Michael Saylor Quietly Explained the Entire Future of Bitcoin in One Sentence.

I don’t often talk about the granddaddy of them all, Bitcoin.

But Michael Saylor, basically the Satoshi oracle, worshipped by many like the second coming of Jesus because of his ability to turn complex financial ideas into plain English, popped up in an interview and gave the clearest explanation I’ve heard yet for why Bitcoin’s adoption will keep accelerating.

You don’t need to be a billionaire to see the playbook he’s using.

Saylor’s not your typical corporate executive.

He’s certainly not a crypto bro throwing darts at the market like a blind folded chimpanzee. What I like about him is how he weaves a narrative that speaks to the knowledge gap.

I always seem to have those aha moments whenever he speaks. Like the time he explained diversification vs staying concentrated, comparing it to sitting on one chair. In most areas of life, we don’t spread ourselves thin. We choose one thing and lean into it.

He also eats his own cooking because his company's MicroStrategy (Now named Strategy) has purchased 582,000 bitcoins, acquiring them at an average price of about $66,384, totalling a cost basis of around $33.14 billion.

The vast majority of the Bitcoin purchases have happened through convertible notes, essentially converting stock into cash to fund even more Bitcoin buys.

Whether this will prove to be a winning strategy long term is still up for debate, but Saylor isn’t slowing down. He’s already mapped out plans to raise another $21 billion through 2025–27.

Naturally, this has led to numerous questions about what happens when the 2x leveraged traders, who are trying to arbitrage those convertible notes, eventually start to sell.

Saylor’s response was emphatic.

“It’s very misunderstood, people think it’s debt. It’s convertible debt, it is unsecured. There’s no recourse. What that means is that Bitcoin could go from $100,000 to $1,000, the debt is not getting called. There is no recourse. Bitcoin can go to one dollar, Bitcoin can literally go to 1 penny, the debt doesn’t have a call feature. It’s like someone basically loans you billions of dollars and you agree in 5 years you will either pay them back in cash or in stock. If Bitcoin crashed by 75% the stock would trade down we would just pay off the debt with stock. The risk isn’t in the debt so much as it is in the equity, and then people are like oh well that makes the equity more risky.

Well yeah that’s the point.”

The Bitcoin thesis is laughably simple when you strip it back.

It’s down to one megatrend sweeping the world: currency debasement.

We’re living longer, working less, having fewer kids, and borrowing more to keep up with the Joneses. So with each new financial cycle, central banks have to fill that productivity gap by printing more money.

It weakens our spending power but increases asset prices.

As the best business cycle analyst in the world, Julien Bittell explained:

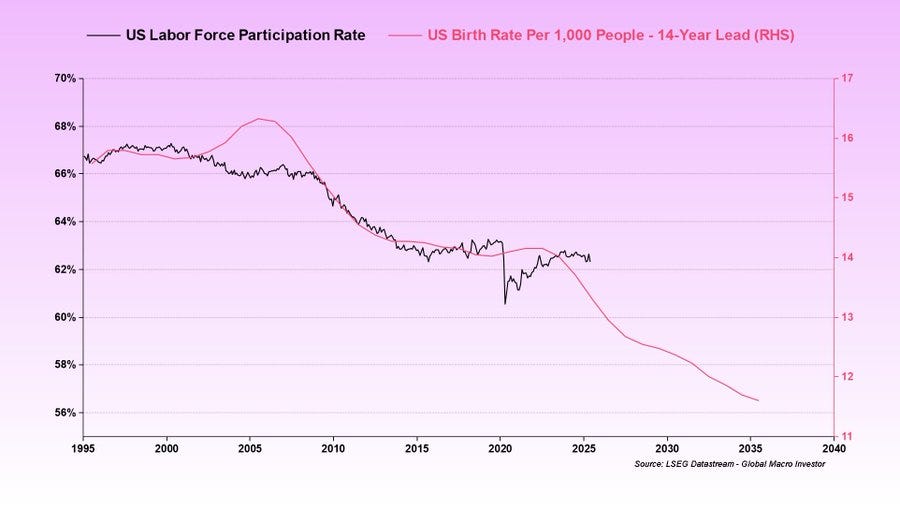

“The labor force participation rate isn’t going to rise anytime soon – it’s set to keep declining over time. This is a structural problem… We’ve got aging demographics, falling birth rates, and now the rise of automation. Humans are already being replaced by AI and robots at a staggering pace, and that shift is only just beginning. This is deflationary. It also reinforces the need for ongoing stimulus to keep the system afloat. Fewer workers. More tech. Same debts…”

What Bittell is saying is that, because demographic decline is slowing productivity, printing more money has become a necessary way to keep the system afloat.

“The only answer is more debt. That’s how the system survives. It’s the only way to keep the whole thing from unravelling…when both the public and private sectors are running debt levels around 120% of GDP, you’re staring down the barrel of a GDP doom loop – unless you stimulate growth or monetise the whole thing. There’s simply not enough GDP growth to sustainably service the interest payments on all that debt.”

