Ripple CEO on Crypto ETF Impact

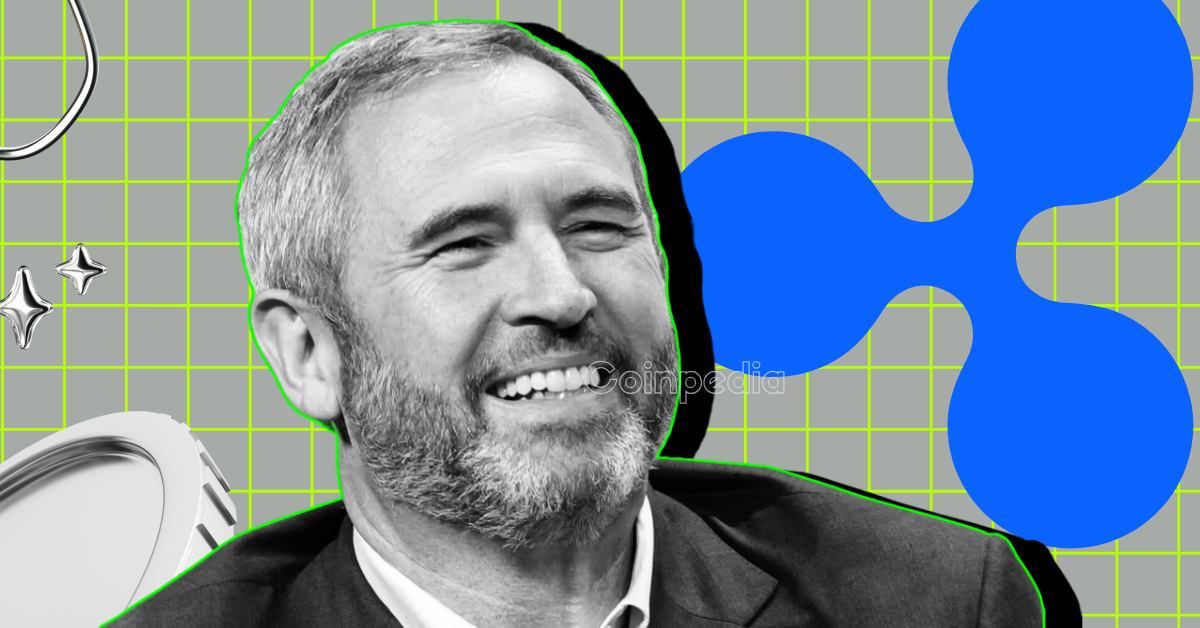

Ripple CEO Brad Garlinghouse recently participated in Ripple’s “Crypto in One Minute” podcast, offering insights into the growing enthusiasm for crypto-based exchange-traded funds (ETFs). This discussion follows the launch of the first XRP futures ETF on Nasdaq, a significant milestone for the crypto industry. Garlinghouse highlighted two primary factors driving the excitement around crypto ETFs since their debut in January 2024.

Firstly, institutional investors, including pension funds and endowments, have historically faced challenges in directly accessing crypto assets. Prior to ETFs, options were limited to cumbersome self-custody or reliance on centralized exchanges, hindering efficient crypto trading. Crypto ETFs have now mitigated this barrier, enabling major Wall Street players and financial institutions to seamlessly trade crypto, thereby enhancing accessibility.

Secondly, Garlinghouse argues that crypto ETFs are institutionalizing the crypto industry. He cited the Bitcoin ETF as a prime example, noting its unprecedented speed in reaching $1 billion and then $10 billion in assets. Garlinghouse predicts that Bitcoin ETFs could eventually rival gold ETFs in scale, underscoring their transformative potential.

The launch of Volatility Shares’ XRP futures ETF on Nasdaq, under the ticker XRPI, signifies a crucial advancement, building on CME’s XRP-futures debut on May 19, 2025. This development, preceded by Teucrium’s 2x Long Daily XRP ETF and Bitcoin futures in 2017, reflects market maturation. Despite regulatory delays from the SEC, XRP's resilience, evidenced by its recovery from $2.29 to $2.34, demonstrates investor confidence.

In a special episode of Crypto In One Minute, Garlinghouse addressed his long-held feeling of being overlooked, now embracing the opportunity to explain the driving forces behind institutional enthusiasm. He noted that traditional options for accessing crypto were either too risky or inaccessible for major players. The introduction of crypto ETFs, particularly on Wall Street, has revolutionized access. Garlinghouse emphasized that this marks the first time institutions can trade crypto directly through regulated markets, unlocking previously untapped capital. He reiterated that this accessibility is a fundamental shift in how the world interacts with digital assets.