LexisNexis: Collision severity and frequency trending down, insurance market softening | Repairer Driven News

In 2024, collision severity declined by 2.5% year-over-year (YoY) while property damage severity increased by 2.5%, and bodily injury severity jumped 9.2%, according to LexisNexis Risk Solutions.

LexisNexis also predicts that initial indications are rate levels will return to more normal levels this year, according to the 2025 U.S Auto Insurance Trends Report. It shows aggregate 2024 market data on consumer driving patterns, auto insurance shopping trends, claim frequency and severity, and consumer responses to rate increases.

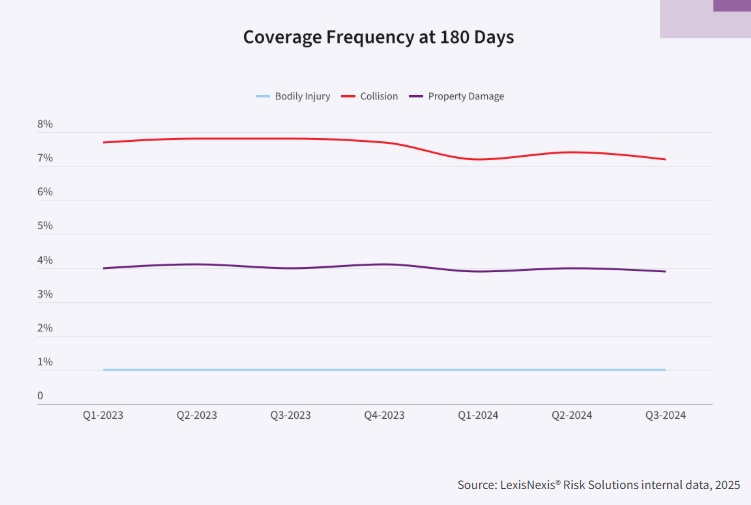

Collision frequency moved from 7.8% in the first three quarters of 2023 to 7.3% in the same period in 2024. Given that collision frequency remained at 8% or higher for much of 2022, this decline is now a trend, LexisNexis wrote.

Property damage frequency also declined, moving from 4.1% in the first three quarters of 2023 to 3.9% over the same period in 2024. This coverage has not seen a frequency below 4% since Q1 2021, according to the report.

Bodily injury frequency stayed the same, at 1%, where it has been for multiple consecutive quarters.

Insurance rate increases are beginning to ease as market conditions soften, rising 10% YoY in 2024 compared to 15% in 2023. However, overall industry rate levels increased by 35% from January 2022 to the end of 2024.

“LexisNexis Risk Solutions notes that in 2025, tariffs may factor into how insurers consider rates,” the report states. “While the market wouldn’t expect the magnitude of activity seen between 2022 through 2024, tariffs, if they stick, could set off a ripple effect of moderate rate increases with implications across the industry.”

Insurer profitability is also improving, with direct written premiums growing 13.6% to $359 billion, slightly less than the 14% growth in 2023, and incurred loss ratios improved steadily throughout the year. LexisNexis says this enables some carriers to pursue growth strategies and file for rate decreases.

“The combination of these two elements allowed those insurers who returned to profitability to take a more surgical and balanced approach to rate changes, with many filing for rate decreases for the first time in years,” LexisNexis said.

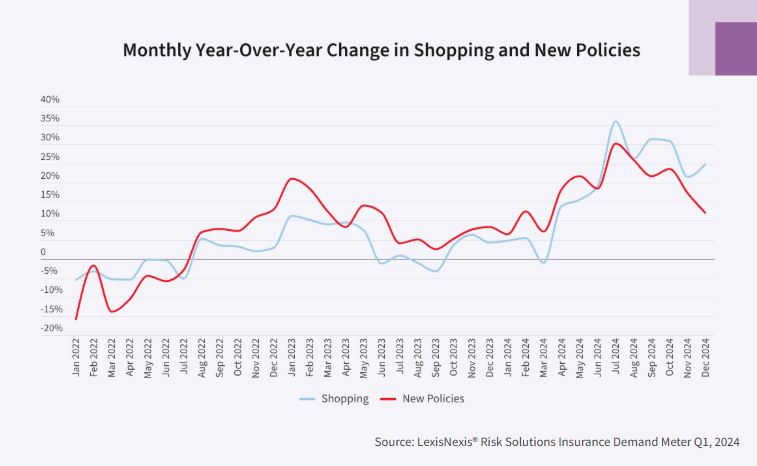

Policy shopping reached an all-time high, with more than 45% of policies in force shopped at least once by year-end.

Older and long-tenured policyholders led the shopping trend, with consumers aged 66 and older shopping and switching at a higher rate than any other age group. Shopping among those who have been with an insurer for 10 or more years rose 35% YoY, with the rate of high-survivability shoppers hitting 40% by the end of 2024.

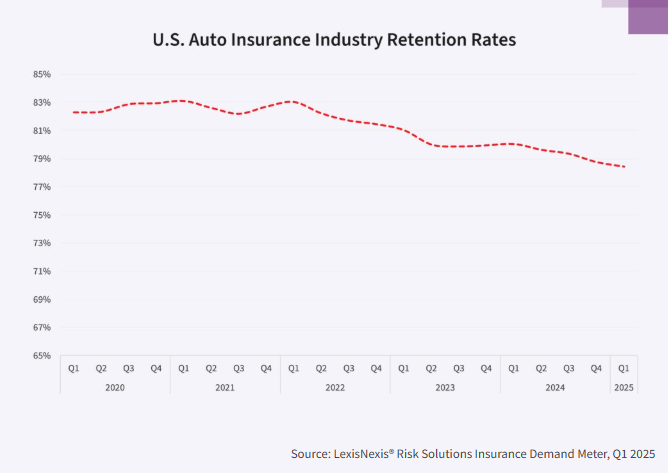

“As long-tenured consumers continue to shop and potentially switch their insurance policies, insurers may want to focus on their retention strategies,” a press release states. “Since 2021, retention has decreased 5 percentage points to 78%, resulting in a 22% increase in policy churn.”

