The Wolf Den #1211 - Sometimes Good Things Happen In Crypto

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

I'm thrilled to officially announce my partnership with Peoples Reserve – a company I connected with after some great conversations and an in-person meeting at the Bitcoin Conference in Vegas. I’m excited to explore everything that Peoples Reserve is building. With Peoples Reserve, users can post Bitcoin as pristine collateral to unlock the purchasing power of their savings without having to give up ownership.

I partnered with Peoples Reserve because they believe that Bitcoin is the most pristine form of collateral in the world, and they are building revolutionary tools to unlock BTC purchasing power by allowing you to simply borrow against it. With Peoples Reserve, you can post BTC as pristine collateral and borrow against it – no rehypothecation, and reduced liquidation risk thanks to variable interest rate mechanisms. It’s a smarter way to access your wealth without selling your Bitcoin.

While the world focuses on Bitcoin’s transformation from “magic internet money” to “digital gold,” the real story is its financialization – from digital gold to pristine collateral. Peoples Reserve is Building Wealth Smarter using Bitcoin Powered Finance⚡️.

Checkout peoplesreserve.com to learn more. It’s awesome.

Usually, when there’s a hack or heist in crypto, the story ends the same way: outrage, despair, and someone tweeting “code is law” while a protocol quietly bleeds out. But every once in a while, something strange happens. The ending isn’t bad. It’s… good. Weirdly good. The kind of ending that makes you pause and wonder if, maybe, this industry is finally growing up.

Aside from the JPMorgan story – which I cover below – and a few smaller headlines, it’s a quiet moment in the space. So I figured: perfect time for a story.

Imagine plugging in your cold wallet and seeing a balance of $0.00.

Your BTC – gone.

Your staked ETH – gone.

Your NFTs – gone.

The wallet you trusted as the safest place to store your crypto – physically secured in your home, with keys you never knowingly shared – completely drained. I honestly can’t imagine the devastation. Not just for myself, but for anyone who finds themselves in that situation. It’s the kind of gut punch that stays with you.

And let’s be honest – it’s not just crypto. Getting scammed is always traumatic. That violation of trust cuts deep, no matter the context.

Unfortunately, scammers target two main groups – and we’re in one of them. They go after older people who struggle with tech and miss the signs of social engineering. And they go after crypto investors: people with self-custodied assets and, sometimes, a shaky understanding of how to truly secure them.

Which brings us to today’s story. I’ll let the victim take it from here.

I have no idea who this individual is, but from everything I’ve seen, they’re sharp. They’ve been in crypto for eight years, held a solid asset, and were actively using DeFi. This wasn’t some clueless newcomer. And yet, reading their post, my heart sank – because I could easily see the same thing happening to me.

I lost funds on Voyager. Different circumstances, same pain. Whether it was FTX, Voyager, BlockFi, a hack, or a scam – anyone who’s lost money in this space knows that feeling. It sticks with you.

In response to the post above, the community quickly rallied behind Khalo. Crypto can be a brutal, unforgiving place – but sometimes, we get glimpses of genuine kindness.

That first post was made on June 3rd at 9:57 a.m. EST. Just a few hours later, at 3:04 p.m., Lukas Schor – co-founder of Safe – replied with this message:

There’s more:

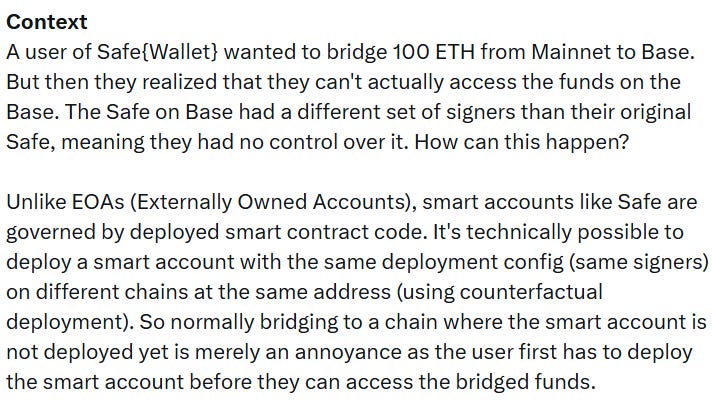

It’s a fairly technical story, so I’ve broken it down as simply as possible. This is just one excerpt from the co-founder’s longer post, but it captures the heart of the issue.

The user tried to bridge 100 ETH from Ethereum Mainnet to Base using their Safe smart wallet.

But when the ETH landed on Base, they couldn’t access it. Why? Because the Safe wallet on Base was set up with different owners (signers) than their original Safe wallet on Mainnet.

Here’s how that could happen.

Safe wallets aren’t like regular wallets – they’re smart contracts with custom rules. Older versions (like the one this user created back in 2020) didn’t prevent someone else from deploying a different Safe with the same address on another chain, but with different owners.

And that’s exactly what happened. On Base, someone had already deployed a Safe wallet at that address – but with different signers – effectively hijacking the wallet and making the funds inaccessible to the original user.

Thankfully, the Safe team jumped in quickly. They discovered that a white-hat group called had already anticipated this exploit and pre-deployed protective Safes on Base to prevent malicious actors from stealing funds via this loophole.

Because of Protofire’s foresight, the Safe team was able to recover and return the 100 ETH.

The root cause? An outdated version of Safe that wasn’t built with cross-chain deployments in mind. Newer versions have patched this issue by preventing conflicting wallet setups across different chains.

This incident also revealed a shortcoming in bridging tools – they need to warn users not just when no wallet exists on the destination chain, but also when a different wallet exists at the same address.

The takeaway: users still need to be cautious. Always test with small amounts before moving serious funds. But the broader goal is to improve tooling and protections so that mistakes like this don’t lead to disaster.

It’s a lot, but the gist is this: a user sent funds to a wallet they thought was theirs – and it wasn’t. Fortunately, a white-hat group had built a safety net before any bad actors could exploit the vulnerability. The ETH was recovered, and now the ecosystem is working to prevent this kind of issue from happening again.

Lukas Schor finished with this, “I'm glad this case could be resolved with a happy end and there is important learnings for wallet developers, especially ones using smart accounts. But it also clearly showed once again that a lot more work is ahead of us to truly make self-custody easy and secure for everyone.”

I’m on the same page as Haseeb.

“Massive respect to Protofire, the Safe team, and to white hats everywhere trying to make us all safer. Crypto is actually beautiful sometimes.”

This was truly not the outcome I expected. Not because I don’t trust Safe Wallet or the user – but because it’s rare to hear about white hat hackers not only returning lost funds, but proactively setting up safeguards to block black hats from exploiting vulnerabilities in the first place. This was next-level thinking – and it literally saved this person 100 ETH.

Of course, this solution was highly specific to this technical scenario. It won’t apply in most other cases. But still, it’s a sign that the space is evolving – maturing in ways that matter.

It’s also the perfect moment to reinforce one of the oldest pieces of advice in crypto: always send a small test amount before transferring large sums. Just 10 or 100 sats to confirm the destination is safe. Yes, it means paying extra fees. But think of it as cheap insurance. A little inconvenience today could save you everything tomorrow.

Crypto still has a long way to go – but stories like this give me hope. They’re a reminder that good actors do exist in this space. People who build safeguards, protect others, and do the right thing even when no one’s watching.

We need more of that energy. And we need to spotlight and amplify stories like this – because they show us the kind of future crypto is capable of.

