Court orders arrest, remand of six CBEX promoters over alleged $1 billion Ponzi scheme

The Federal High Court in Abuja has ordered the arrest and remand of six promoters of the recently crashed Ponzi scheme platform, Crypto Bridge Exchange (CBEX), over an alleged $1 billion scam that targeted Nigerian investors.

On Thursday, the judge, Emeka Nwite, granted the order following an ex parte motion filed by the Economic and Financial Crimes Commission (EFCC), which is investigating the platform’s collapse and its promoters’ role in the suspected fraud.

The suspects named in court include Adefowora Abiodun Olanipekun, Emmanuel Oku, and four others.

The EFCC alleges that the group operated through a front company, ST Technologies International Limited, to promote CBEX and lure Nigerians into investing in cryptocurrencies and other digital assets with promises of up to 100 per cent returns within 30 days.

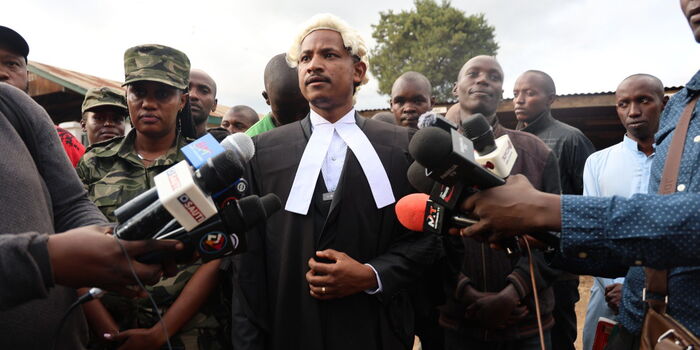

At Thursday’s court session, EFCC lawyer Fadila Yusuf told the judge that the scam involved foreign collaborators and required urgent action to track and apprehend the suspects.

The lawyer then urged the court to issue a warrant of arrest for the defendants.

She also sought another order remanding the defendants in the custody of the complainant/applicant (EFCC) pending the conclusion of the investigation into the alleged offences and possible prosecution.

Granting the EFCC’s request, Mr Nwite ordered that the suspects be remanded in EFCC custody once arrested, pending the conclusion of the investigation and possible prosecution.

According to the EFCC, ST Technologies was registered with Nigeria’s Corporate Affairs Commission (CAC) but never obtained a licence from the Securities and Exchange Commission (SEC) to operate as an investment firm.

The commission further noted that a Special Control Unit against Money Laundering (SCUML) certificate which ST Technologies possessed does not constitute regulatory approval to handle investments.

EFCC, through its spokesperson, Dele Oyewale, earlier assured Nigerians that it was working with international agencies, including Interpol, to recover the stolen funds.

CBEX reportedly restricted withdrawals on 9 April, prompting concerns among users. Shortly before going dark, the platform issued a suspicious notice asking users to deposit additional funds — $100 for accounts with balances below $1,000, and $200 for those above — under the guise of account verification. Many users complied, unaware the platform was about to shut down.

Despite growing warning signs, some investors continued to join the scheme, mistaking the restrictions for a technical glitch.

The Director-General of the SEC, Emomotimi Agama, has said the commission only recently became aware of CBEX’s operations and could not act earlier since the platform was never registered.

“Registration is the foundation of regulation,” he said in a televised interview on Monday. “You cannot operate and then apply for a license later. That alone is a red flag.”

Mr Agama warned the public to verify investment opportunities before committing funds and urged influencers to act responsibly.

He noted that the new Investment and Securities Act (ISA) 2025 imposes a N20 million fine and up to 10 years imprisonment for promoting unregistered investment schemes.

“No blogger, influencer, or celebrity should amplify fraudulent platforms,” he said. “The law is clear, and the penalties are severe.”

Two suspects have already been arrested by the EFCC in connection with the CBEX scandal, although their identities have not been disclosed.

“We’ve made a breakthrough,” a top official of the commission told The Nation newspaper. “The EFCC Chairman, Ola Olukoyede, is personally leading the probe, which covers how CBEX entered Nigeria’s digital asset space, its promoters, funding sources, and linked financial institutions.”

The EFCC is reportedly tracking five key suspects, including a Briton.

“We’re moving cautiously to avoid missteps,” the source added. “All suspects are under surveillance.”