Japan's Inflation Crossroads: Can the BOJ Tame Prices Without Stalling Growth? - Inflation Hits Multi-Year High | The Economic Times

1/7

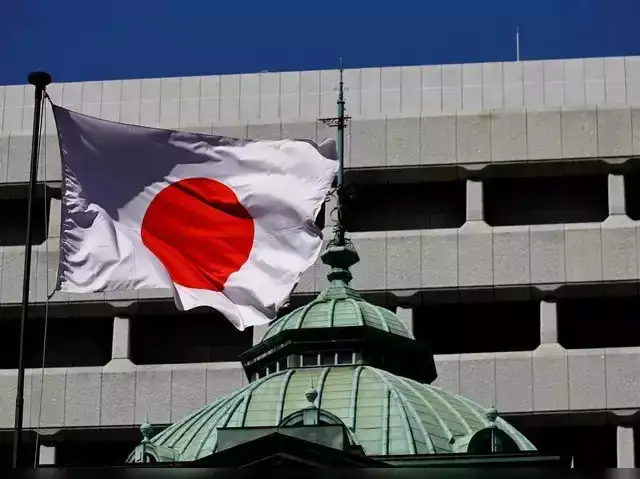

Core inflation in Tokyo rose by 3.6% year-on-year in May, marking the fastest pace since January 2023. This increase surpassed market expectations of a 3.5% rise and reflects persistent upward pressure on prices. Tokyo’s inflation has now remained above the Bank of Japan’s 2% target for three consecutive years, reinforcing concerns about entrenched price growth. (Source: Reuters)

ETMarkets.com

2/7

The latest data shows food prices remain the biggest driver of inflation. Non-fresh food prices rose by 6.9% in May compared to the previous year, while rice prices saw a dramatic surge of 93.2%. Services inflation also edged higher, climbing to 2.2% in May from 2.0% in April, as companies gradually passed on increased labour costs to consumers.

ANI

3/7

A broader index excluding both fresh food and fuel, closely watched by the BOJ, rose 3.3% in May, signalling a continued broad-based rise in prices. With inflation gaining momentum, some economists believe the BOJ might raise interest rates earlier than expected, possibly before October, especially after already hiking rates to 0.5% earlier this year.

AP

4/7

Despite rising prices, Japan's economic data presents a mixed picture. Factory output in April declined by 0.9% from the previous month, indicating that manufacturers are facing pressures from weakening global demand and higher U.S. tariffs. This puts the central bank in a tough spot—managing inflation without stifling already fragile growth.

etimes.in

5/7

While falling crude oil prices and a rebounding yen are expected to ease import costs in the coming months, domestic price pressures remain strong. A private survey shows Japanese companies plan to raise prices on nearly 2,000 food and beverage items in June—three times more than a year ago—suggesting inflation may stay elevated.

ETMarkets.com

Economists point to rising service prices and strong wage growth as signs that inflation could become more persistent. BOJ Governor Kazuo Ueda acknowledged that companies are still actively raising wages and prices. However, experts like Tsutomu Watanabe warn that growing public concern over food inflation could destabilise otherwise anchored inflation expectations.

Reuters

7/7

The BOJ faces a delicate challenge. While inflation remains well above target, economic headwinds—from weak exports to policy uncertainty abroad—could derail recovery. With markets watching closely, the central bank must carefully time any further rate hikes to avoid worsening economic vulnerabilities while keeping inflation in check.

(: This slideshow has been sourced from Reuters)

Agencies