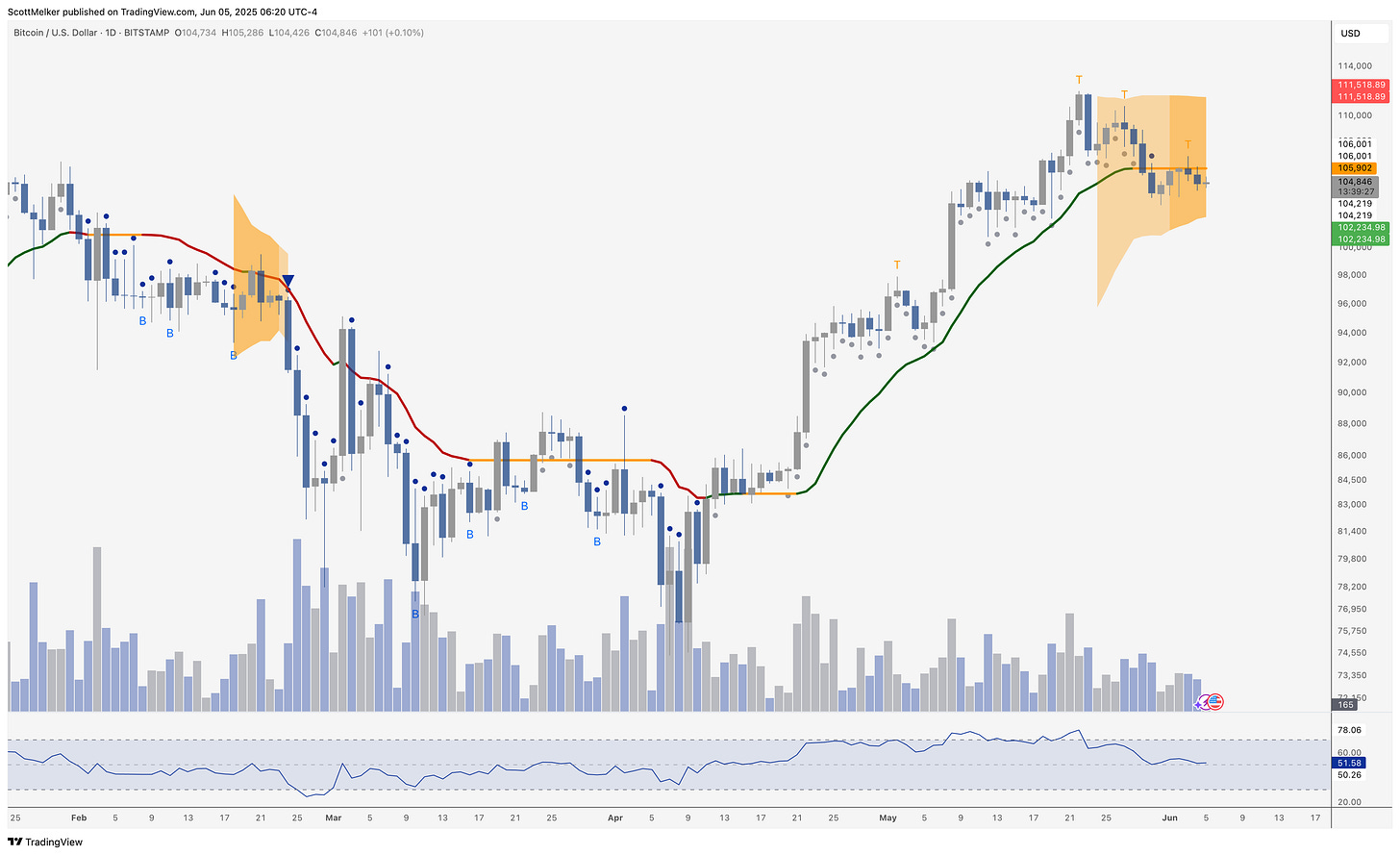

Today, I want to take a look at the Bitcoin chart using Trading Alpha. This is an indicator suite that I often reference, and the creator Wick is often on my shows.

The daily chart paints a shaky picture for Bitcoin (weekly still looks great). As you can see, we have multiple top signals (Ts), which have been confirmed by down candles the next day. We also lost the grey bullish dots last week, and trackline has flipped from support to resistance. The orange squeeze shading indicates that volatility is likely to pick up soon - it could go either way, but the indicators are leaning more bearish for now.

It will be interesting to see what Bitcon does next.

U.S. stock futures were largely unchanged Thursday morning as investors exercised caution ahead of Friday’s highly anticipated jobs report. The S&P 500 futures hovered near flat, reflecting investor indecision following a mix of economic data that sent conflicting signals about the state of the U.S. economy. Treasury yields ticked slightly lower, with the 10-year note falling one basis point to 4.35%, extending a bond rally from earlier in the week. Meanwhile, the U.S. dollar remained stable.

