Nvidia Stock: Strategic Expansion Amid China Trade Challenges

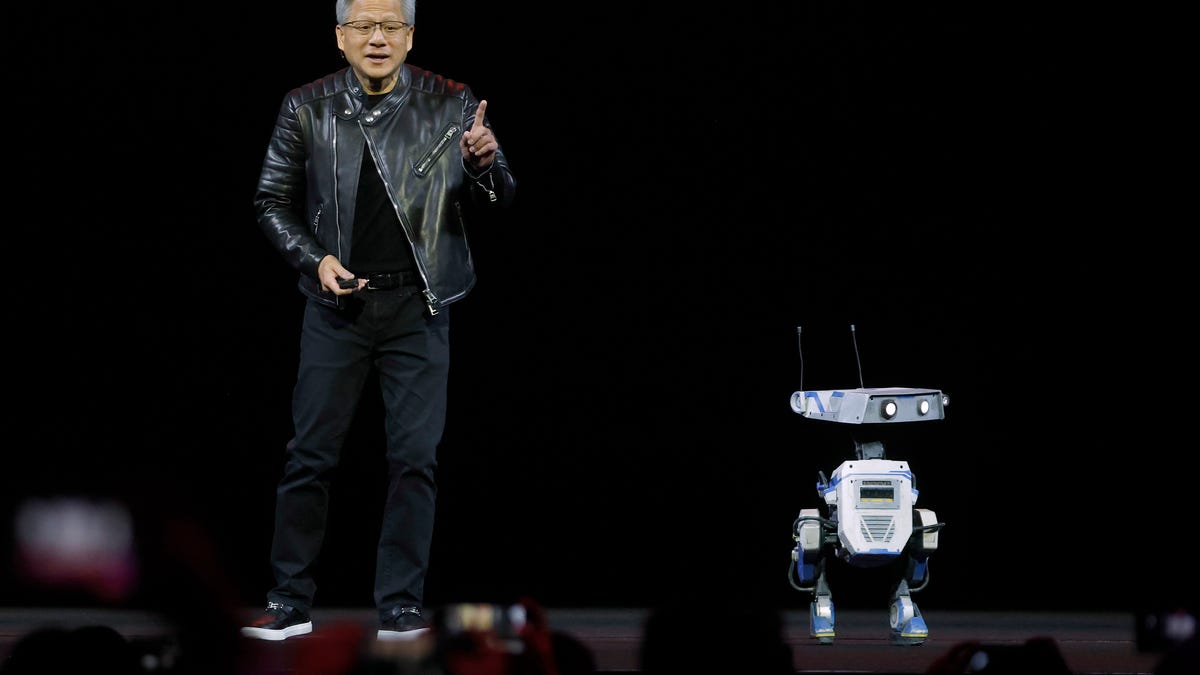

Nvidia's stock showed minimal movement on Monday, edging up just 0.13% to $135.57 after falling 2.44% to $132.10 in after-hours trading the previous Friday. Behind this apparent calm, the AI giant unveiled a flurry of strategic initiatives at Computex 2025 in Taipei. CEO Jensen Huang announced the "NVLink Fusion" program, opening Nvidia's ecosystem to allow customers and partners like MediaTek, Marvell, and Qualcomm to connect non-Nvidia processors with their technology. The company deepened collaborations with ASUS on advanced AI-POD designs and revealed plans to build an AI factory in Taiwan with Foxconn utilizing the new Blackwell GPU series. Additionally, reports indicate Nvidia is exploring entry into quantum computing through potential investment in startup PsiQuantum, marking its first venture into physical quantum computer manufacturing.

The US export restrictions on China have significantly impacted Nvidia, with Huang acknowledging $5.5 billion in inventory write-downs and approximately $15 billion in lost revenue. To maintain presence in this crucial market despite trade barriers, Nvidia reportedly plans to deliver modified AI chips to China beginning next quarter. These adapted versions will include a stripped-down Hopper series variant without High-Bandwidth Memory (HBM), with a similarly modified Blackwell series expected to follow later in 2025. This strategic adjustment represents Nvidia's attempt to balance compliance with US regulations while preserving its competitive position in the Chinese market, where local alternatives continue to gain ground.

Ad

Fresh Nvidia information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Source StockWorld

.jpg)