Stablecoins: A 1+ billion-user onboarding opportunity - a16z crypto

Stablecoins now present what I believe is the first credible opportunity to onboard a billion people into crypto.

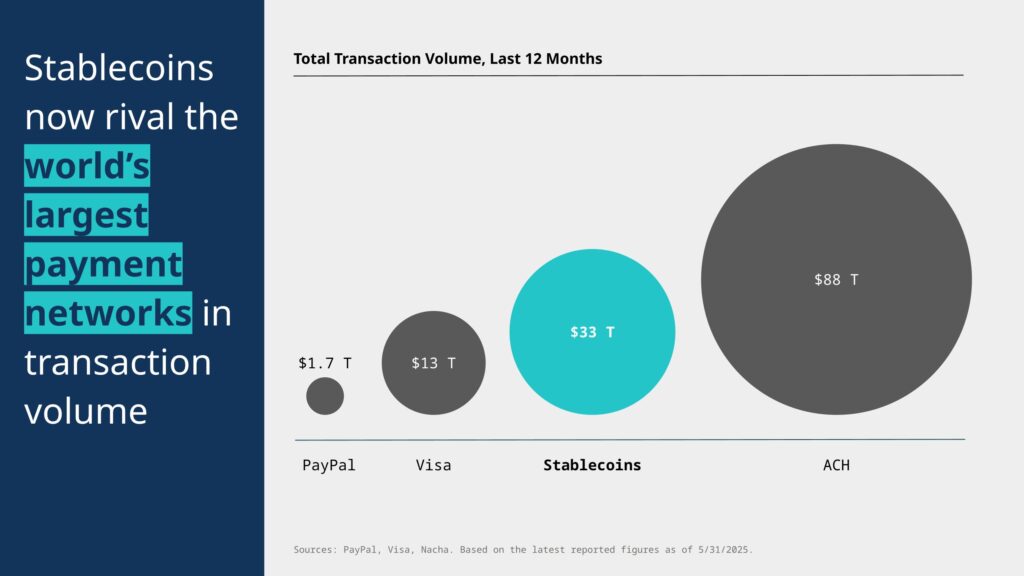

If you haven’t checked in on the latest stablecoin data recently, you might be surprised. Stablecoins have done $33 trillion in transaction volume in the last 12 months, consistently hitting new all time highs.

To put that into perspective, that’s close to 20 times the volume of PayPal, close to 3 times the volume of Visa, and quickly approaching the volume of ACH.

It’s incredible to see stablecoins in the mix among these massive global payment networks that have been around for decades.

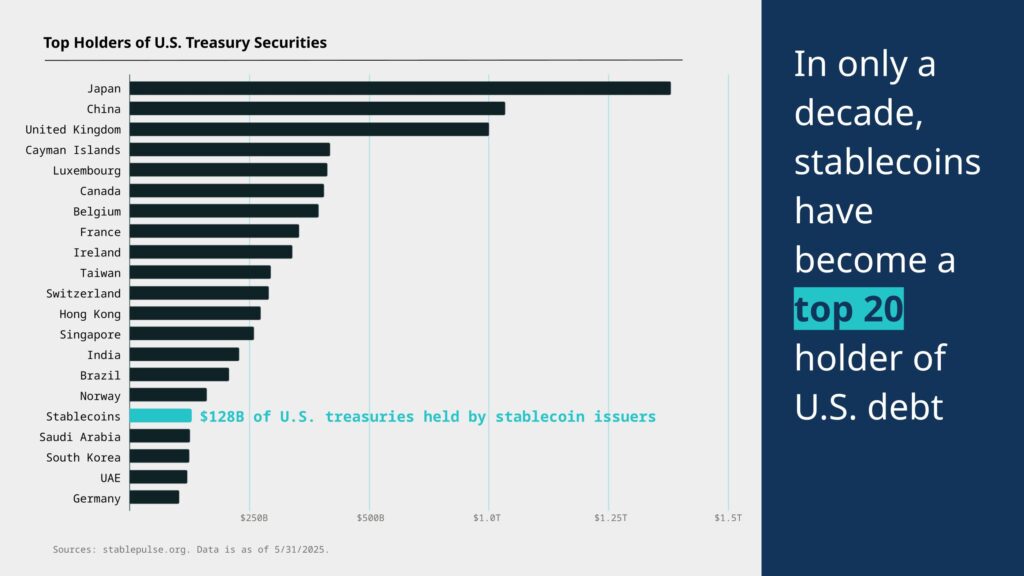

A result of all this stablecoin growth is $128 billion of U.S. treasuries held by stablecoins. That makes them a top 20 holder of US debt, ahead of entire countries like Saudi Arabia, South Korea, UAE, and Germany.

