Bank of Ghana posts Operating Loss of GH¢9.49bn in 2024 - MyJoyOnline

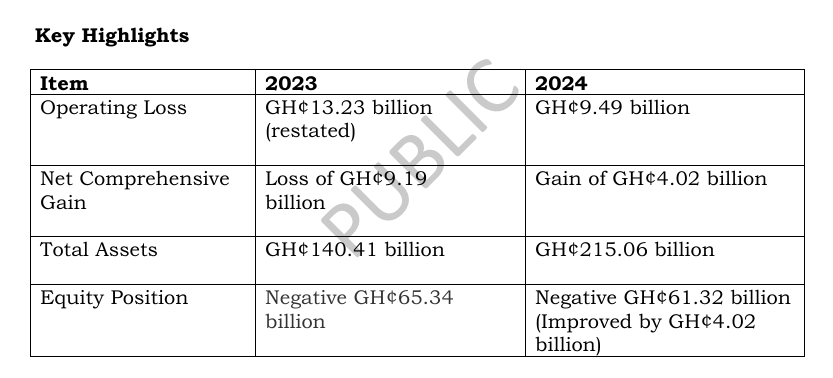

The Bank of Ghana (BoG) has recorded an Operating Loss of GH¢9.49 billion in 2024, compared to an Operating Loss of GH¢13.23 billion (restated) in 2023. However, the bank in a statement noted that this represents a Net Gain of GH¢4 billion compared to its 2023 financials, which recorded a loss of GH¢9.19 billion.

The GH¢9.49 billion Operating Loss in 2024 is the result of total operating income of GH¢9.40 billion, falling short of total operating expenses of GH¢18.89 billion.

Thefinancial statement released by the Bank of Ghana said these are the drivers for the operating loss posted in 2024.

• Cost of Open Market Operations, GH¢8.60 billion.

• Revaluation and exchange differences (losses) totaling GH¢3.49 billion. Notably, exchange losses of GH¢1.82 billion on the Government’s Gold for-Oil Programme.

• Currency issue expenses, of GH¢1.01 billion for 2024, from GH¢0.69 billion in 2023.

• Modification to the choice of accounting treatment of foreign exchange gains and losses resulting from revaluation of the Bank’s assets and liabilities in gold, special drawing rights and foreign securities.

In summary, the Bank of Ghana noted that “the 2024 financial year saw improvements in the bank’s financial performance and position, as evidenced in the reported loss for the year of GH¢9.49 billion, and the GH¢4.02 billion enhancement in its equity position to close the year at a negative value of GH¢61.32 billion”.

The release of the 2024 Financial Statements reflects the Bank’s compliance with statutory obligations, continued commitment to transparency, accountability, and sound financial governance.

The Bank of Ghana added that “the bank is committed to maintaining price and financial stability and creating an enabling environment for businesses and individuals to thrive”.

Below is the Financial Statement of BoG

The Bank of Ghana recorded a loss of 10.5 billion Ghana cedis for its operations in 2023. However, this was restated as “GH¢13.23 billion (restated) in the 2024 financials.

This shows a significant reduction from the 60.8 billion cedis it recorded in 2023.

The loss posted for 2023, according to the Bank of Ghana was attributable to an increase in total interest expenses on its open market operations.

The loss position was driven largely by an increase in total interest expense incurred on Open Market Operations by GH¢ 6.7 billion.

The Bank of Ghana last year announced that it was implementing some measures that will help turn around its operations losses recorded in 2023.

Some of these measures included refraining from monetary financing of the government of Ghana’s budget. “In this regard, the bank will continue to adhere to the terms of the Memorandum of Understanding on zero financing of the budget signed between the Bank of Ghana and the Ministry of Finance.”

It is also promising, to “continue with policy measures aimed at optimising Bank of Ghana’s investment portfolio and operating cost mix to bolster efficiency and profitability.”

The Financial results showed that Total Liabilities of Bank of Ghana and its subsidiaries exceeded its total assets by GH¢65 billion, compared to the GH¢54.5 billion in 2022.

The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.