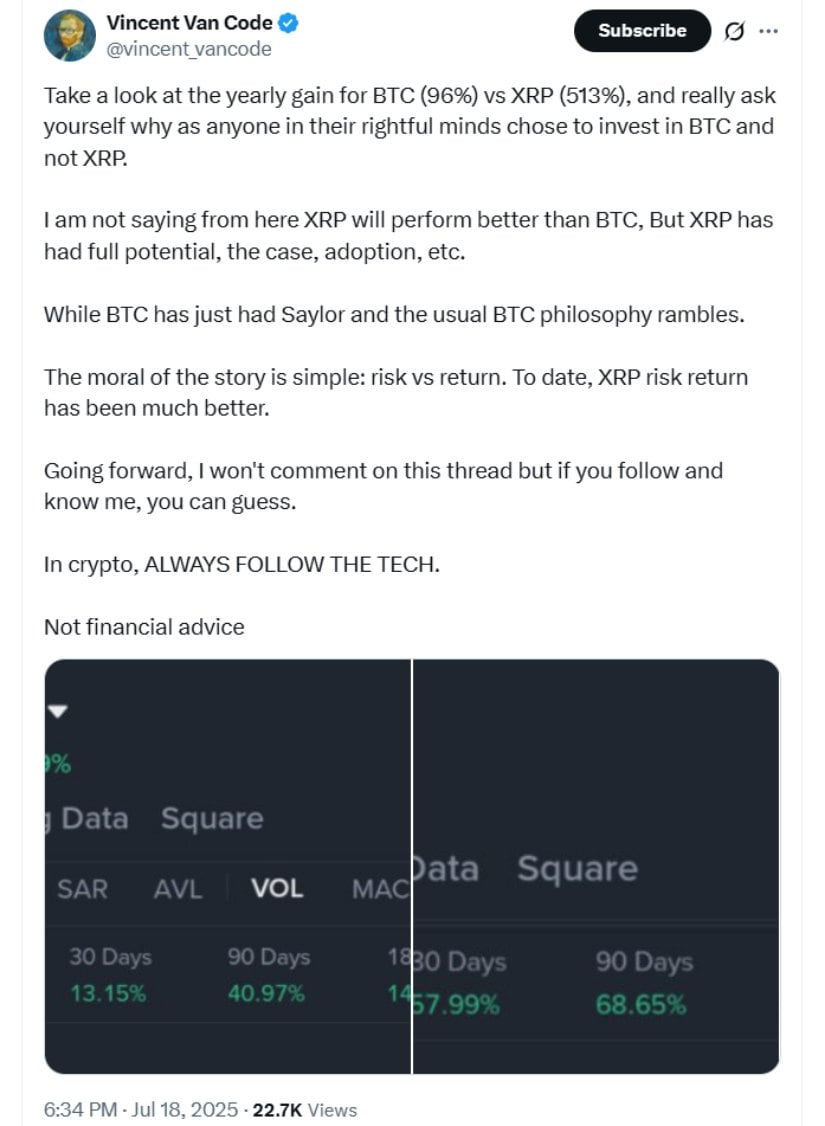

XRP has outperformed Bitcoin in 2025 by a significant margin. According to Vincent Van Code, XRP’s yearly gain stands at 513%, while Bitcoin has managed 96%. This performance comes amid increased adoption of Ripple’s technology, especially in the cross-border payment sector.

Vincent Van Code highlighted that XRP delivered a 513% yearly gain compared to Bitcoin’s 96%, arguing that XRP has historically offered a far superior risk-to-return profile. Source: Vincent Can Code via X

Ripple’s Q3 2024 report stated that over $30 billion in transactions were processed via its network. XRP now supports infrastructure for more than 300 financial institutions, including major players like Santander, further solidifying its use case as more than a speculative asset.

This stands in contrast to Bitcoin, which, while widely adopted as a store of value, remains under scrutiny for volatility and environmental impact. MicroStrategy, spearheaded by Michael Saylor, holds over 601,550 BTC, yet XRP’s recent traction suggests growing competition for capital in the crypto treasury space.