The report adds that new business growth outpaced auto policy shopping in the first half of the year.

“As insurers staggered the timing of rate increases across states, consumers found favorable deals,” the report states. “In the second half of the year, shopping outpaced switching. This was likely due to insurers implementing higher rates over time, making it harder for shoppers to find enticing deals.”

Jeff Batiste, LexisNexis Risk Solutions U.S. auto and home insurance senior vice president and general manager, said in the press release that auto insurers continue to navigate a dynamic market.

“The combination of the market softening and a return to profitability presents a potential new chapter for the industry as insurers encounter a consumer base that is more willing than ever to shop for deals,” he said. “However, this is the market as we understand it now, and we might be seeing a different picture in a couple of months.

“Insurers who can quickly evaluate shifting trends and adapt pricing models should have a competitive advantage, enabling them to price risk more accurately and quickly, which should also set themselves up for more success as these trends impacting the industry persist.”

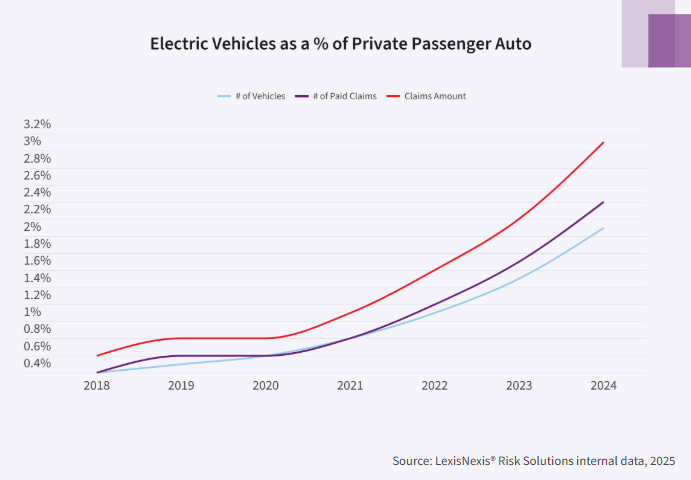

According to LexisNexis, transitioning to electric vehicles (EVs) also comes with new risks, as drivers experienced a 14% rise in claim frequency.

In 2024, 1.57 million EVs were sold in the U.S., an 8.9% increase compared to 2023. This percentage is higher than the 2.6% growth during the same period of all light-duty vehicles — cars, vans, SUVs, and pickup trucks that weigh 8,500 pounds or less, according to the report.

The number of insured EVs grew by 40% to 5.6 million last year, which is much higher than the 1.8% growth in the number of private passenger autos insured during the same period.

The report also analyzes driving violations. LexisNexis notes that while the National Highway Traffic Safety Administration (NHTSA) reported 2024 traffic fatalities decreased by 3.8% to 39,345 compared to 2023, that was still 11% higher than the average for the decade preceding the COVID-19 pandemic.

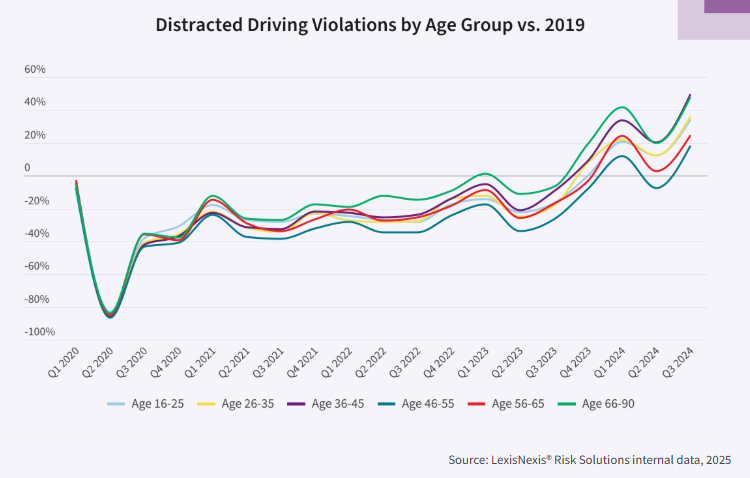

Overall, traffic violations increased by 17% YoY, and nationwide rates surpassed those in 2019. Major speeding violations rose 16% YoY (38% higher since 2019), and minor speeding violations increased 25% YoY (21% higher since 2019).

Driving under the influence increased by 8% over 2023 levels, with drivers aged 66-90 experiencing the largest jump in DUI violations. However, drivers between the ages of 26 and 35 make up the largest percentage of overall DUI violation volumes, according to LexisNexis.

Cell phone use while driving continues as a significant contributor to distracted driving, with texting while driving remaining particularly dangerous, according to the report. Many states have enacted and strengthened distracted driving laws, including bans on handheld device use and increased penalties for violations.

The number of drivers with distracted driving violations increased by 50% during the first three quarters of 2024 compared to the same period in 2023.

Images

Featured image credit: Cameris/iStock

Share This: