Optimal Exit Strategies for Niche Technology Companies

May 20, 2025

The pathway to a successful exit for technology companies operating in niche markets is often more intricate and demands a more tailored approach than for their counterparts in broader markets. Understanding the specific characteristics of these niche environments and the implications for exit strategies is paramount for founders, investors, and stakeholders aiming to realize optimal value.

A niche market, in its essence, represents a specific segment of consumers who share distinct characteristics and are, consequently, likely to purchase a particular product or service. This results in small, highly specific groups within a broader target market. In the technology sector, this can manifest as software developed for a highly specialized industry vertical – for instance, software designed for video designers, which is a niche within the broader market of software for artists , or a specialized Software-as-a-Service (SaaS) solution catering to a very particular business need.

The critical aspect of a niche market is its focused nature. This focus, while a source of strength in establishing a business, presents a dual-edged sword when considering exit strategies. It signifies deep expertise and often a strong product-market fit within that defined space, but it can also imply a limited appeal to a wider range of potential acquirers if the company’s value and scalability are not effectively communicated.

Key characteristics of niche technology markets typically include:

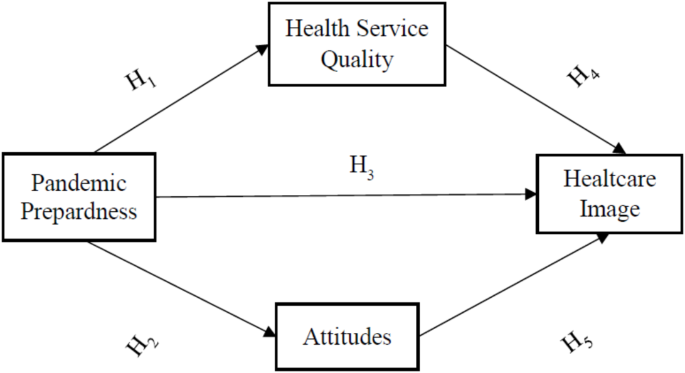

A well-defined exit strategy serves as a cornerstone of any venture capital investment and, indeed, for any company with ambitions beyond perpetual private ownership. Modern thinking in tech entrepreneurship emphasizes the need for proactive exit planning, ideally commencing from the company’s inception. For technology companies rooted in niche markets, the “how and when of realized investment value” is profoundly shaped by their distinct market dynamics. These companies cannot always replicate the exit playbooks designed for businesses with mass-market appeal; their unique value propositions necessitate a more customized and strategic exit approach.

The journey for niche tech companies is marked by both distinct challenges and unique opportunities:

This interplay of factors gives rise to a “Niche Paradox” in exit planning. The elements that foster initial success in a niche market – such as intense focus, deep specialization, reduced initial competition, and the ability to command premium prices – create inherent value. However, these same characteristics, particularly the limited market size and the risk of saturation , can be perceived as constraints or higher risks by acquirers or public market investors conditioned to prioritize sheer scale, as often sought in venture capital exits aiming for “significant return on investment”. Consequently, successful exits for niche technology companies frequently hinge on identifying buyers who specifically value that depth and specialization, or on the company’s ability to craft a compelling narrative that convincingly demonstrates scalability, either within its core niche or by leveraging its expertise into adjacent areas. This strategic articulation is key to bridging the perceived gap between niche focus and broader investment appeal.

The objective of this article is to navigate these nuanced considerations, presenting a comprehensive overview of the most viable exit alternatives for technology companies operating in niche markets. By exploring the intricacies of each option, this analysis aims to equip founders, investors, and M&A professionals with the insights needed to make informed decisions and maximize exit outcomes.

