Rising Demand, Strong Profits, and a Discounted Stock Price

The financial world is no stranger to misinformation and manipulation. A recent example is Builder.ai. The startup, once valued at $1.5 billion, was revealed to be far from the AI-driven company it claimed to be. Instead, its AI-app service was a team of 700 engineers based in India.

Doing your diligence to be sure you don’t get exploited by misinformation and manipulation has never been more critical. This applies to all kinds of investing, even dividend strategies, which most people consider to be safe and simple. The truth is that not all dividends are real. Some are false, paid out of cash balances or borrowings. Only diligent analysis can uncover the truth about whether a company can afford to keep paying its dividend. To learn more about False Dividend Stocks, click here.

Diligence not only helps expose potential pitfalls but also reveals strong investment opportunities. We’re specifically talking about businesses with solid fundamentals and stock prices that are undervalued. Our system is designed to identify exactly these types of stocks, which we feature as Long Ideas.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

You need a Professional Membership or higher to view all the content on this page.

Already a member?

Learn more about our research here.

One kind of footwear, specifically clogs, have been grabbing consumers’ attention and money. Long gone are the days of clogs being overlooked, as even high fashion/luxury brands such as Gucci and Balenciaga have introduced clogs in their collections in recent years.

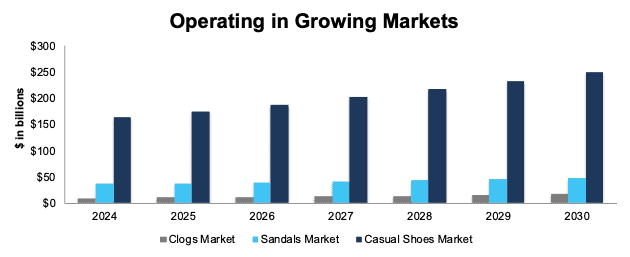

As the innovator of clog-style shoes, this company is in a great position to take advantage of the growing footwear demand. This company defines its total addressable market (TAM) in three markets, all of which are forecasted to grow globally through 2030.

Sources: Value Market Research, IndustryARC, Grand View Research, and New Constructs

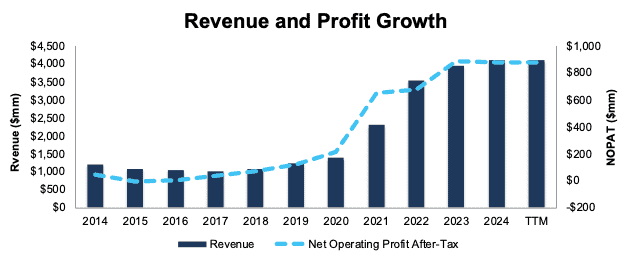

Despite some challenges, this company is growing top- and bottom-line.

The company has grown revenue by 14% and net operating profit after-tax (NOPAT) by 15% compounded annually since 2006 (earliest data available).

More recently, the company improved its NOPAT margin from 4% in 2014 to 21% in the TTM while invested capital turns fell from 1.3 to 1.0 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns though, and drive return on invested capital (ROIC) from 5% in 2014 to 22% in the TTM.

Additionally, the company’s Core Earnings grew 41% compounded annually from $23 million in 2014 to $777 million in in the TTM.

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.

_w=1200_h=630_pjpg.jpg?v=20230522122229)