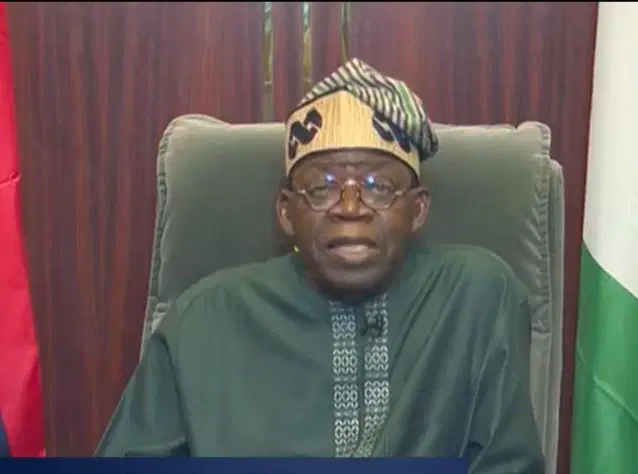

Tinubu issues executive order to cut oil sector costs, boost investment

President Bola Tinubu has signed a new Executive Order targeting cost reduction, increased investment, and higher revenue returns. According to the President, the decision is a bold step to drive efficiency and revive investor confidence in Nigeria’s oil and gas sector,

The Office of the Special Adviser to the President on Energy, in a statement by Senan Murray on Friday, explained that the new Executive Order builds on previous reforms introduced in 2024, which enhanced fiscal terms, streamlined project timelines, and aligned local content requirements with international standards.

The directive titled ‘Upstream Petroleum Operations Cost Efficiency Incentives Order, 2025’, introduces a framework of performance-based tax incentives aimed at rewarding operators who achieve measurable cost savings in their oil and gas projects.

According to the Order, companies that meet or exceed industry cost-efficiency benchmarks, set annually by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), will be eligible for significant fiscal rewards. These benchmarks will vary by terrain – onshore, shallow water, and deep offshore.

Crucially, the new regime allows qualifying companies to retain 50 per cent of the incremental government revenue generated from their cost savings. However, to preserve public revenue, available tax credits will be capped at 20 per cent of a company’s annual tax liability.

“This is not about charity, it’s about value,” President Tinubu stated. “Nigeria must attract investment based on a credible promise of returns. This Order signals to the world that our oil and gas sector is being reformed to become efficient, competitive, and beneficial to all Nigerians. Every barrel must count, for jobs, growth, and our national future.”

To ensure smooth and effective implementation, the President has tasked his Special Adviser on Energy, Mrs. Olu Verheijen, with overseeing inter-agency coordination and driving alignment across key government institutions.

“This reform is not just about slashing costs. It’s a strategic effort to make Nigeria’s upstream sector globally competitive and fiscally resilient”.

By incentivising efficiency, we are boosting investor confidence and ensuring greater value for the Nigerian people,” Verheijen emphasised. Despite pledges from the Nigerian National Petroleum Company Limited (NNPC) as far back as 2020 to reduce the per-barrel cost of oil production to $10, the reality has been grim as operators record production costs as high as $48 for a barrel.

In the first half of 2024 alone, Nigeria’s oil production costs surged to $11.4 billion, compared to total revenue of $19.5 billion generated from the 235.9 million barrels of crude oil produced in that period. This translated into a worrying production cost-to-revenue ratio of 58.46 per cent.

Put simply, for every dollar Nigeria earned from oil, over half went back into covering production expenses.The cost per barrel, currently standing at $48, is among the highest in the world,

Chairman of the House of Representatives Committee on Finance, James Faleke, had described Nigeria’s production costs as unsustainably high, warning that they place the country at a competitive disadvantage in global markets.

Chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, had also confirmed that oil companies operating in Nigeria reported an average production cost of $48.71 per barrel, a figure that contrasts with the $10 goal set by the NNPC five years ago.

With oil price currently hovering at about $65 per barrel, it means that Nigeria is only earning about $17 dollars from every barrel, a development which remains a serious concern for the country’s foreign exchange crisis and further investment.

Industry experts believe the new framework could help reshape Nigeria’s troubled oil sector. Partner at Kreston Pedabo, Olufemi Idowu, noted that the tax incentives could promote efficient operations and encourage better cost management.

According to him, if companies successfully keep their costs below set benchmarks, they stand to benefit significantly from tax credits. He added that while the government has laid the groundwork, the real challenge now lies with the oil-producing companies themselves, who must optimise their operations to unlock the full potential of the incentive scheme.