| Purchase by a larger company for technology, talent, market share, or other strategic assets. | Access to unique IP, specialized talent, or established market position in a specific segment. | Strategic premium, synergies, technology/market access. | Low to Medium (control typically ceded; legacy may or may not be preserved depending on integration). | Demonstrating broader strategic value beyond the niche; integration risks. | Strong strategic fit with acquirer’s goals; clear articulation of unique value. | |

|---|---|---|---|---|---|---|

| Sale to a firm specializing in acquiring and holding niche businesses long-term (e.g., “Forever Acquirer”). | Preservation of autonomy, brand, and legacy; long-term operational focus. | Sustainable profitability, recurring revenue, market leadership in the niche. | Medium to High (often high operational autonomy; legacy preservation is a key appeal). | Valuation may be more conservative than a strategic sale; alignment with consolidator’s long-term philosophy. | Stable, profitable business with strong niche leadership; cultural fit with acquirer. | |

| Existing management team acquires the company from current owners. | Continuity of specialized knowledge, culture, and vision; trusted leadership. | Sustainable cash flow, market value (potentially less than strategic), ability to service debt. | High (management gains ownership and control; legacy often continued by a known team). | Management team’s ability to secure significant financing; potential for lower valuation than external sale. | Strong, credible management team with a clear plan and access to funding. | |

| Financial sponsor acquires a controlling stake or entire company, often with a 3-7 year exit horizon. | Capital for growth/acquisitions; operational expertise; path for mature, profitable niche businesses. | EBITDA multiples, cash flow generation, growth potential, consolidation opportunities (buy-and-build). | Low (PE firm takes control; focus on financial returns and defined exit timeline). | Aligning with PE’s financial return focus and exit timeline; potential for operational/cultural changes. | Strong financial performance, clear value creation plan, and a defensible market position. | |

| Company offers shares to the public for the first time. | Access to significant capital, enhanced visibility, liquidity for early stakeholders. | High growth potential, large Total Addressable Market (TAM), strong financial performance, compelling investor story. | Low (accountability to public shareholders and regulators; founder control significantly diluted). | Demonstrating sufficient scale and TAM; high cost and regulatory burden; public market scrutiny of niche focus. | Significant scale, rapid growth, and a compelling narrative of expansion beyond the initial niche. | |

| Acquisition primarily for the talent/expertise of the employees, not the product/service. | Exit for teams with valuable, specialized skills, even if the product lacks commercial success. | Value of the talent pool, cost of alternative recruitment. | Very Low (product/brand usually discontinued; team integrated into acquirer; legacy of the company is minimal). | Typically lower valuation than product-driven acquisitions; integration and retention of the acquired team. | Highly specialized, in-demand talent; cultural fit with the acquirer. | |

| Company stock is transferred to employees via a trust, providing an exit for owners. | Rewards employees, preserves company culture/independence, potential tax benefits. | Fair market value (typically without strategic premium), company’s ability to fund the ESOP. | Medium to High (ownership transfers to employees; founders can shape legacy and ensure continuity). | Complexity of setup and administration; ongoing financial obligations; may offer less cash at close than other sales. | Consistent profitability and cash flow; founder desire for employee benefit and company continuity. | |

| Investors provide capital for a percentage of future revenues (not a full exit, but a liquidity event). | Non-dilutive liquidity for founders while retaining control and equity. | Predictability and strength of recurring revenue. | High (founders retain control and equity). | Requires existing, predictable revenue; cost of capital can be high; ongoing revenue share impacts cash flow. | Strong, predictable recurring revenue streams (e.g., SaaS); clear understanding of repayment terms. |

Choosing an exit path requires a thorough understanding of each alternative’s mechanics, suitability, and implications, especially when viewed through the lens of a niche technology company’s unique characteristics.

A strategic acquisition occurs when a larger company purchases a smaller one to gain access to its technology, talent, market share, or other strategic assets that align with the acquirer’s broader goals. This can also involve a direct competitor acquiring a company to consolidate market presence or eliminate a rival.

For niche technology companies, this is a highly pertinent exit route. These companies often cultivate unique technologies, possess deep expertise in a specific domain, command a loyal customer base within a defined segment, or house specialized talent pools. Such attributes are frequently attractive to larger corporations aiming to enter or bolster their position within that particular niche. The impetus for acquisition might be the niche product itself, the underlying intellectual property (IP), or the established, targeted market access the niche company provides.