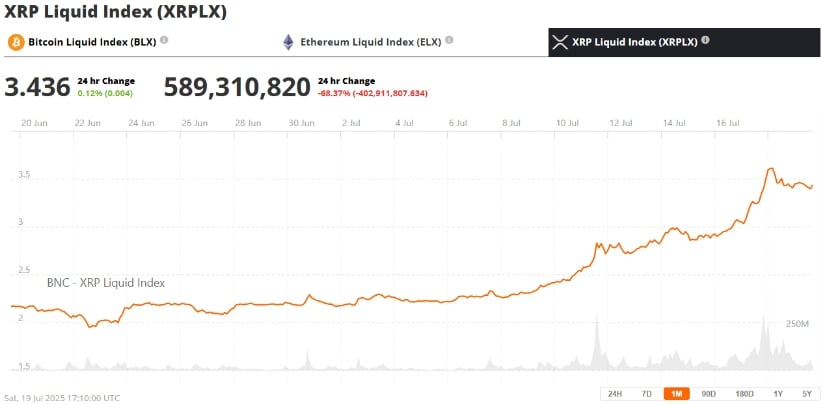

The recent surge in XRP price saw the token reach a new high of $3.70, surpassing its 2018 peak of $3.40. However, current technical indicators show that XRP may be entering a short-term correction phase.

XRP was trading at around $3.43, up 0.12% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Analysts observed a falling star candlestick pattern, often seen as a warning of near-term bearish momentum. The Relative Strength Index (RSI) also surged to 88, signaling overbought conditions. As of now, the price of XRP today hovers around $3.45, maintaining strong weekly gains despite a minor pullback.

However, historical data suggests that overbought RSI levels during strong uptrends, especially on weekly charts, don’t necessarily indicate an imminent crash. As traders monitor accumulation zones, many see this as a healthy consolidation within a broader bullish structure.

Hamilton’s report coincides with a growing number of companies turning to XRP for treasury holdings. Everything Blockchain recently announced plans to acquire $10 million in XRP, following in the footsteps of Webus International, Trident, and others. The move signals institutional confidence in the long-term worth of XRP, especially after the 2023 XRP lawsuit update eliminated its regulatory uncertainty.

This strategic change can potentially reshape treasury models beyond Bitcoin, especially with corporations seeking assets with real-world applications and regulatory clarity.

XRP’s resurgence traces back to the 2023 SEC ruling, where the court clarified that XRP is not a security—a turning point that re-established investor trust. This clarity has differentiated Ripple Labs and the XRP Ledger from many other altcoins still grappling with U.S. regulatory ambiguity.

XRP has broken above its 2018 high, turning key resistance into support and signaling a powerful bullish breakout, with $10 now emerging as the next major target. Source: HexaTrades on TradingView

This development gave rise to a new wave of bullish XRP predictions, with analysts issuing XRP price prediction 2025 targets in the $5–$7 range. Longer-term XRP price prediction 2030 models forecast figures as high as $10–$15, depending on broader market conditions and further utility-driven adoption.

XRP’s compelling combination of utility, adoption, and now strong price action has led many to reassess its role in the digital asset landscape. With momentum building and institutional interest rising, XRP is no longer seen as just an alternative to Bitcoin—but a leading contender for the future of global finance.

As Hamilton’s analysis shows, XRP may have been overlooked, but the tide appears to be turning. For investors and institutions alike, the real question is no longer “Why XRP?” but “Why not XRP?”

Recommended Articles

Bitcoin News Today: Trump Media to Acquire $2.5 Billion in Bitcoin

Bitcoin News Today: Trump Media to Acquire $2.5 Billion in Bitcoin

Have we forgotten the point of stablecoins? | Opinion

We need to see more innovation happening outside of traditional finance to help those who could benefit the most from st...

Tim Draper: Macroeconomic Factors Will Disrupt BTC Four-Year Cycle

Venture capitalist Tim Draper tells Cointelegraph that deteriorating fiat currencies and macro factors will likely disru...

Crypto: ETH ETFs Surpass BTC ETFs For The First Time

For the first time, Ethereum ETFs have surpassed Bitcoin ETFs in daily inflows. A major turning point for crypto finance...

Charles Schwab Enters Crypto War, Launching Spot Bitcoin & Ethereum Trading

The post Charles Schwab Enters Crypto War, Launching Spot Bitcoin & Ethereum Trading appeared first on Coinpedia Fintech...

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...