OMC Stocks in Focus: LPG compensation confirmed; HPCL, BPCL, IOCL may gain on payout clarity

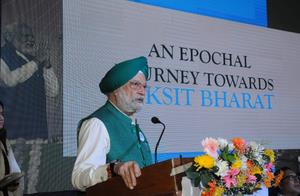

Shares of India’s top oil marketing companies (OMCs) — Hindustan Petroleum Corporation (HPCL), Bharat Petroleum Corporation (BPCL) and Indian Oil Corporation (IOCL) — are likely to be in focus this week after Petroleum Minister Hardeep Singh Puri assured the industry of a full and final payout of LPG subsidy compensation from the Finance Ministry.

The minister’s statement, made with “100 per cent certainty,” removes a long-standing overhang from the financials of these companies and is expected to offer short-term as well as structural relief to the sector.

For the past several quarters, OMCs have borne under-recoveries on domestic LPG sales as part of the government’s subsidy framework. The formal confirmation of compensation disbursement is seen as a boost to their bottom line, especially for the June or September quarter.

The payout could ease pressure on working capital and support balance sheet improvement, particularly as companies brace for crude oil volatility and rising capex requirements.

Brokerages expect HPCL, BPCL, and IOCL shares to react positively in the near term as the news eliminates regulatory uncertainty.

Analysts believe the announcement may also lead to valuation re-rating for select OMCs, especially if further reform signals emerge in the upcoming budget or from the Ministry of Petroleum and Natural Gas.

BPCL may remain in particular focus given ongoing discussions around divestment and strategic sale, which could gain traction now that compensation clarity has been provided.

Institutional investors may look to increase exposure to PSU energy stocks following this clarity, especially with government subsidy policies more clearly communicated.

In the past six months, public sector energy stocks have already attracted significant interest due to strong refining margins, stable fuel pricing, and expectations of capital returns through dividends.

With subsidy-related ambiguity now behind, investors will watch for details of the exact compensation amount, timing of disbursement, and potential inclusion in Q1FY26 earnings. The move could also influence sectoral ETFs and mutual fund positioning ahead of earnings season.