Key Considerations & Success Factors for Niche Tech:

To maximize the potential of a strategic acquisition, niche tech companies should focus on:

Strategic acquisitions in the niche tech space are often driven by a larger company’s need for specific “capabilities” or “market access.” While acquisitions can be motivated by gaining technology, talent, or market share , and can be for market expansion or acquiring new technologies , niche companies offer a concentrated form of these. For example, Microsoft’s acquisition of Visio, a company with “niche” software that had achieved significant market share in scientific and engineering disciplines, was leveraged by Microsoft’s powerful marketing engine to make Visio a major player, effectively acquiring both technology and market access. Because niche companies excel in highly specific capabilities and possess deep, albeit sometimes narrow, market access , strategic acquirers are often less focused on the target’s absolute revenue size (which might be modest) and more on its unique, hard-to-replicate assets. The “build vs. buy” calculation for an acquirer frequently favors “buy” when the required capability or market access is highly specialized and time-consuming to develop internally.

This exit strategy involves selling the company to a specialized firm, often a holding company or a private equity-like entity, that has a declared strategy of acquiring multiple businesses within specific vertical markets. Unlike traditional private equity that typically aims for a 3-7 year exit, these “forever acquirers” or “serial acquirers” intend to buy and hold businesses for the long term, focusing on sustainable profitability and operational excellence. Prominent examples include Perseus Group (a part of Constellation Software) and Volaris Group.

This model is exceptionally relevant for niche technology companies, particularly those in the software sector with stable operations and recurring revenue streams (like SaaS). Such acquirers inherently understand and value market leadership within a well-defined, often specialized, vertical. They are not looking for unicorns but for durable, profitable businesses.

Key Considerations & Success Factors for Niche Tech:

Companies considering this exit path should demonstrate:

“Forever acquirers” present a distinct “third way” for founders of niche technology companies, particularly those who prioritize legacy, stability, and employee welfare. Traditional exit routes often involve either full integration into a larger strategic acquirer, which can risk the loss of the company’s unique identity and culture , or a sale to a private equity firm, which typically involves a 3-5 year horizon focused on a subsequent sale and may bring significant operational changes. In contrast, entities like Perseus Group or Volaris Group emphasize a long-term investment philosophy, operational autonomy for the acquired businesses, and the preservation of their legacy. This model is compelling for founders who have built a sustainable, profitable niche business and are seeking an exit that ensures the continuity of their company’s culture and mission, rather than solely maximizing the immediate financial return or being absorbed into a larger entity. It is an exit that often feels less like an end and more like a continuation under a supportive, patient new owner.

A Management Buyout (MBO) is a transaction where the existing management team of a company acquires a significant portion, or all, of the company from its current owners or shareholders. This effectively transitions ownership to those already running the day-to-day operations.

MBOs can be a highly suitable exit strategy for niche technology companies, particularly when the management team possesses deep, specialized expertise in the company’s niche and has a clear, compelling vision for its future. This route inherently ensures the continuity of specialized knowledge, which is often a critical asset in niche markets.

Key Considerations & Success Factors for Niche Tech:

For an MBO to succeed in a niche tech context, several elements are critical:

The viability of MBOs in niche technology companies is often disproportionately dependent on the “embedded expertise” within the management team. Niche tech firms thrive on specialized knowledge and an intimate understanding of their specific market segments, technologies, and customer needs. An MBO ensures that decision-making authority remains with those who “understand the business best” , which is a significant advantage. This deep-seated expertise not only builds confidence among potential financiers who are backing the management team’s ability to run the company successfully , but also provides assurance to selling founders that the specialized nature and legacy of the business will be understood and preserved. This transforms the MBO from a purely financial transaction into a transfer of stewardship, rooted in trust and shared knowledge of the niche.

A sale to a Private Equity (PE) firm involves a financial sponsor acquiring either a controlling interest or the entire company, often utilizing a significant amount of borrowed capital (leveraged finance). The core objective of a PE firm is to enhance the value of the acquired company over a defined holding period, typically ranging from three to seven years, before exiting their investment. Common PE exit routes include selling the company to another strategic buyer, divesting to another PE firm (a “secondary buyout”), or taking the company public through an IPO.

