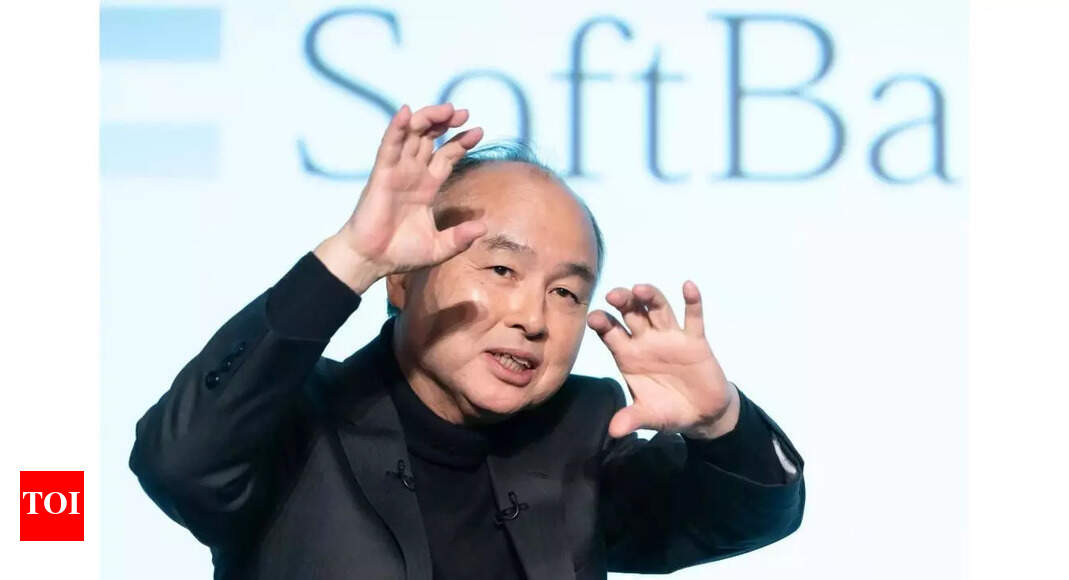

SoftBank Founder Reportedly Explores $1 Trillion Investment for US AI Chip Hub

SoftBank Group founder Masayoshi Son is reportedly spearheading an ambitious initiative to establish a vast artificial intelligence and robotics industrial zone in Arizona, a project estimated to potentially cost up to $1 trillion upon full development. This endeavor, previously known as Project Crystal Land, is envisioned as a foundational US-based manufacturing ecosystem dedicated to advanced AI and robotics technologies. Informally referred to as the Arizona AI megaproject, the proposed site is drawing comparisons to China’s established innovation and manufacturing hubs.

The comprehensive plan for this megaproject reportedly encompasses various critical components. These include cutting-edge research and development laboratories, sophisticated semiconductor production units, dedicated housing facilities for the technology workforce, and seamless integration with smart grid systems, all designed to foster a self-sufficient technological environment.

To garner crucial support for this colossal initiative, Masayoshi Son has reportedly engaged in discussions with prominent global tech entities such as Samsung and Taiwan Semiconductor Manufacturing Company (TSMC). Furthermore, he has allegedly held meetings with US government officials, including Secretary of Commerce Howard Lutnick, to explore potential partnerships and secure necessary backing for the project. This strategic move aligns with SoftBank’s increasing focus and substantial investments in the field of artificial intelligence.

SoftBank's growing commitment to AI is further evidenced by its recent financial engagements. The company notably pledged $19 billion to Trump’s Stargate Project, an extensive $500 billion AI infrastructure initiative championed by OpenAI CEO Sam Altman and Oracle’s Larry Ellison. Beyond this, SoftBank has also committed a significant $40 billion investment in OpenAI and expended $6.5 billion to acquire Ampere Computing, solidifying its position in the evolving AI landscape.

To finance the monumental Arizona project, SoftBank is expected to employ a project-based financing model, a method commonly utilized in large-scale infrastructure developments such as oil pipelines. This approach aims to minimize upfront capital requirements by leveraging the firm’s substantial existing liquidity, which stands at $23 billion, and utilizing its significant stake in Arm Holdings as collateral.

Following the emergence of these reports, the market reacted positively, reflecting optimism regarding the potential scale and impact of the project. SoftBank’s stock observed a 2% increase, while TSMC shares also rose by 1.9%. While discussions are underway and plans are ambitious, no formal timelines or specific construction details for the Arizona AI megaproject have been officially confirmed. The ultimate realization and success of this groundbreaking project will largely hinge on securing essential regulatory approvals and gaining robust support from both industry partners and federal agencies.