ASX Penny Stocks: 3 Picks With Market Caps Under A$700M

The Australian stock market is experiencing a significant upswing, with the ASX 200 reaching new heights amid optimism from positive U.S.-China trade discussions. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their affordability and growth potential. Despite being an older term, these stocks can offer substantial opportunities when backed by strong financials and solid fundamentals.

| EZZ Life Science Holdings (ASX:EZZ) | A$1.64 | A$77.36M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.64 | A$122.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.58 | A$397.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.645 | A$434.95M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.99 | A$704.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.24 | A$753.01M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.845 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$228.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$161.33M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,004 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

★★★★★★

Clarity Pharmaceuticals Ltd is a clinical stage radiopharmaceutical company focused on research and development of radiopharmaceutical products in Australia and the United States, with a market cap of A$768.03 million.

The company generates revenue from its radiopharmaceutical development segment, totaling A$10.78 million.

A$768.03M

Clarity Pharmaceuticals, a clinical-stage radiopharmaceutical company, is advancing its pipeline with promising diagnostic and therapeutic trials. Despite being pre-revenue with A$10.78 million generated from development activities, Clarity's strong cash position and debt-free status provide financial stability. Recent positive Phase II DISCO trial results for 64Cu-SARTATE in neuroendocrine tumors highlight its potential as a superior diagnostic tool compared to existing methods. Additionally, the company has initiated pivotal Phase III trials for prostate cancer diagnostics, supported by favorable early data and strategic supply agreements for copper isotopes to ensure commercial scalability in the US market.

★★★★★★

Deep Yellow Limited, along with its subsidiaries, is a uranium exploration company operating in Namibia and Australia, with a market cap of A$1.31 billion.

Deep Yellow Limited does not report specific revenue segments.

A$1.31B

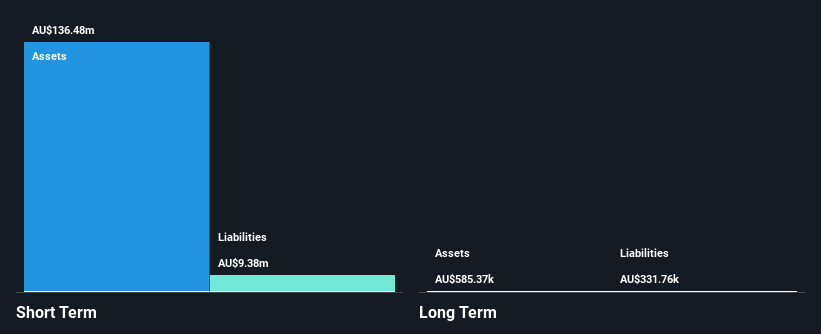

Deep Yellow Limited, a uranium exploration company, remains pre-revenue with minimal earnings but reported A$6.29 million in revenue for the half year ending December 2024. Despite being unprofitable and forecasts indicating declining earnings over the next three years, Deep Yellow trades significantly below its estimated fair value. The company benefits from a strong cash position with short-term assets of A$246.1 million exceeding liabilities and no debt burden, offering financial stability amid market volatility. Management's experience and an undiluted shareholder base further enhance its investment profile despite ongoing challenges in achieving profitability.