PE interest in niche technology companies is growing, particularly for those that are mature, profitable, and demonstrate strong cash flow characteristics. Niche businesses operating in fragmented markets that are ripe for a “buy-and-build” strategy (where a PE firm acquires a platform company and then makes add-on acquisitions) are also attractive targets. Many PE firms have developed sector specializations, including dedicated teams and funds focused on technology.

Several types of PE transactions are relevant for niche tech companies:

Key Considerations & Success Factors for Niche Tech:

Niche tech companies seeking PE investment or acquisition should typically exhibit:

The growing interest from Private Equity in niche technology sectors signals an important evolution in these markets. Historically, venture capital in technology has often prioritized rapid, top-line growth, sometimes accepting short-term unprofitability in pursuit of market share. PE firms, particularly in buyout scenarios, generally target companies with established profitability, strong underlying cash flows capable of servicing acquisition debt, or very clear and credible paths to achieving these financial characteristics. The increasing prevalence of PE firms targeting niche tech, including specialized SaaS and software companies , suggests a maturation within these niches. Strategies like “buy-and-build,” where a PE firm acquires a platform company in a fragmented niche and then makes several smaller, add-on acquisitions , are particularly well-suited to many specialized tech markets. This trend indicates a shift in investment focus beyond purely speculative early-stage potential towards extracting value and driving operational enhancements in more established, often profitable, niche players. It reflects a recognition that niche leadership can be translated into sustainable, profitable scale, especially through consolidation and strategic capital deployment.

An Initial Public Offering (IPO) is the process by which a privately held company offers shares of its stock to the public for the first time, thereby becoming a publicly traded entity listed on a stock exchange.

For niche technology companies, pursuing an IPO is generally less common and presents more significant challenges compared to companies with broader market appeal. Success typically requires the niche company to have achieved substantial scale, demonstrate a consistent track record of high growth, and be able to articulate a compelling narrative for a large and expandable total addressable market (TAM), even if its origins are in a specialized niche.

Key Considerations & Success Factors for Niche Tech (if pursuing an IPO):

If a niche tech company contemplates an IPO, it must strategically address these factors:

For a niche technology company, an IPO is often less about simply “exiting” a stable niche and more about a strategic “scaling event” that necessitates a fundamental shift in its narrative. IPOs are primarily a mechanism for accessing significant capital to fuel future growth. Given that niche companies often operate within markets of a defined, sometimes limited, size , and public markets demand compelling stories of large TAM and substantial future growth potential , a successful IPO candidate from a niche background must reframe its story. The narrative must evolve from one of deep specialization in a confined market to one where its established niche expertise serves as a credible launchpad for much broader market penetration, or for defining and leading a new, rapidly expanding category that originates from that niche. Common pitfalls for companies going public include the failure to develop such a compelling story about the company’s future that excites potential investors. Therefore, the IPO becomes a strategic maneuver to fund this ambitious expansion, rather than a straightforward cashing-out from a mature, well-defined niche position. It’s about persuading the public markets that the “niche” is, in fact, the foundation of something considerably larger and more impactful.

An acqui-hire is a form of acquisition where the overriding objective for the acquiring company is to obtain the talent, skills, and expertise of the target company’s employees, rather than its existing products, services, customer base, or ongoing revenue streams. In many acqui-hire scenarios, the acquired company’s products are discontinued post-transaction, and the team is integrated into the acquirer’s existing projects or new initiatives.

This exit route can be particularly relevant for niche technology companies that have cultivated a team with highly specialized and in-demand knowledge – for example, in areas like specific artificial intelligence applications, complex SaaS architecture, cybersecurity, or unique data science methodologies – even if the company’s own product has not achieved significant commercial success or market traction.