And this has all happened in only a decade. Citi bank recently projected that by 2030, stablecoins could reach $3.7 trillion in treasuries making it the largest holder at the top of this list.

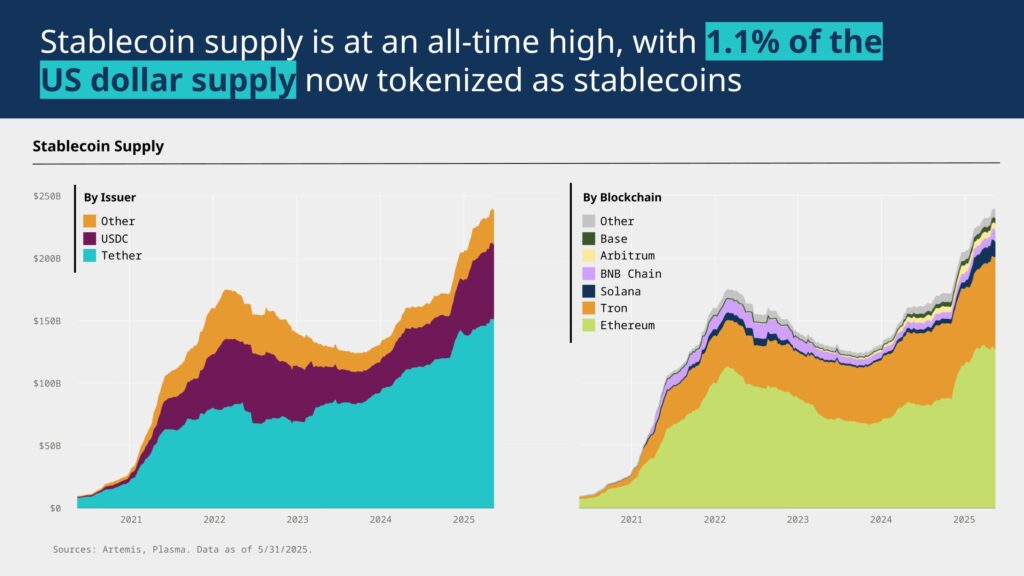

Stablecoin supply is at an all-time high, and another great stat is that over 1% of the total US dollar supply is now tokenized as stablecoins.

On the issuer side, it’s a two horse race between USDC and Tether.

On the infrastructure side, Ethereum and Tron continue to dominate. But if you zoom into the recent months, we are seeing some notable growth on chains like Solana, Arbitrum, and Base.