This week’s economic indicators have painted an uneven picture. Data released Wednesday showed a contraction in the U.S. services sector and a slowdown in private sector hiring, which strengthened expectations that the Federal Reserve might cut interest rates twice this year. However, this dovish narrative was challenged by separate data showing a surprising increase in U.S. job openings in April. The upcoming nonfarm payrolls report is expected to confirm slower job growth while keeping the unemployment rate steady, but analysts warn that it would take a major downside surprise to jolt markets into renewed volatility.

Across the Atlantic, the European Central Bank is widely expected to announce its eighth consecutive rate cut later on Thursday, with another reduction anticipated in September. European equities moved higher, pushing toward a two-week high, while the euro held its ground after gaining more than 10% year-to-date against the dollar. Despite the current stretch of calm in global markets, some investors warn it may not last, as unresolved trade negotiations between the U.S. and key partners – as well as the broader impact of tariffs – continue to inject uncertainty into the outlook.

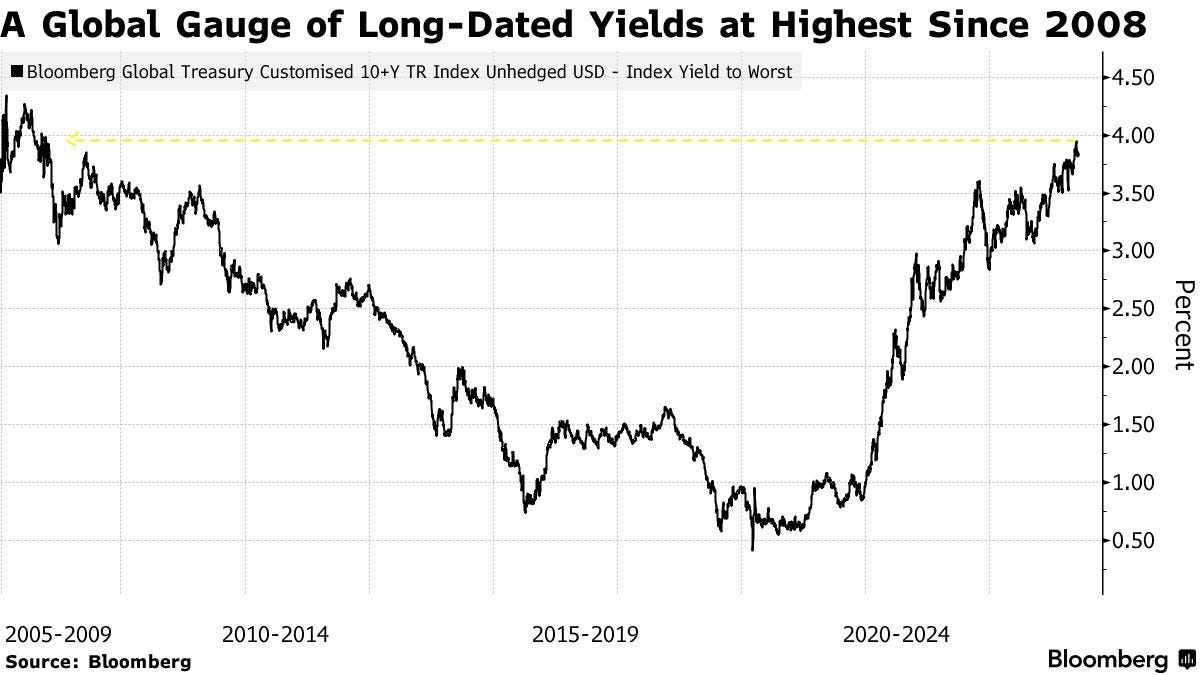

Bond investors are also keeping a close eye on the long-term effects of Trump’s tax policies. Concerns are mounting over the sustainability of U.S. fiscal deficits, with analysts questioning whether global investors will continue supporting U.S. borrowing at current levels. Jefferies’ Mohit Kumar noted a cautious stance: “Our bias remains to sell any rallies” in U.S. bonds due to growing unease over deficits and debt.

