Ripple CEO Brad Garlinghouse confirmed on X on Wednesday that the company is applying for a license with the US Office of the Comptroller of the Currency (OCC), following an earlier report by The Wall Street Journal.

“True to our long-standing compliance roots, Ripple is applying for a national bank charter from the OCC,” he wrote.

Garlinghouse said if the license is approved, it would be a “new (and unique!) benchmark for trust in the stablecoin market” as the firm would be under federal and state oversight — with the New York Department of Financial Services already regulating its Ripple USD stablecoin.

Global bank Standard Chartered is bullish on Bitcoin for the rest of the year, citing increasing corporate treasury buying and strong exchange-traded fund inflows.

Standard Chartered expects Bitcoin to print new highs of $135,000 by the end of the third quarter and then break $200,000 by the end of the year, the bank’s digital asset research head, Geoff Kendrick, said in a Wednesday report shared with Cointelegraph.

“Thanks to increased investor flows, we believe BTC has moved beyond the previous dynamic whereby prices fell 18 months after a ‘halving’ cycle,” Kendrick said, adding that the common halving trend would have led to price declines in September or October 2025.

FTX’s bankruptcy estate has raised concerns over payouts to creditors in countries with ambiguous or restrictive cryptocurrency regulations.

On Wednesday, the FTX estate filed a motion with the US Bankruptcy Court for the District of Delaware, seeking authorization for the FTX Recovery Trust to freeze distributions to creditors in “potentially restricted foreign jurisdictions.”

The jurisdictions — 49 countries in total — have unclear or restrictive crypto laws, potentially posing risks due to complex cross-border legal implications.

“Distributions made by or on behalf of the FTX Recovery Trust into jurisdictions in violation of these legal restrictions may trigger fines and penalties, including personal liability for directors and officers, and/or criminal penalties up to and including imprisonment,” the filing reads.

A GitHub repository posing as a legitimate Solana trading bot has been exposed for reportedly hiding crypto-stealing malware.

According to a Friday report by blockchain security firm SlowMist, the now-deleted solana-pumpfun-bot repository hosted by account “zldp2002” mimicked a real open-source tool to harvest user credentials. SlowMist reportedly launched the investigation after a user found that their funds had been stolen on Thursday.

The malicious GitHub repository in question featured “a relatively high number of stars and forks,” SlowMist said. All code commits across all its directories were made about three weeks ago, with apparent irregularities and a lack of consistent pattern that, according to SlowMist, would indicate a legitimate project.

Authorities in the United Arab Emirates (UAE) have reportedly taken Ildar Ilham, the founder of the decentralized finance protocol WhiteRock Finance, into custody as part of allegations over a $30-million scam through ZKasino.

According to a Thursday X post from crypto sleuth ZachXBT, UAE authorities arrested Ilham in connection with an investigation into “wide-scale fraud” surrounding ZKasino. ZachXBT’s report suggested that WhiteRock was connected to ZKasino’s $30 million fundraising.

The alleged investor scam followed ZKasino’s launch in April 2024, with the platform promising an airdrop of its native token to select users. However, reports indicate that more than a year later, the funds still have not been returned.

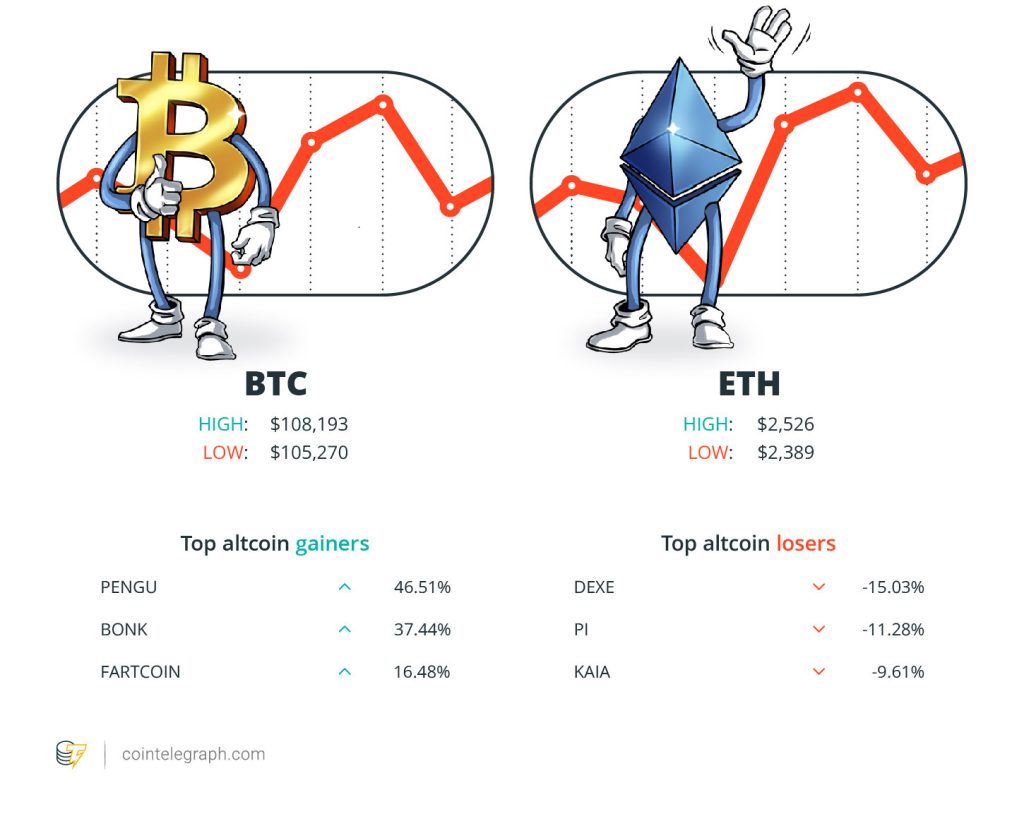

At the end of the week, Bitcoin is at $108,193, Ether at $2,526 and at $2.22. The total market cap is at $3.33 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Pudgy Penguins at 46.51%, Bonk at 37.44% and Fartcoin at 16.48%.

The top three altcoin losers of the week are DeXe at 15.03%, Pi at 11.28% and Kaia at 9.61%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

“Foreign stablecoin issuers need to seriously consider a license under MiCA as recent supervisory actions in Germany point to a strict enforcement of the rules.”

group general counsel at Bitcoin Suisse

“People who are working on cryptography really need to more actively think of cryptography as something that has social and moral implications.”

“My whole goal is to make things transparent from the regulatory aspect and give people a firm foundation upon which to innovate and come out with new products.”

Paul Atkins, chair of the US Securities and Exchange Commission

“Spot volume has cooled, taker buy pressure has weakened, and profit-taking has intensified — especially among short-term holders who rode the move from sub-$80,000 levels.”

“Given that stablecoin issuers essentially function as banks, they should be subject to the same regulations as banks in order to reduce systemic risk.”

Letitia James, attorney general of New York

“With a new month and quarter, we often see a choppy start after which price chooses a direction later on. Give it some time to play out and watch for confirmations.”

Daan Crypto Trades, pseudonymous crypto trader

Dogecoin is trading near $0.17, staging a modest rebound after fluctuating between $0.13 and $0.25 since February. Despite its sideways movement, DOGE remains the seventh most traded crypto by 24-hour trading volume. Investors continue to monitor whether the memecoin can reclaim the key psychological level of $0.25.

The daily chart reveals DOGE tracing a double bottom pattern, a classic reversal signal, with a support base at $0.15 established over recent weeks. This long-term setup hints at a potential climb to $0.25, a target that could materialize sooner than expected.

Over the past two months, DOGE has been confined within a descending channel, a pattern indicating signs of a potential uptrend breakout. Pseudonymous crypto analyst Trader Tardigrade posted an analysis on X, highlighting a decisive move above the 50-day trendline, followed by a successful retest and an uptrend continuation.

The self-claimed victim of a crypto romance scam who recently sued Citibank for failing to catch red flags has just filed a second lawsuit targeting two other banks.

Michael Zidell sued East West Bank and Cathay Bank in a California federal court on Tuesday, accusing the banks of turning “a blind eye to their statutory duties and obligations.”

He claimed he sent 18 transfers totalling nearly $7 million to the alleged scammers’ account at East West Bank, and made 13 transfers totalling over $9.7 million to an account at Cathay Bank.

Roman Storm, one of the co-founders and developers behind the cryptocurrency mixing service Tornado Cash, appeared in a video interview as his US criminal trial is expected to begin in less than two weeks.

In an interview released Wednesday by Crypto In America, Storm said his legal team intended to address at trial the allegations that he had personally profited from illicit funds through his role at Tornado Cash.

However, he declined to say whether he would testify in his own defense over charges of money laundering, conspiracy to operate an unlicensed money transmitter, and conspiracy to violate US sanctions.

“This is the decision that we will make,” said Storm on taking the stand in court. “I don’t have a 100% answer right now. I may or may not.”

A US government watchdog has recommended reforms to the Internal Revenue Service (IRS) criminal investigation division’s handling of digital assets, citing repeated failures to follow established protocols.

In a Tuesday report, the US Treasury Inspector General for Tax Administration said its evaluation of the IRS criminal investigation division revealed shortcomings around the seizure and safeguarding of digital assets.

According to the government watchdog, the IRS failed to follow all guidelines between December 2023 and January 2025 for seizure memorandums around confiscated crypto, detailing the addresses, dates and amounts.

Stablecoins will cement the US dollar’s dominance as a global reserve currency, but Bitcoin aims to replace it. Which one will win?

JD says it hasn’t launched a stablecoin, crypto specialists join investigation into South Korea’s former first lady, and more.

Amid reports of ordinary people becoming delusional using AI, is it a particularly good idea to take acid with ChatGPT as your Shaman?

Subscribe

The most engaging reads in blockchain. Delivered once a week.