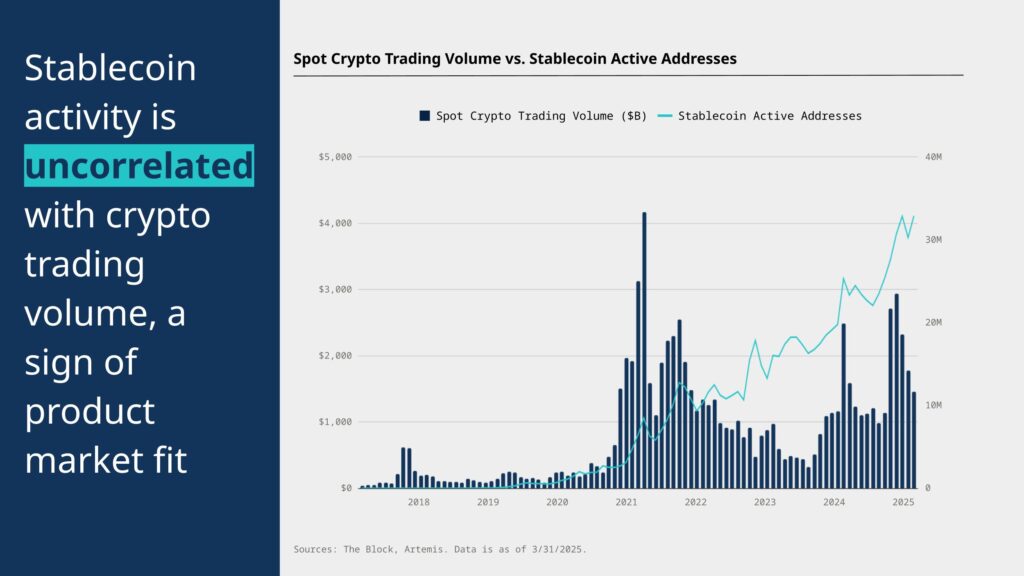

What makes me most excited about stablecoins is the fact that all this activity seems to be uncorrelated with broader crypto trading volume, which is a sign of organic use and product market fit.

For a long time, stablecoins have been criticized for only being used to settle speculative crypto trades, but this data shows otherwise. If you look closely at the shape of these two graphs, you can see a viral loop with stablecoin activity that’s independent from trading.

This might be my favorite chart to tell the stablecoin story today.

It’s no surprise that stablecoins are just now starting to pick up.

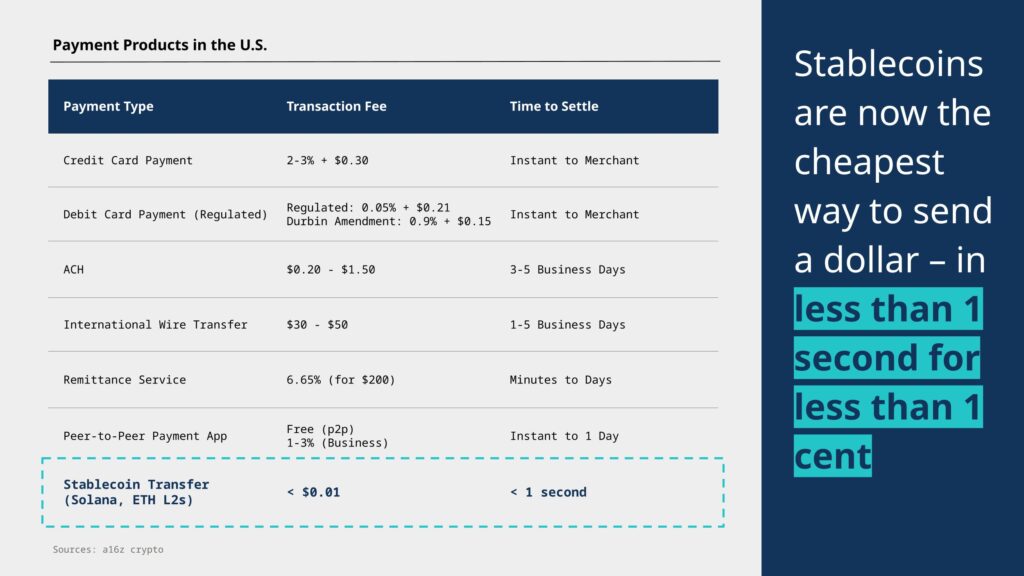

Over the last several years, we’ve made significant progress on blockchain infrastructure. With new high-throughput L1s like Solana, and new Ethereum L2s like Base, we’ve finally been able to make stablecoins a good product for payments.

Stablecoins are now the cheapest way to send a dollar – in less than 1 second for less than 1 cent. And if you compare that to the other options we have in the US, some of which are really clunky and costly, it’s easy to see why stablecoins make sense.

This is a great example of how infrastructure improvements unlock new applications, and I’m excited to see what else might get unlocked.

***

is a data science partner at a16z crypto, where he supports deal flow and portfolio companies. Prior to a16z, he was a Data Scientist at SVB Capital where he developed and managed a proprietary data and analytics platform.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.