TIL Creatives

TIL Creatives"Shipping Ministry is working with Ministries of Petroleum and Natural Gas, Steel, and Fertiliser to address the low imports on India flagged ships," the Ministry of Ports, Shipping, and Waterways (MoPSW) said, responding to queries from ET. "This has resulted in demand for around 200 ships of 8.6 million Gross Tonnage (GT) worth around ₹1.3 lakh crore which would be jointly owned by the public sector companies (PSUs) and built in Indian shipyards over the next few years," the ministry said.

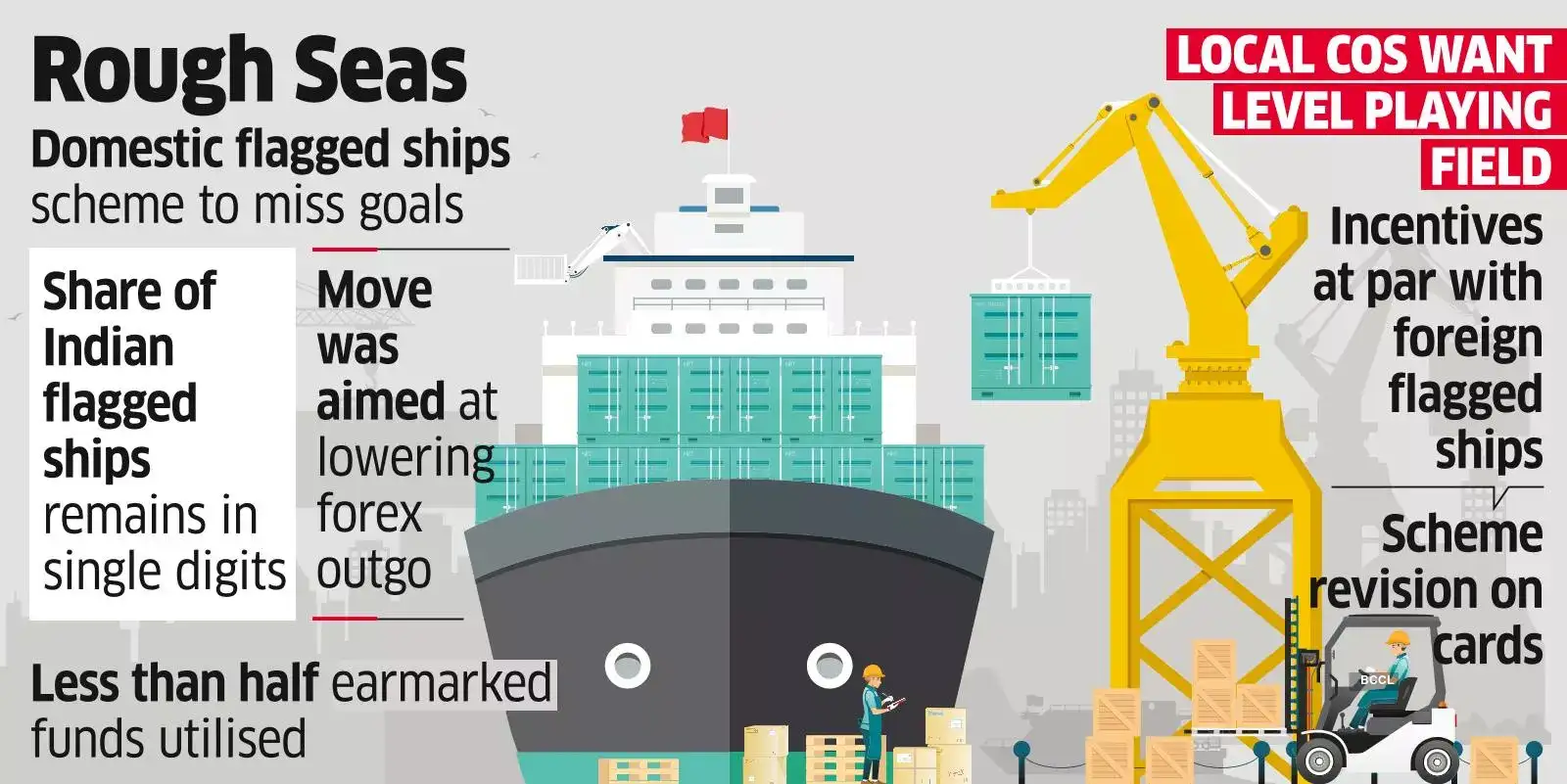

The Centre's latest attempt to bolster the lineup of Indian-flagged merchant ships follows the high probability of the current ₹1,624 crore scheme to promote such vessels missing its goal. Maritime trade experts say the share of cargo carried by domestically-flagged ships in imports is still at around 8%, unchanged since 2021 when the scheme was launched.

"A review of the scheme is now expected but just ₹330 crore has been disbursed till now, and the share of Indian flagged ships remains in single digits," a senior official told ET. The scheme was announced in the FY22 budget and approved by the Union cabinet in July 2021. Funds were to be disbursed till FY26, providing up to 15% subsidy to Indian shipping companies participating in global tenders issued by the Centre and its arms. Sops were offered for importing government cargo such as crude oil, liquid petroleum gas (LPG), coal, and fertilisers.

The share of Indian vessels in the carriage of the country's export import (EXIM) trade plunged to about 7.8% in FY19 from 40.7% in 1987-88. As per official estimates, this led to around $70 billion annual foreign exchange outgo to foreign shipping lines. Indian ports handled around 1540.34 million metric tonnes (MMT) cargo in 2023-24, 7.5% higher than a year ago.

Indian-flagged ships mandatorily employ Indian seafarers while also complying with domestic taxation and corporate laws, leading to 20% higher operating costs, according to official estimates.

Sector watchers say the increased operating costs is due to higher costs of debt funds, shorter loan tenures, and taxation on wages of Indian seafarers engaged on Indian vessels. There is also an integrated Goods and Services Tax (GST) on Indian companies importing ships, blocked GST tax credits, discriminatory GST on Indian vessels providing services between two Indian ports; all of which are not applicable to foreign ships providing similar services. The domestic industry has been lobbying for lowering of these duties and taxes.

"Nothing has happened to reduce this burden of duties and taxes on Indian ships that impairs their competitiveness," Anil Devli, CEO, Indian National Shipowners Association told ET.