Pakistan's Energy Revolution: A Strategic Play in the Global AI and Crypto Infrastructure Boom

In a bold move to transform its energy liabilities into economic assets, Pakistan has unveiled a groundbreaking initiative to allocate to Bitcoin mining and AI data centers. This strategic pivot positions Pakistan as a frontier market for Web3 and AI infrastructure, leveraging its geographic centrality, underutilized energy resources, and forward-thinking regulatory reforms. For investors, this is not just an opportunity—it’s a geopolitical and economic realignment in the making.

Pakistan’s energy sector faces a paradox: while the nation struggles with frequent power shortages, its thermal and hydropower plants often operate at due to fluctuating demand. The 2,000 MW allocation targets this surplus, repurposing stranded assets to fuel high-margin industries like Bitcoin mining and AI computing.

The math is compelling. At current global Bitcoin mining electricity rates ($0.05–$0.10/kWh), even a conservative estimate of could generate in foreign revenue. This figure dwarfs traditional exports like textiles or agriculture, which face global competition. Moreover, the government’s proposed incentives—tax holidays, customs exemptions, and streamlined regulations—lower barriers for investors, making Pakistan a into Asia’s digital infrastructure boom.

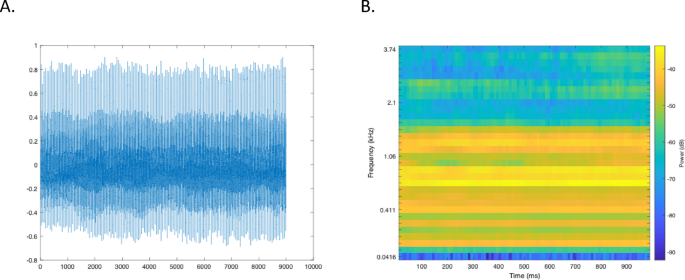

This data underscores the soaring demand for energy-intensive mining, a sector Pakistan is now poised to dominate.

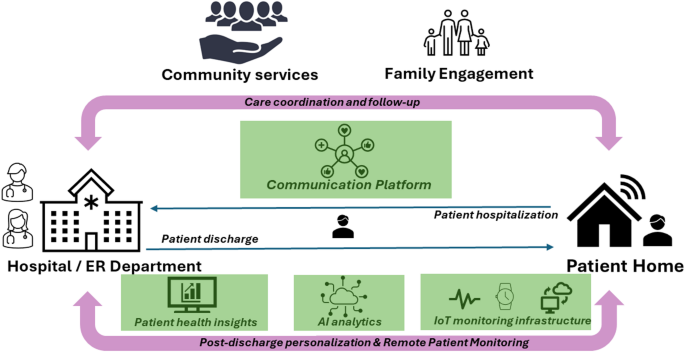

Pakistan’s geographic advantage is its between Asia, Europe, and the Middle East. The Africa-2 submarine cable—stretching 45,000 km and connecting 33 countries—ensures Pakistan boasts , critical for real-time AI processing and global data routing. This infrastructure positions Pakistan as a for cross-regional cloud services, attracting multinational tech firms seeking to reduce dependency on U.S. or Chinese hubs.

The geopolitical calculus is clear: as global powers vie for control of AI and blockchain ecosystems, Pakistan offers a neutral, English-speaking, and energy-rich alternative. For investors, this is a chance to away from overhyped markets and into a region with untapped potential.

The Pakistan Crypto Council (PCC), a government-backed entity, is spearheading regulatory clarity—a rarity in emerging markets. Key reforms include:

- : 10-year tax holidays for AI infrastructure developers and reduced VAT on equipment.

- : Plans to hold Bitcoin in a national wallet, stabilizing foreign exchange reserves.

- : Future phases will power data centers with Pakistan’s and hydropower, aligning with global ESG trends.

These policies signal a . For example, while the U.S. and EU grapple with crypto regulation, Pakistan is actively miners and AI firms—a stark contrast that could fast-track its digital economy.

Beyond direct revenue, the initiative creates a for Pakistan’s economy:

- : Thousands of roles in engineering, cybersecurity, and data sciences will emerge, addressing youth unemployment.

- : The PCC has already attracted global miners and AI firms, with more anticipated as infrastructure scales.

- : Holding Bitcoin reserves reduces reliance on volatile fiat currencies, shielding the economy from external shocks.

This data reveals Pakistan’s FDI growth lagging behind India and Southeast Asia—until now. The 2,000 MW initiative could catapult it into the top tier.

Pakistan’s window of opportunity is narrowing. As energy prices rise and global AI infrastructure demand hits , early movers will secure the best deals. Investors who act now can:

1. before renewables drive up prices.

2. in a region with 40 million crypto users and 250 million potential digital consumers.

3. into a geopolitically strategic market with asymmetric upside.

The 2,000 MW initiative is more than an energy play—it’s Pakistan’s . By monetizing surplus power, leveraging geographic connectivity, and adopting forward-thinking policies, the nation is primed to capture a of the global AI and crypto infrastructure market.

For investors, the calculus is simple: this is a with government backing and exponential growth potential. The question isn’t whether to act—it’s why you’re waiting.

Act now, before the bridge is built and the opportunity fades.