Key Considerations & Success Factors for Niche Tech:

For an acqui-hire to be a successful exit for a niche tech company, several factors are key:

Acqui-hires in the context of niche technology companies often represent a “soft landing” driven by acute talent scarcity in hyper-specialized domains. Niche tech environments naturally cultivate deep and specific skill sets within their teams. Simultaneously, the broader tech industry faces intense competition for top talent, making it incredibly challenging to find and recruit individuals with these specialized competencies through traditional means. Acqui-hires are fundamentally about obtaining such talent quickly and efficiently. Indeed, a top-tier research team or a group with unique core competencies can be an attractive acquisition target even if the company has not achieved significant commercial success with its own products. Therefore, for niche tech companies that may not have achieved product-market fit or scalable revenue but possess a team with rare and valuable expertise (e.g., in a specific AI algorithm, a complex niche software architecture, or a unique development methodology), an acqui-hire can be a pragmatic and often dignified exit strategy. The transaction’s value is less about the company’s current market performance and more about the acquirer’s pressing need for that specific, hard-to-find human capital – a strategic talent grab when other exit options might be limited.

An Employee Stock Ownership Plan (ESOP) is a type of qualified employee benefit plan that allows employees to gain an ownership interest in the company. In an ESOP transaction, the company (or its selling shareholders) sells stock to a trust, which holds the shares on behalf of the employees. This can serve as a full or partial exit mechanism for founders and existing shareholders.

ESOPs are a suitable exit alternative for stable, profitable niche technology companies where founders may wish to reward their employees, ensure the continuity of the company’s culture and mission, and potentially realize significant tax advantages. They are generally less common for high-growth, venture capital-backed startups that are typically aiming for a larger-scale M&A event or an IPO.

Key Considerations & Success Factors for Niche Tech:

For an ESOP to be a successful exit strategy for a niche tech company:

ESOPs, in the context of niche technology companies, often represent an “internal perpetuation” strategy. This approach places a high value on the company’s established culture, the contributions of its employees, and its continued service to a specialized customer base, sometimes prioritizing these elements over achieving the absolute maximum external valuation. Niche companies frequently foster strong internal cultures and benefit from loyal, knowledgeable employees who are integral to their success. An ESOP allows founders to reward this loyalty and expertise by making employees owners. While the valuation in an ESOP is based on fair market value and typically doesn’t include a strategic premium , the primary motivation is often not solely about maximizing the sale price to an external entity. Instead, it’s about facilitating an internal succession and ownership transition that promotes shared prosperity and preserves the unique character and independence of the business. This makes ESOPs a compelling option for founders whose goals extend beyond personal wealth maximization to include the long-term well-being of their company and its people.

Royalty-Based Financing (RBF), also known as revenue sharing, is not a full exit strategy in the traditional sense, but rather a method of raising capital or achieving partial liquidity for founders. In an RBF arrangement, investors provide capital to a company in exchange for a percentage of its future monthly revenues. These payments continue until a predetermined multiple of the original investment (a “cap”) is repaid to the investor.

This financing model is particularly relevant for niche technology companies, especially those with predictable, recurring revenue streams, such as Software-as-a-Service (SaaS) businesses or other subscription-based models. It offers founders a way to access liquidity without selling equity or ceding control of their company.

Key Considerations & Success Factors for Niche Tech:

For RBF to be a viable option for a niche tech company:

RBF offers founders of niche technology companies a form of “patient liquidity” while allowing them to preserve control over their business. Many niche tech companies, particularly those that are bootstrapped or have consciously chosen a path of sustainable growth rather than hyper-growth fueled by venture capital, place a high value on maintaining control and their specialized focus. For these founders, RBF can be an attractive option if they require liquidity – perhaps for a partial cash-out to de-risk their personal financial situation, to fund a specific growth initiative without diluting ownership, or to buy out a passive shareholder – but are not yet ready for a full sale and wish to continue steering their company’s direction. It represents a form of capital that aligns well with the often steadier, more focused, and control-oriented growth trajectory characteristic of many successful niche businesses.

