Equity Bank Lowers Loan Fees by 3% After CBK Cut Base Interest Rate to 10.75%, Joins Other Lenders

TUKO.co.ke journalist Wycliffe Musalia has over six years of experience in financial, business, technology, and climate reporting, which offers deep insights into Kenyan and global economic trends.

Equity Bank Kenya is among the first lenders to reduce loan interest rates after the Central Bank of Kenya (CBK) lowered the base lending rate.

Source: Twitter

CBK announced a 50 basis point drop in the base lending rate from 11.25% in December 2024 to 10.75% in February 2025.

The regulator urged commercial banks to reflect the changes in their loan fees for increased borrowing by the private sector to stimulate the country's economy.

The CBK directive saw Equity Bank reduce its shilling-denominated loan fees by 3% or 300 basis points to 14.739%, plus a margin based on specific customer risk profile.

Equity Bank said the new rate will take effect on February 13, 2025, for new loans and from March 1, 2025, for existing loans.

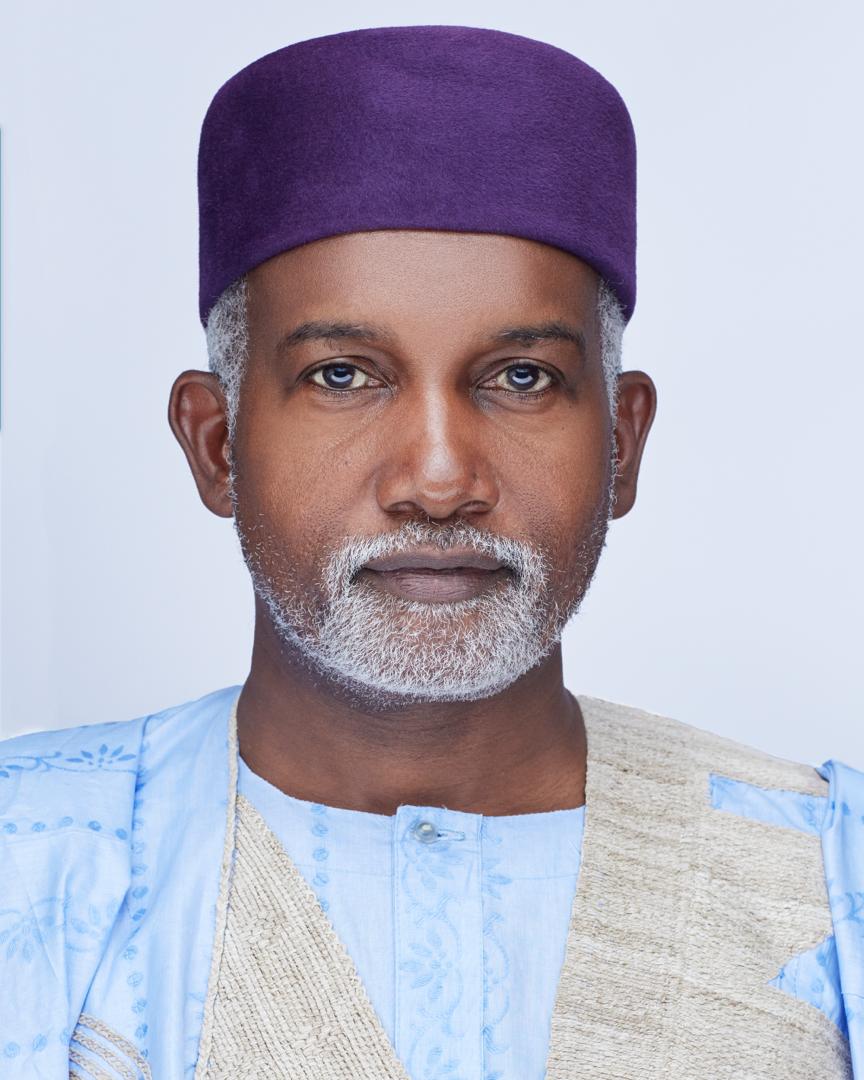

Equity Bank Kenya Managing Director Moses Nyabanda said the move is aimed at easing access to more affordable credit for its customers and enhancing financial inclusion in the country.

“We understand the financial pressures facing Kenyans today, and we're committed to doing our part to ease that burden. This rate cut is about more than just lower interest rates; it's about opening doors for Kenyans to invest in their businesses, support their families, and their livelihoods,” said Nyabanda, in a press statement released on Wednesday, February 12.

This is the third time that the lender is cutting loan interest rates within the last six months.

In September 2024, Equity Bank reduced its base lending fee from 18.24% to 17.83%.

Following the Central Bank Rate (CBR) reduction in October 2024, the lender also cut its loan fees to 17.39% in November 2024.

Equity Group Managing Director (MD) James Mwangi said the reduction focused on the CBK's agenda to maintain economic stability amid improving inflation trends and favourable economic indicators.

Kenya Commercial Bank (KCB) also announced a reduction in its loan interest rates from 15.6% to 14.6%.

KCB said the new rates will take effect from February 10, 2025, for new shilling-denominated loans and from March 10, 2025, for existing facilities.

Co-operative Bank of Kenya also adhered to the CBK directive, cutting its loan interest rate by 2% to 14.5%.

The bank said the loan fees will be calculated plus a margin of between 0% to 4% per year, based on the borrower's credit score.

Source: TUKO.co.ke