What we end up with, then, is a reinforced debt cycle that makes investing in risk assets a no-brainer.

Currently, the rate of money printing is approximately 9% per year. Add a current 2.5% inflation rate, so your real hurdle rate to stay even is 11–12%.

That’s why I wince when I hear financial “gurus” like Dave Ramsey telling people to buy the S&P 500. It averages around 11%, so in reality, you’re barely treading water. Ramsey’s great when it comes to debt and saving, but this part of the conversation needs more nuance.

More folks are waking up to the role of money printing and liquidity as the main drivers of asset prices.

Take Michael Howell, the top liquidity expert in the world. In his book, Capital Wars, he says the single most significant force driving global markets is liquidity.

“Liquidity drives asset prices because it represents the flow of money and credit that fuels market activity, overshadowing traditional factors like interest rates or earnings, as it determines the availability of capital to invest and the ease of moving assets in global markets.”

Top research analyst, Jamie Coutts, says the recent rally in Bitcoin lines up perfectly with a surge in global liquidity (more money flowing into the system).

When liquidity rises, Bitcoin tends to rise too, by roughly 20% for every 1% increase in liquidity.

Coutts expects a wave of panic buying as prices increase, which will drive prices even higher and faster.

“Bitcoin has rallied 40% since April, when my global liquidity aggregate (GLI) after three years broke out to new all-time highs on the back of a plummeting US dollar. Since then, the aggregate has increased by 2%. Bitcoin's Q2 rally is entirely consistent with liquidity regimes of this nature. While Bitcoin's sensitivity to GLI moderates over time, for every additional 1% of liquidity added to the system, we should expect to see a price increase of more than 20% in Bitcoin. While this simple model accounts for the continuation of the hoovering of capital from all corners of the globe into Bitcoin, it doesn’t account for the inevitable “oh shit” moment of panic buying that is going to happen...eventually. It will be the best of times, it will be the worst of times.”

Like me, you’ve probably felt the sting at the supermarket lately.

Everything costs more, and your money doesn’t go as far. Michael Saylor says the answer is Bitcoin, because it’s “perfect” money. Why? It’s limited. Unlike the pound or dollar, no one can print more of it.

It’s the simplest explanation a child could understand.

What he’s saying, and it’s a more nuanced point, is that gold, as a traditional asset, helps illustrate the logic behind Bitcoin’s design and value.

During the gold standard era, prices remained stable because both the gold supply (which served as the money supply) and the economy were growing at approximately 2% per year.

When money supply and economic growth rise at the same rate, prices remain steady. But when the money supply grows faster than the economy, it drives up the cost of goods and services because, excuse the phrase, you’re getting less bang for your buck.

Michael Saylor breaks it down like this:

“Bitcoin is perfect money. The reason you had stable prices during the gold era of the gold standard age is that gold was inflating by 2% per year, and the economy was growing at a rate of 2% per year. So if the output of goods and services grows at the rate of the money supply, the price is constant. If the money supply were fixed and the economy continued to grow, prices would fall 2% every year.”

It comes down to the strength of your spending power.

Saylor says that in a gold-based system, if a tech product improves rapidly, the price could drop 20% a year. But money printing is offsetting that. For example, if they print 10% more money, the product’s price might only fall 10%, not 20%.

It’s a constant tug-of-war between productivity gains and money supply.

Saylor says:

“What’s going on is a race between productivity and money supply— if I can drive the price of the product down 20% a year and inflate the amount of money 10% a year, the price of that thing will fall 10% — but if I didn’t inflate the money it would fall 20%.

So I looked at gold and thought, I need something like gold. I thought, gold is not perfect, but it was the best idea in the 19th century — and it’s not quite working in the 20th century. So I started thinking, what if someone designed digital gold?

If you could go back to the engineers and say “How can you perfect gold?” And the engineering idea is: “How do you fix gold and make it perfect?”.

Well, you make it impossible to mine anymore.”

The punchline to this entire piece is that the system is broken because we have no other option but to inflate the money supply, and Bitcoin is the fix.

Saylor and many of his contemporaries are speaking increasingly more about the structural reality we’re living in:

Currency debasement ultimately becomes the silent tax we're all paying for. Because the cost of goods and services hasn’t dropped, nor has wage growth increased meaningfully.

That’s the loop we’re stuck in.

Saylor’s point is brutally simple: if the money keeps getting weaker, you need a stronger asset.

Something fixed. Something immune to the whims of central banks. Something like digital gold — only better. And Bitcoin ticks every box. Fixed supply. Global. Transparent. Trustless.

He bets that as this dynamic continues to play out, the productivity gap will widen, and the money supply will expand. Capital will naturally flow into the one asset that sits outside the system.

If the value of our money continues to decline while the system demands more to stand still…at what point do we start looking for something better?

It’s the point Michael Saylor hammered home in one sentence.

If this blog brought you any value, please become a subscriber and share this with someone in your network. It’s how Carrot Lane grows.