★★★★★★

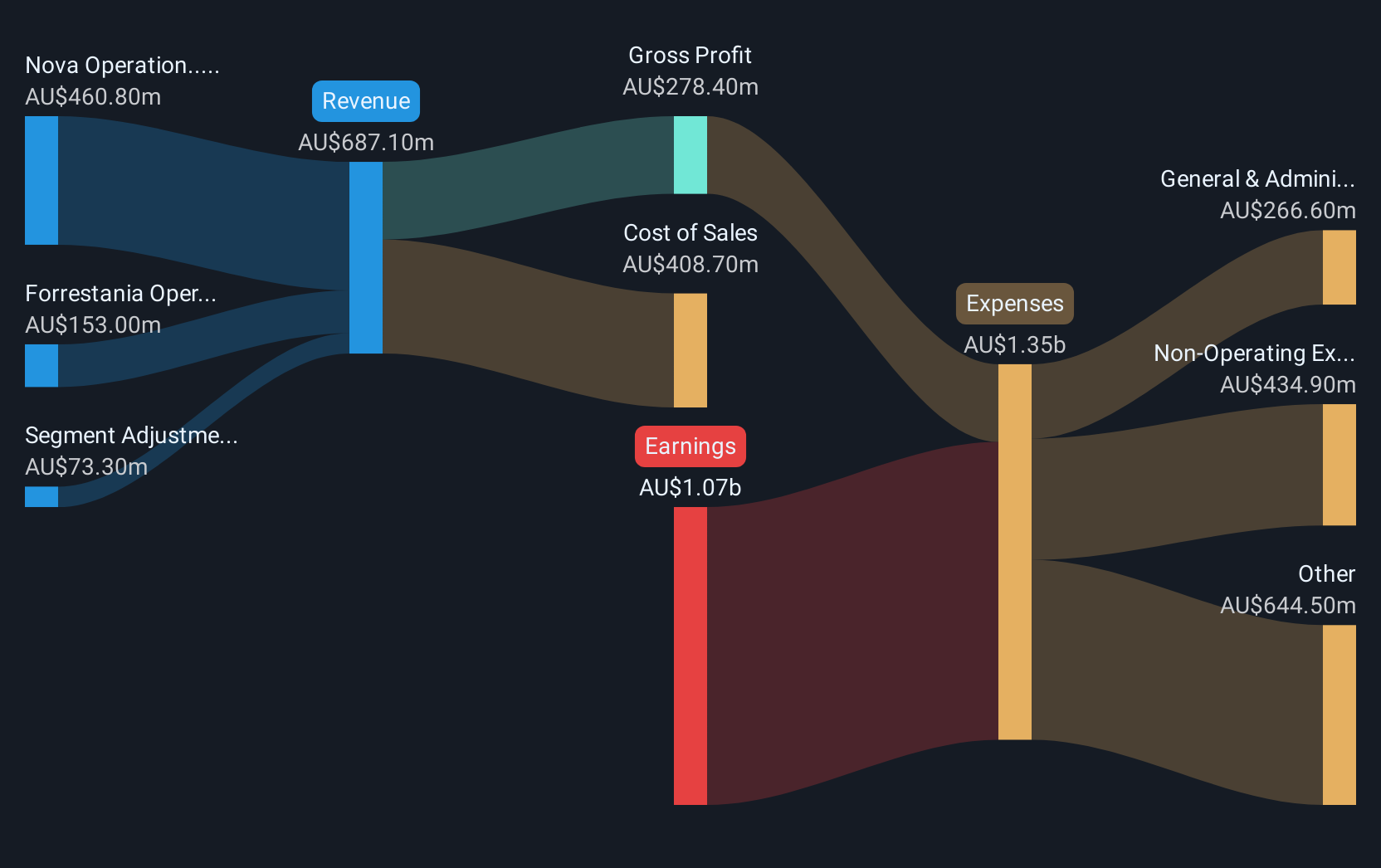

IGO Limited is an exploration and mining company in Australia that focuses on discovering, developing, and operating assets for metals used in clean energy, with a market cap of A$3.22 billion.

The company's revenue is primarily derived from its Nova Operation, which generated A$460.8 million, and the Forrestania Operation, contributing A$153 million.

A$3.22B

IGO Limited, with a market cap of A$3.22 billion, focuses on clean energy metals but faces profitability challenges. Despite generating significant revenue from its Nova and Forrestania operations, it remains unprofitable with losses increasing over the past five years. The company benefits from being debt-free and having short-term assets (A$437.5M) that exceed liabilities, providing financial stability. However, recent executive changes may impact strategic direction as both the CFO and Chief People and Sustainability Officer announced their departures in 2025. Earnings are forecast to grow significantly per year despite current unprofitability challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]