Report reveals there is no lack of funding for small businesses - here's the problem | The Citizen

A report has revealed that there is no shortage of funding for micro, small, and medium enterprises (MSMEs) in South Africa; however, the challenge is that traditional lending models make it more difficult for these businesses to secure approval.

The report, titled “SA MSME Access to Finance Report 2025”, by Finfind and African Bank, released on Thursday, supports the belief that change is needed to address the funding gap for these businesses.

MSMEs in the country play a significant role as the majority of the workforce is found within the segment. These are businesses with a turnover of less than R1 million per annum.

The report stated that the inability of small businesses to secure funding remains a significant barrier to entrepreneurship, business expansion, and broader economic growth in the country.

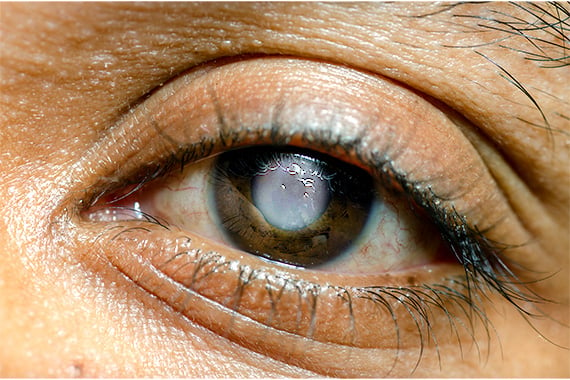

One of the reasons small business owners struggle to secure funding is that they are seen as high-risk without collateral.

The report shows that these owners also struggle to access personal finance as most do not have a regular monthly income paid into their personal bank accounts to confirm income and affordability, and the majority have below average credit scores, this is largely due to paying business expenses first to stay afloat to the detriment of their personal credit health.

“Many MSMEs struggle to access finance, not because funding isn’t available, but because they are not funding-ready,” reads the report.

Being funding-ready is just as important as funding availability.

Darlene Menzies, CEO of Finfind, said there have been multiple calls for the ‘Funding Readiness Voucher’ programme, where business advisors and small business accountants provide funding readiness assistance to MSMEs.

“The idea was born out of the Presidential Jobs Summit catalytic project in 2018 to bolster job creation for youth and help MSMEs access finance.”

The report stated that the annual turnover of small businesses puts them in a challenging position as far as credit regulation is concerned.

“The National Credit Act (NCA) classifies juristic entities with a turnover of less than R1 million per annum as consumers rather than commercial entities, creating a fundamental challenge when it comes to accessing it,” reads the report.

Finfind has noticed that new players are revolutionising MSME financing through streamlined, accessible, and faster loan processing.

The report also gave some recommendations for MSMEs seeking funding. One of the most important recommendations is for these businesses to maintain proper financial records, establish a formal business bank account and utilise a basic accounting solution.

Owners need to present a viable and well-managed operation with transparent fund utilisation and repayment plans.

“Business owners need to explore both traditional banks and alternative fintech options based on specific needs and profile.”

The report stated that funders need to examine how they assess risk and develop products to meet real demand by utilising the tools, technologies, and data now available. “It requires commitment to change.”

It is also recommended that there be collaboration between traditional banks and fintech companies to leverage respective strengths.

Funders need to introduce specialised micro-financing options with appropriately scaled requirements for businesses with a turnover below R1 million per annum.