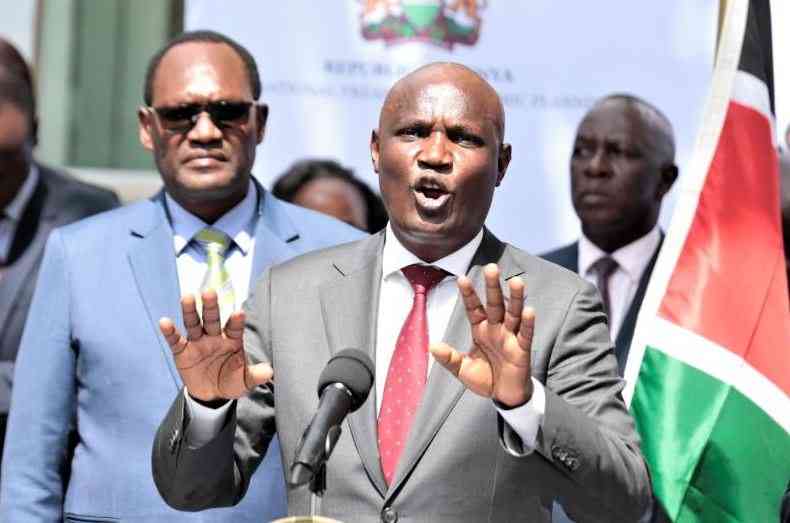

Kiharu MP Ndindi Nyoro has sustained his criticism of President William Ruto and how he is handling the public debt.

Source: Facebook

The lawmaker, who formerly sat in the Budget and Appropriations Committee as its chairman, predicted a financial free fall in the near future due to the country's inability to service its debt on time.

The debt currently stands at upward of KSh 10 trillion.

He noted that the country would still need to borrow to sustain its budget for the 2025/26 fiscal year, this despite the National Treasury's assurance of managing the debt.

The borrowing of over 21% to finance the budget is an indicator of a bad financial decision, which will frustrate the efforts to get out of the debt hole.

Nyoro, while noting that the KSh 900 billion debt the government targets this year is higher than the one acquired last year, warned that getting out of the debt cycle would be a tall order with the regime's supposedly unviable efforts to reduce the heavy debt repayment burden.

"I’m not saying this to provoke anyone, but we need to face reality — Kenya’s debt levels are getting out of hand. Out of our 4.2 trillion shilling budget, nearly 900 billion will be borrowed. That’s not sustainable. We keep saying we’re coming out of the debt hole, yet we’re borrowing even more than we did last year. That’s not walking the talk," he said.

He also seemed to pick holes in the manner the government is running the critical sectors of the economy, suggesting that some of the approaches would be detrimental in the long run.

The lawmaker took issue with the securitisation of government receivables, which he observed might not be sustainable due to the change of policies in the successive regimes.

Source: Twitter

He drew an instance from a loan the government seeks to secure and then use a seven-year fuel levy as its collateral, without the assurance the next government(s) would sustain it until maturity.

This, according to Nyoro, meant the government would be spending the loaned money upfront and then banking on a fuel levy whose longevity cannot be guaranteed.

He said that left with the burden will ultimately be Kenyans, who will be made to service it as sovereign debt.

"As a leader, I am genuinely concerned. The issue lies in securitisation — and many of our problems today are rooted in financial decisions made in the past. We’ve chosen to be clever instead of intelligent. Take the KSh 7 levy, for example. It was introduced to secure debt payable over the next seven years. Now, we want to spend KSh 175 billion in revenue meant to be collected over those years all at once, today. Then we are borrowing money that is to be collected for the next seven years...The KSh 7 levy will be the one that will be repaying this money. What if there is a change of government or a change of government policy that comes and abandons the fuel levy? It therefore means this KSh 175 billion Kenya falls back as a sovereign debt that is to be paid by Kenyans," he said.

Meanwhile, even Nyoro sounded an alarm, National Treasury John Mbadi is on record allaying the fears of Kenya defaulting on its loans.

He previously explained that the country has enough time to honour its debts, most of which would be due in 2032.

The CS, however, appreciated that the country was grappling with the problem of liquidity.

He said that whilst the pressure lay on money circulation, the country was striving to get out of the zone where defaulting is inevitable.

Source: TUKO.co.ke