Know Your New Tax Laws, Atoyebi Urges Nigerians

A tax analyst and expert, Arabinrin Aderonke Atoyebi, has urged Nigerians to familiarise themselves with the new tax reform laws, describing the development as a bold step towards a more efficient, transparent, and citizen-friendly tax system.

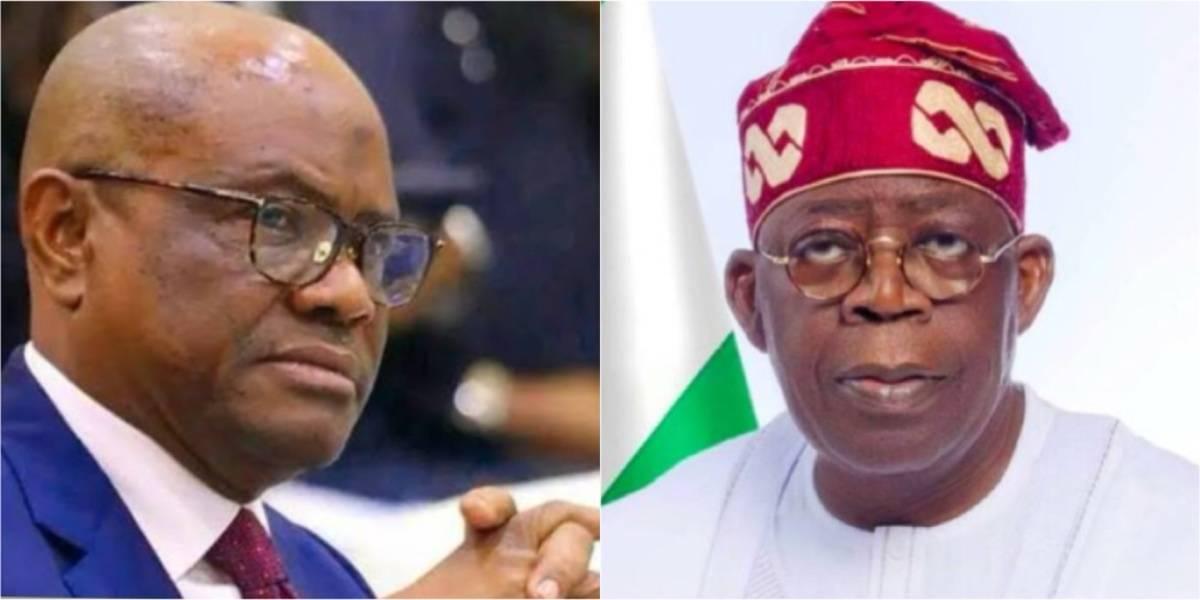

Atoyebi commended President Bola Ahmed Tinubu for signing the tax reform bills into law and noted that they would significantly change how taxes are collected and paid in the country.

“These reforms are aimed at simplifying the tax system, improving fairness, and enhancing the overall efficiency of tax administration nationwide,” she said.

Atoyebi said the new laws would provide the needed clarity for many Nigerians, who have viewed the country’s tax structure as complex and burdensome.

The four newly signed bills are the Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service (Establishment) Act and Joint Revenue Board (Establishment) Act.

The Nigeria Tax Act, Atoyebi explained, consolidates several outdated tax laws into a single, streamlined document.

“In the past, multiple and often conflicting tax regulations made it hard for individuals and businesses to know what taxes to pay and how to comply. Now, unnecessary and duplicate taxes have been eliminated,” she said.

The new law also ensures that tax rules are uniformly applied across the country. “Whether you live in Lagos, Kano, or Calabar, tax officials will follow the same standard procedures, reducing the chances of being taxed twice or receiving contradictory instructions from different levels of government,” she stated.

A major provision of the Act is the treatment of Value Added Tax (VAT). While the rate remains at 7.5 percent, essential goods and services like food, healthcare, education, housing rent, and public transportation will be exempted or zero-rated.

“This is meant to ease the cost burden on everyday Nigerians,” Atoyebi stated.

She also noted that the Act strengthens the input VAT system, allowing businesses to offset VAT on purchases. This helps prevent double taxation and encourages business expansion. Additionally, all individuals and entities are now required to obtain a Tax Identification Number (TIN), which will aid in registration, monitoring, and promoting accountability.

Under the Nigeria Revenue Service (Establishment) Act, the Federal Inland Revenue Service (FIRS) is replaced with the Nigeria Revenue Service, which will now collect all federal taxes and other government revenues. The agency will deploy upgraded digital platforms to ease tax registration, filing, and payments.

“This move is expected to reduce delays, errors, and corruption in the tax system,” Atoyebi said.

The Joint Revenue Board (Establishment) Act sets up a unified tax governance body to coordinate between federal, state, and local tax authorities. It will promote policy consistency and resolve the overlapping mandates that have long confused taxpayers.

To further protect citizens, the law also creates a Tax Appeal Tribunal and an Office of the Tax Ombuds, where taxpayers can file complaints, resolve disputes, and seek justice in cases of unfair treatment.

Relief for Low-Income Earners and SMEs

The reforms also introduce direct relief for low-income earners and small businesses. Individuals earning up to ₦800,000 annually will be exempt from paying personal income tax. Additionally, small and medium-sized enterprises (SMEs) will benefit from simplified tax procedures and lower compliance costs.

“These measures are a lifeline for small traders and entrepreneurs who drive much of our economy,” Atoyebi said.

All changes are scheduled to take effect from January 1, 2026. This gives the government ample time to conduct public sensitisation campaigns and train tax officers to ensure a smooth transition.

Atoyebi emphasised the importance of public understanding. “Knowing your rights and responsibilities under the new laws is essential. This is how we build a tax culture that works for everyone.”

She concluded by reaffirming the significance of the reforms: “The Renewed Hope Agenda is about every Nigerian. These reforms signal a national readiness to do things differently. Congratulations to all Nigerians, we are stepping into a new era of accountability and inclusive development.”

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel