Binance Introduces Will Function for Crypto Inheritance

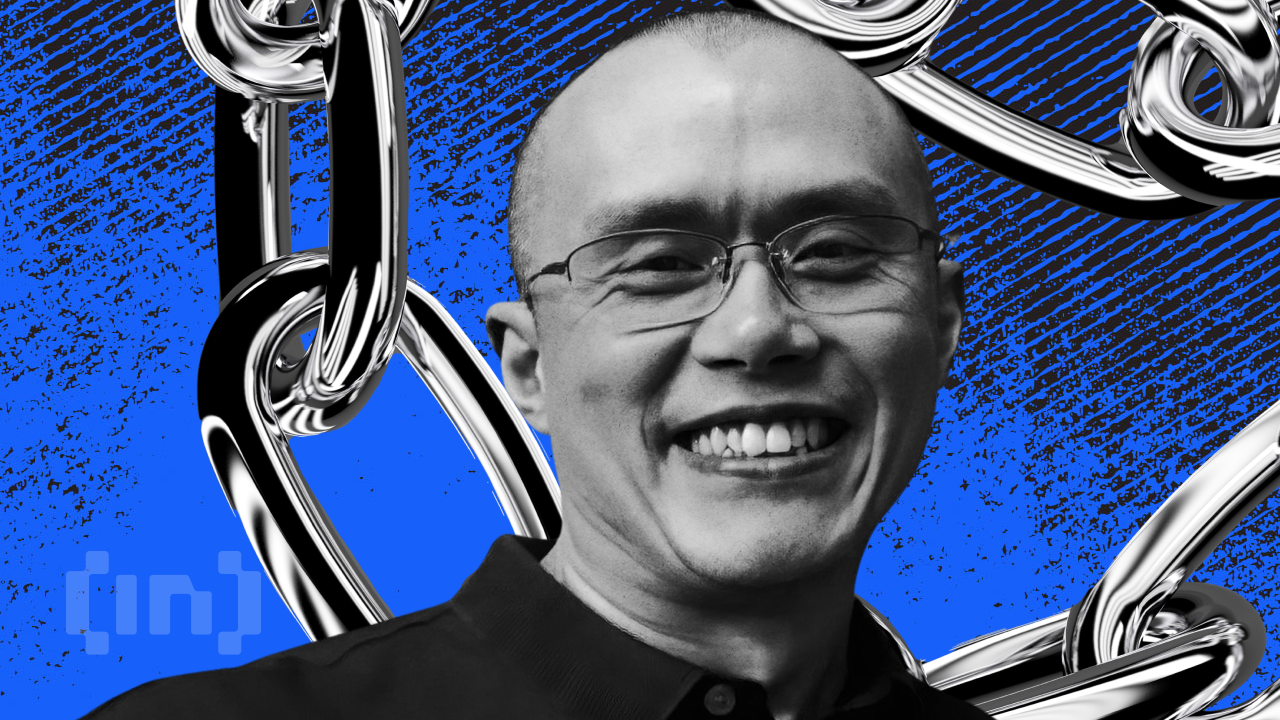

Binance founder Changpeng Zhao (CZ) has called for the implementation of a “will function” across crypto platforms to address the growing need for reliable inheritance systems in the digital assets space. This function would allow users to designate beneficiaries for their digital assets in the event of their death, ensuring that their crypto legacy is secured.

In a statement shared on X, CZ emphasized the importance of such a feature, stating, “Every platform should have a ‘will function’—so that when someone is no longer around, their assets can be distributed to designated accounts according to specified proportions.” He also urged regulators to allow minors to hold crypto accounts that can receive payments but not trade, enabling children to legally inherit digital assets left behind by family members. CZ acknowledged that inheritance is a sensitive topic but stressed that it is a necessary feature for all asset holders on a platform.

The conversation around crypto inheritance was sparked by a post from Web3 community builder cryptobraveHQ, who highlighted that over $1 billion worth of crypto assets are transferred to centralized exchanges each year due to accidental deaths. The crypto commentator noted that many traders either do not inform their families about their holdings or fail to share crucial details such as the number of assets or the platforms they use. As a result, when these users pass away unexpectedly, their accounts become inactive, and the exchanges end up with their digital assets.

In response to these concerns, Binance introduced an “emergency contacts and inheritance heir” feature on June 12. This update enables users to designate emergency contacts and submit an application if their account becomes inactive for an extended period or in the event of death. This allows users to choose in advance who may be eligible to receive their crypto holdings. Once the set inactivity threshold is reached and the user remains unresponsive, the exchange will contact the emergency contacts listed. If verification is successful, those individuals can begin the inheritance claim process.

Competitors like Coinbase and BitGo are using more traditional methods to handle crypto estate planning. Coinbase requires heirs to provide legal documents like death certificates and wills, a manual process that does not include any in-app beneficiary settings. BitGo, on the other hand, uses multi-signature wallets, cold storage protocols, and customizable access controls to support inheritance through legal third-party partnerships.

Binance's proactive approach to addressing inheritance concerns reflects a forward-thinking strategy to protect users' wealth beyond their lifetime. By integrating a “will function,” crypto platforms can offer users peace of mind, knowing that their digital assets will be passed on to their intended beneficiaries. This move is expected to set a new standard for the industry, encouraging other platforms to adopt similar safeguards and ensuring that the crypto legacy of users is protected for future generations.