ReFinD and MobileMoney Limited Move to Drive Financial Inclusion

This collaboration focuses on leveraging research to enhance mobile money agent networks, particularly in underserved and vulnerable communities.

Under the agreement, MobileMoney LTD will provide access to its extensive agent network, data, and insights to support ReFinD’s research. The partnership prioritizes two key areas:

The partnership focuses on developing strategies to attract new agents to the mobile money ecosystem and identifying and removing economic and non-economic barriers that hinder agents’ ability to scale access to financial services.

Prof. Peter Quartey, Director of ISSER and Executive Director of ReFinD, emphasized the partnership’s alignment with ReFinD’s mission to improve financial services for underserved communities.

“We are confident that our findings will serve as a model for similar studies across MTN’s African markets,” he stated.

Prof. Quartey highlighted the importance of research funding for middle-income countries, advocating for diverse sources such as government grants, seed money, and pilot studies.

He stressed the value of natural experiments and learning from global examples, citing successful initiatives in countries like India, Indonesia, and the Philippines.

He further called for stronger public collaboration, effective proposal writing, and strategic alignment with funding bodies to ensure impactful research outcomes.

By integrating commercial solutions with rigorous academic research, he believes middle-income countries can address pressing challenges and drive meaningful progress.

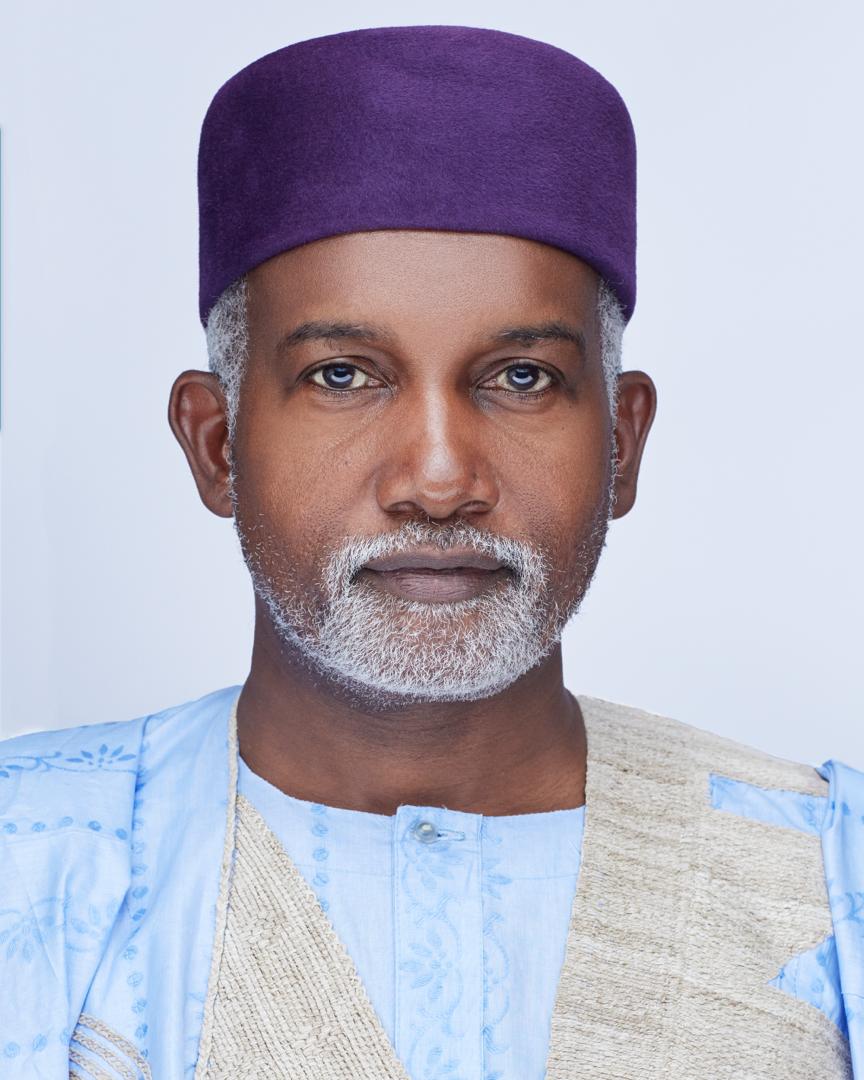

Shaibu Haruna, CEO of MobileMoney LTD, underscored the transformative potential of the partnership with ReFinD in promoting financial inclusion.

“We look forward to working with ReFinD as a partner equally committed to unlocking financial possibilities for every Ghanaian,” he said.

He added that MobileMoney LTD plans to extend its collaboration with ISSER beyond the ReFinD project, focusing on additional research initiatives to expand access to financial services.

Haruna highlighted MobileMoney LTD’s significant reach, noting its global service to over 90 million users on a 90-day active basis, and its critical role in enabling more than 200,000 businesses to thrive.

“While we’ve made progress, our next growth phase focuses on reaching the most marginalized areas to achieve true financial inclusion,” he explained.

The partnership, according to Haruna, provides a platform to explore key questions about unlocking value in the financial ecosystem. “This is not just a CSR initiative; it’s a strategic commercial relationship that fosters knowledge sharing and industry collaboration. Lessons from this initiative will not only benefit Ghana but also inform practices globally,” he said.

Haruna also stressed the need to bridge the gap between academic research and practical business solutions. “Too often, exceptional research remains untested. With this partnership, we aim to move beyond theory to deliver real-world impacts. At later stages, we will evaluate the outcomes to ensure research findings translate into actionable solutions,” he noted.

Looking ahead, Haruna expressed enthusiasm for expanding the collaboration beyond agent ecosystems to address other aspects of MobileMoney LTD’s value chain. “There are many questions to tackle, particularly regarding technologies that can effectively serve underserved communities,” he said.

He also referenced MobileMoney LTD’s international footprint, including opportunities for similar collaborations in markets like Uganda. “This partnership marks the beginning of even greater opportunities, and we are excited to build on this foundation,” he concluded.

Prof. Francis Annan, Scientific Lead and Co-Chair of ReFinD at ISSER, spoke on the growing synergy between academia and industry in advancing financial research.

“In the past, academia and the commercial sector often operated independently, missing out on immense collaborative potential. Today marks a milestone in bridging that gap to address key questions about financial services and implement effective solutions,” he said.

Prof. Annan stressed the importance of rigorous, evidence-based research to inform policy and promote financial development. He highlighted the role of large-scale commercial partnerships, such as with MTN Group, in achieving these goals.

“It’s hard to imagine large-scale financial inclusion initiatives without the support of key commercial players like MTN. Their insights and resources are vital for identifying and addressing the critical questions in this space,” he said.

He noted the signing of a master memorandum of understanding (MoU) between ReFinD and MTN as a significant achievement. “This global initiative involves researchers from countries like the U.S., Nigeria, and the Philippines, all united by a mission to advance financial services for underserved populations,” he added.

Prof. Annan outlined key research areas, including introducing retail agents in underserved markets, improving agent conduct, and enhancing consumer protection—issues central to the Central Bank of Ghana’s agenda.

He expressed optimism about scaling the findings from Ghana to other countries with similar conditions. “This collaboration creates a unique opportunity to share lessons globally and scale impactful solutions,” he said.

Prof. Annan commended MTN MobileMoney Ltd., ReFinD, and all involved partners, emphasizing the importance of academia-industry collaboration.

“This initiative bridges research and practice to advance financial inclusion for the poor. The potential is enormous, and I look forward to what we will achieve together,” he added.

Follow on Google News