Regardless of the chosen exit path, meticulous preparation is fundamental to maximizing valuation and ensuring a smooth transaction. For niche technology companies, this preparation often involves highlighting unique strengths while addressing potential concerns related to market size or scalability.

Acquirers and investors need to see not just current dominance within a niche, but also tangible evidence of future potential and a well-managed business. Scalability is a crucial factor; companies should be prepared to demonstrate successful operational expansion, optimized cost structures, and the ability to capture larger segments of their target market, or adjacent markets. For early-stage technology companies, several characteristics enhance attractiveness for an exit. These include a combination of profitability and rapid growth, strong and defensible intellectual property (IP), clearly defined core competencies (such as a top-tier research and development team, even if commercial success is still nascent), third-party validation of technology or products (e.g., successful pilot programs or early adopter sales), and demonstrable market traction within the niche.

For niche Software-as-a-Service (SaaS) companies, specific metrics are particularly scrutinized during exit discussions. Key performance indicators (KPIs) that signal readiness and value include a strong annual growth rate (ideally in the 50-100% range), a healthy Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio (greater than 3 is often a benchmark), low annual customer churn (less than 7% is desirable), and a customer acquisition cost payback period of less than 12 months. Other important metrics include Customer Lifetime Value (CLV), Net Revenue Retention (NRR), and Monthly Recurring Revenue (MRR) growth and stability.

Beyond these metrics, specific financial strategies are vital for niche SaaS companies contemplating an exit:

- Reliable cash flow is critical, especially in niche markets where each customer relationship carries more weight due to a smaller overall customer pool. Effective cash flow management ensures resources are available to acquire and retain customers and demonstrates financial stability to potential acquirers.

- Adherence to accounting standards like ASC 606 (or IFRS 15 for international companies) is essential. Accurate revenue recognition, particularly for recurring revenue models, is fundamental for valuation, as it underscores the predictability and quality of earnings.

- Developing robust financial plans, forecasts, and budgets that are aligned with product roadmaps and go-to-market strategies demonstrates financial maturity and a clear vision for sustainable growth. This is particularly important for niche players who need to show how they can effectively allocate resources within a focused market.

Finally, companies must strategically leverage their inherent niche strengths. This includes emphasizing deep customer understanding, cultivating high customer loyalty (which translates to predictable revenue and lower churn), and justifying the potential for premium pricing due to the specialized value delivered.

Proactive and early planning for an exit significantly increases the likelihood of a successful outcome and can maximize valuation. Ideally, an exit strategy should be considered and formulated from the very founding of the company, influencing subsequent strategic decisions. A fully marketed technology company exit typically takes between six and 18 months to complete; thorough preparation can substantially shorten this timeline and reduce deal friction. Reacting to unsolicited offers or deciding to sell under pressure often leads to suboptimal terms and valuations.

The role of cannot be overstated. Experienced advisors can assist with developing the exit strategy, preparing the company for sale, identifying and approaching potential buyers, managing the negotiation process, and navigating the complexities of due diligence, ultimately helping to expedite the process and secure better terms, especially for early-stage or specialized tech companies.

A critical component of preparation is the creation of a . A well-organized VDR, containing all important corporate, financial, legal, IP, and operational documents, is key to streamlining the due diligence process. Its completeness and clarity are significant determinants of how long an exit takes and its ultimate success.

Furthermore, ensuring is paramount. This includes having well-prepared, audited financial statements (often for the preceding three years), clean corporate records, clear IP ownership documentation, and robust internal controls.

Misaligned expectations among key stakeholders – including founders, investors (such as venture capitalists), and key employees – can easily derail an otherwise promising exit opportunity. It is crucial to build and maintain alignment regarding valuation expectations, the desired timing of an exit, post-acquisition roles, and overall strategic objectives. This alignment should be tested and revisited regularly, at least annually or as significant milestones are achieved.

For companies with venture capital backing, aligning the investment timeline with the anticipated exit horizon is particularly important. A mismatch between a VC’s fund lifecycle and the startup’s readiness for an exit can lead to adverse outcomes, such as pushing for an exit prematurely or, conversely, missing a lucrative opportunity because the fund is nearing its end-of-life.

