Powering Africa: Responsible Innovation for Inclusion.

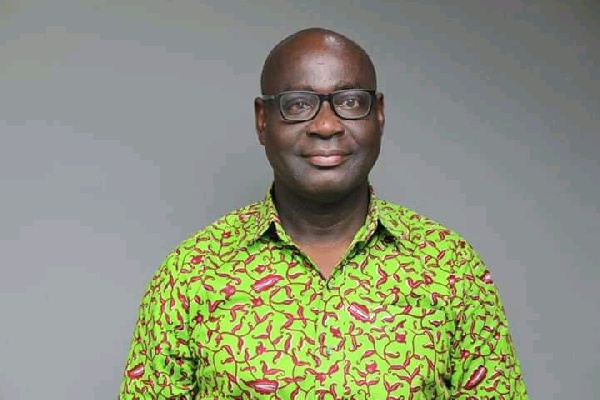

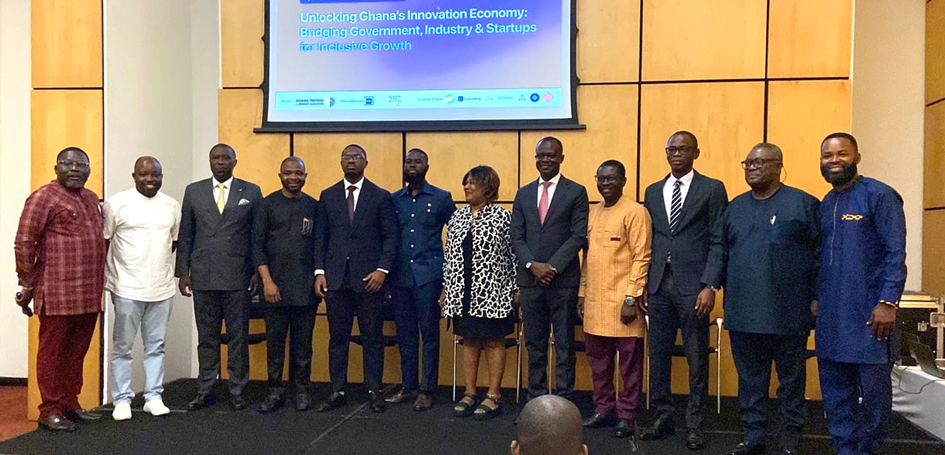

The Bank of Ghana (BoG) is unwavering in its commitment to leveraging responsible innovation as a key driver for extensive financial inclusion in Ghana. This stance was reaffirmed by First Deputy Governor, Dr. Zakari Mumuni, at the AyaHQ Public-Private Sector Roundtable on June 25, 2025. Dr. Mumuni urged robust collaboration among regulators, startups, and policymakers, emphasizing its critical role in unlocking Ghana’s economic potential. The central bank’s proactive engagement with FinTech, including digital assets, open banking, and the e-Cedi, aims to cultivate a safe, inclusive, and efficient financial environment for all Ghanaians.

Ghana is experiencing a rapid surge in financial services digitalization, from widespread mobile money adoption to advanced AI-enabled platforms. The Bank of Ghana prioritizes ensuring this growth occurs within a robust, risk-managed framework, balancing innovation with financial stability and consumer protection.

To achieve this, the BoG implements key regulatory interventions. These include comprehensive frameworks like the Payment Systems and Services Act, providing a legal backbone for digital transactions. The BoG also supports regulatory sandboxes, offering controlled environments for FinTech innovators to test new products under supervision. This oversight ensures new solutions are viable and safe before wider market deployment, promoting a secure and stable digital financial landscape.

Dr. Mumuni passionately underscored the indispensable role of cross-sector collaboration in advancing Ghana’s financial inclusion agenda. He called for a unified front, bringing together financial regulators, dynamic FinTech startups, and government policymakers. This synergistic partnership is deemed crucial for nurturing innovation, attracting investment, and removing barriers to financial access.

The Bank of Ghana’s advocacy for this collaborative model aims to solidify Ghana’s position as a prominent hub for FinTech innovation within Africa. By collectively navigating emerging technologies and co-creating resilient financial infrastructure, stakeholders can develop inclusive products tailored to Ghanaian citizens’ diverse needs. This holistic approach promises to expand financial access and boost Ghana’s economic resilience and prosperity.

The BoG’s strategic vision, championed by Dr. Mumuni, firmly places responsible innovation at the core of Ghana’s journey towards pervasive financial inclusion. This balanced approach, combining technological advancement with robust regulatory oversight and strong partnerships, is set to significantly advance Ghana’s economic development, ensuring digital finance benefits every Ghanaian.

BoG financial inclusion, responsible innovation financial inclusion, Bank of Ghana responsible innovation, financial inclusion policy, central bank financial inclusion, inclusive finance innovation, digital financial inclusion Ghana, sustainable financial services, fintech for financial inclusion, ethical finance access