In corporate news, several notable developments made headlines. Trafigura Group reported that despite market volatility, its trading division did not capitalize on the swings, with dividend payouts exceeding net profits. Citigroup plans to cut 3,500 tech jobs in China as part of a broader restructuring. Wise Plc is aiming to list its shares in the U.S., another setback for London’s stock exchange. Meanwhile, Wizz Air Holdings shares plunged 26% after disappointing earnings and no forward guidance, and Cobalt Holdings scrapped plans for a London IPO. In China, regulators summoned EV executives, including BYD, to address the intensifying price war in the industry.

If you're still getting up to speed on what it really means for a corporation to add Bitcoin to its balance sheet, this study takes a deep dive into three key areas:

“While bitcoin may not be a conventional holding among corporate treasurers, a greater understanding of bitcoin may help to explain why corporate treasurers of large, publicly traded companies have started to embrace it in recent years. Many of bitcoin’s properties, such as a maximum supply of 21 million tokens and verifiable scarcity on a public blockchain, may make it an attractive aspirational store of value. This critical segment of a portfolio could potentially be a valuable hedge against growing fiscal deficits, currency debasement, and geopolitical risks. As corporate treasurers grapple with new economic headwinds, bitcoin’s unique properties have acted as tailwinds.”

Free studies like this are hands down one of the best ways to learn about crypto. They’re written by professionals, often with minimal bias, and provide deep, well-developed insights you won’t find in most news headlines.

Let’s cut to the chase: I don’t see this ending well.

Yes, it’ll generate buzz when it launches. Yes, some people – including Pump.fun – will probably make a lot of money. But will it deliver real value or bring users back in a meaningful, lasting way? Highly doubtful.

Multiple sources say the ICO could raise anywhere from $1 billion to $4 billion, with tokens sold to both public and private investors. I get that Pump.fun wants to resurrect the glory days and has been pushing out new products to make that happen. But let’s be honest – this space doesn’t need another token. And if the goal is to spark a new wave of degeneracy, an ICO isn’t the move.

This doesn’t look like a turning point. It looks like a top signal.

Everyone knows Tether as the dominant stablecoin issuer – by far the most successful in the market. But here’s something you might not know: Tether believes it’s on track to become the .

This was revealed in Las Vegas and, surprisingly, flew under the radar.

Now imagine this: the same company that issues the most widely used stablecoin also controls the largest share of Bitcoin mining. All the excess BTC generated could potentially be used to back USDT – further reinforcing its dominance.

That’s not just a flex. It’s a power move.

“We have announced our AI platform recently. It’s called QVAC.”

“We are collaborating to launch a Rumble Wallet that will be Bitcoin first and a little bit of stable coins wallet for the people.”

JPMorgan just took a major step forward in its crypto strategy: the bank will now accept Bitcoin and crypto-based ETFs – including BlackRock’s IBIT – as collateral for loans. It’s a notable shift for the $3.6 trillion asset manager and another clear sign that traditional finance is warming to crypto.

Yes, even with Jamie Dimon’s long history of crypto skepticism, JPMorgan has been quietly deepening its involvement in the space over the past year.

For high-net-worth individuals, this is a big deal. While most people sell stocks when they need liquidity for a house or car, wealthier investors tend to borrow against their assets – maintaining exposure and avoiding capital gains taxes.

Now, JPMorgan’s clients can do the same with crypto ETFs. That legitimizes these holdings as part of a modern portfolio strategy – and could easily spark a new wave of ETF demand.

Trump’s crypto empire is growing fast – from ETFs to stablecoins to multi-billion dollar deals. I’m joined by Sidney Powell from Maple Finance to unpack their new partnership with Cantor Fitzgerald and what it means for institutional Bitcoin lending. With $2 billion in BTC-backed credit now in play and Trump’s Truth Social ETF filing making waves, the crypto market is heating up fast. Don’t miss this breakdown of the moves shaping the future of digital finance.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.