The rigorous preparation undertaken by a niche technology company for an exit serves a critical underlying function: “de-risking the specialized” nature of the business in the eyes of potential acquirers. Niche markets, by their very definition, are specialized , and this specialization, while a strength, can be perceived as a risk by broader-market acquirers if the company’s value, operations, and market dynamics are not clearly understood or seem too narrow. Key preparatory steps – such as developing robust and audited financials , ensuring clear and defensible intellectual property , meticulously documenting processes and controls (as evidenced by a comprehensive VDR ), and demonstrating tangible market traction and customer validation – all contribute to making the company’s operations, value proposition, and future potential more transparent, verifiable, and thus less risky. By providing clear, credible data and showcasing operational maturity and financial discipline, the niche company can effectively overcome potential skepticism about its market size, scalability, or long-term viability, thereby making its unique assets and focused market leadership more attractive and justifiable for acquisition at a favorable valuation.

The journey of building a technology company within a niche market is distinct, and so too is the process of navigating its eventual exit. The “best” exit strategy is not a universal formula but one that is highly contextual, deeply intertwined with the specific circumstances and aspirations of the company and its stakeholders.

As the preceding analysis demonstrates, a multitude of exit alternatives exist, each with its own set of advantages, disadvantages, and suitability for niche tech companies. The optimal choice hinges on a careful evaluation of numerous factors, including the company’s type, size, stage of maturity, financial health, market position, and the overarching goals of its founders and investors. An effective exit strategy must be formulated based on clearly defined objectives – whether they are to maximize financial return, ensure a smooth transition, preserve a legacy, or reward employees.

The selection process requires a candid assessment of:

- What do the founders hope to achieve? Is it primarily wealth maximization, the continuation of their vision and legacy, an ongoing role in the business, or ensuring the well-being and future prospects of their employees?.

- What is the company’s current stage of development – early growth, established profitability, or market leadership? How strong is its financial performance and competitive positioning within its niche?

- If the company is backed by external investors, their expectations regarding returns and the timing of liquidity are critical considerations that must be aligned with the chosen exit path.

- Nature and Value of Intellectual Property: The strength, defensibility, and strategic importance of the company’s IP can significantly influence which types of acquirers or exit strategies are most appropriate.

Successfully exiting a niche technology company is a testament to strategic foresight and diligent preparation. The power of deeply understanding both the inherent advantages (like focused expertise and customer loyalty) and potential limitations (like market size constraints) of operating within a niche cannot be overstated. This understanding allows founders and their teams to position the company effectively for the most suitable exit.

The importance of early planning, seeking professional M&A and legal advice, and building a fundamentally strong, well-documented, and financially sound business are recurring themes that underpin successful exits across all alternatives. The journey of a niche tech company, characterized by its specialized focus and deep market knowledge, can indeed culminate in a variety of rewarding and successful exits, provided the path is chosen thoughtfully and prepared for strategically.

The very definition of a “successful exit” for niche technology companies appears to be broadening. While financial return remains a critical, and often primary, metric, the increasing viability and acceptance of diverse exit options such as acquisitions by “forever acquirers” or transitions to Employee Stock Ownership Plans , alongside traditional M&A and IPOs, point to an evolving landscape. These alternative paths often allow for the prioritization of different outcomes – for example, the preservation of a unique company culture, the long-term welfare of employees, continued service to a specialized customer base, or the enduring legacy of the founder’s vision – which may, in some cases, take precedence over achieving the absolute highest short-term valuation multiple. Niche markets themselves often foster strong company cultures and deep, loyal relationships with both customers and employees. This evolution suggests a maturation of the niche tech ecosystem, where enduring value is recognized not just in rapid disruption and hyper-scale, but also in sustainable, focused excellence and the positive impact a company has on its specific community and stakeholders.

Check out the latest Business news bellow:

If you're interested in purchasing a Press Release/Sponsored Article, feel free to contact us at: [email protected] .

Sylvia