Sebi Bars Global Trading Giant Jane Street for 'Manipulation' - The Economic Times

Four entities tied to Jane Street Group (JS Group)—JSI Investments, JSI2 Investments, Jane Street Singapore and Jane Street Asia Trading —have been prohibited from dealing in securities, directly or indirectly.

Jane Street has 21 days to file a response.

“JS Group is not a good faith actor that can be, or deserves to be, trusted,” Sebi whole-time member Ananth Narayan said in his 105-page, ex-parte, interim order issued on July 3. “The integrity of the market, and the faith of millions of small investors and traders, can no longer be held hostage to the machinations of such an untrustworthy actor.”

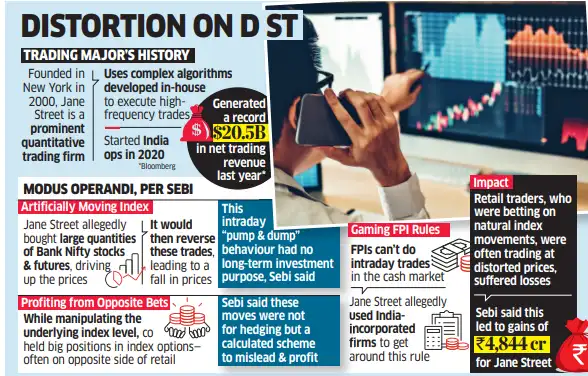

The firm disputed the findings of the Sebi interim order and said it will engage with the regulator on the matter. “Jane Street is committed to operating in compliance with all regulations in the regions we operate around the world,” the company spokesperson said in an emailed response.The regulator examined Jane Street’s trades in India between January 1, 2023, and March 31, 2025. During this period, it made over ₹43,289 crore ($5.07 billion) profit in index options and ₹7,687 crore ($900 million) in losses across stock futures, index futures and cash markets on the NSE.Founded in New York in 2000, Jane Street is a prominent quantitative trading firm with offices in all the key financial centres of the world. It uses complex algorithms developed in-house to execute high-frequency trades.

The regulator’s finding is that the NSE’s Bank Nifty Index —comprising the stocks of India’s top dozen lenders—had prima facie been manipulated in a complex and illegal manner aided by the JS Group’s immense trading, financial and technological prowess. Jane Street would drive up prices with heavy buying in the morning and send them down through a selling spree later in the day, according to Sebi. It also sought to push index levels down with heavy sell orders close to the option expiry, the regulator said.

Sebi found that the Bank Nifty options alone contributed Rs 17,319 crore, amounting to 40% of the total index option’s profits.“This is an unusual case where prima facie, multiple liquid stocks with high retail participation have together been manipulated to facilitate the manipulation of the index options market, resulting in massive profits for the manipulators, at the cost of other participants and retail traders,” Sebi said.

A detailed investigation is still underway. It would cover other major stock indexes including NSE’s Nifty.

“It is important to note, however, that this examination has so far been limited to select high-profit expiry days in the Bank Nifty index. There may exist similar patterns in other indices or trading behaviours reflecting alternate strategies which have not yet been analysed. Accordingly, many more trading days may merit detailed investigation to assess the full scope and recurrence of such conduct,” Sebi said in its order.

The regulator found at least 15 instances of the JS Group undertaking large and aggressive trades in the underlying Bank Nifty component stocks and futures that wasn’t for investment or for any standalone economic rationale. In fact, it said, given the sheer size and aggressive nature of the intervention in cash and futures markets and the immediate reversal the same day, the standalone trades in the cash and futures were more likely to end up showing a large net loss.

“These trades were undertaken only to distort Bank Nifty index option prices in the interim and entice market participants in Bank Nifty index options to trade at such distorted levels, while the JS Group would take advantage of this and run much larger opposite side positions in the index options market,” Sebi said.

Jane Street, in an August 30, 2024, letter to Sebi, had argued that these trades were to “remove unwanted delta” or to “manage overall delta.”

The regulator didn’t accept these statements. “JS Group was undertaking an intentional, well-planned, and sinister scheme and artifice to manipulate cash and futures markets and hence manipulate the Bank Nifty index level, to entice small investors to trade at unfavourable and misleading prices, and to the advantage of the JS Group,” it said. The regulator alleged that the Jane Street Group appeared to be most active on expiry days of index options.

Sebi said that by incorporating entities in India, JS Group also managed to “work around” foreign portfolio investor (FPI) regulations that prohibit such overseas entities from undertaking intraday cash market transactions.

“Thereby (Jane Street executed) the manipulative scheme without specifically flouting the FPI regulations," it said.

Out of the 11,219 FPIs registered with Sebi as of March 31, 2024, only 2.5% are engaged in algorithmic trading, as per regulatory data. JS Group is part of this short-term, algorithmic trading community.

The aggressive dumping of Bank Nifty component stocks and futures in sharp reversal of the heavy pumping purchases done in the morning was immensely profitable for the large Bank Nifty option positions being run by the JS Group, and to the detriment of all those that had traded in the morning against JS Group at artificially boosted prices, Sebi said. This was a classic case of “marking-the-close,” where an entity with huge options exposures that are expiring shortly, is moving the underlying market aggressively in its favour, Sebi said.

Nithin Kamath, the founder of discount broker Zerodha, posted on X: “You’ve got to hand it to Sebi for going after Jane Street. If the allegations are true, it’s blatant market manipulation. The shocking part? They kept at it even after receiving warnings from the exchanges.”

He also highlighted that such firms are key to the derivatives market.

“Prop trading firms like Jane Street account for nearly 50% of options trading volumes. If they pull back— which seems likely —retail activity (~35%) could take a hit too. So this could be bad news for both exchanges and brokers,” Kamath posted.

Stories you might be interested in