Apple's growing list of problems clouds AI reboot

It says something about Apple’s current status that its trailing position in artificial intelligence isn’t the company’s biggest problem.

It might seem to be next week, though. Investors are glum ahead of Apple’s Worldwide Developers Conference that kicks off Monday. The stock has slid 20% since the first of the year, which is the worst run the shares have experienced ahead of the company’s WWDC event since at least 2010.

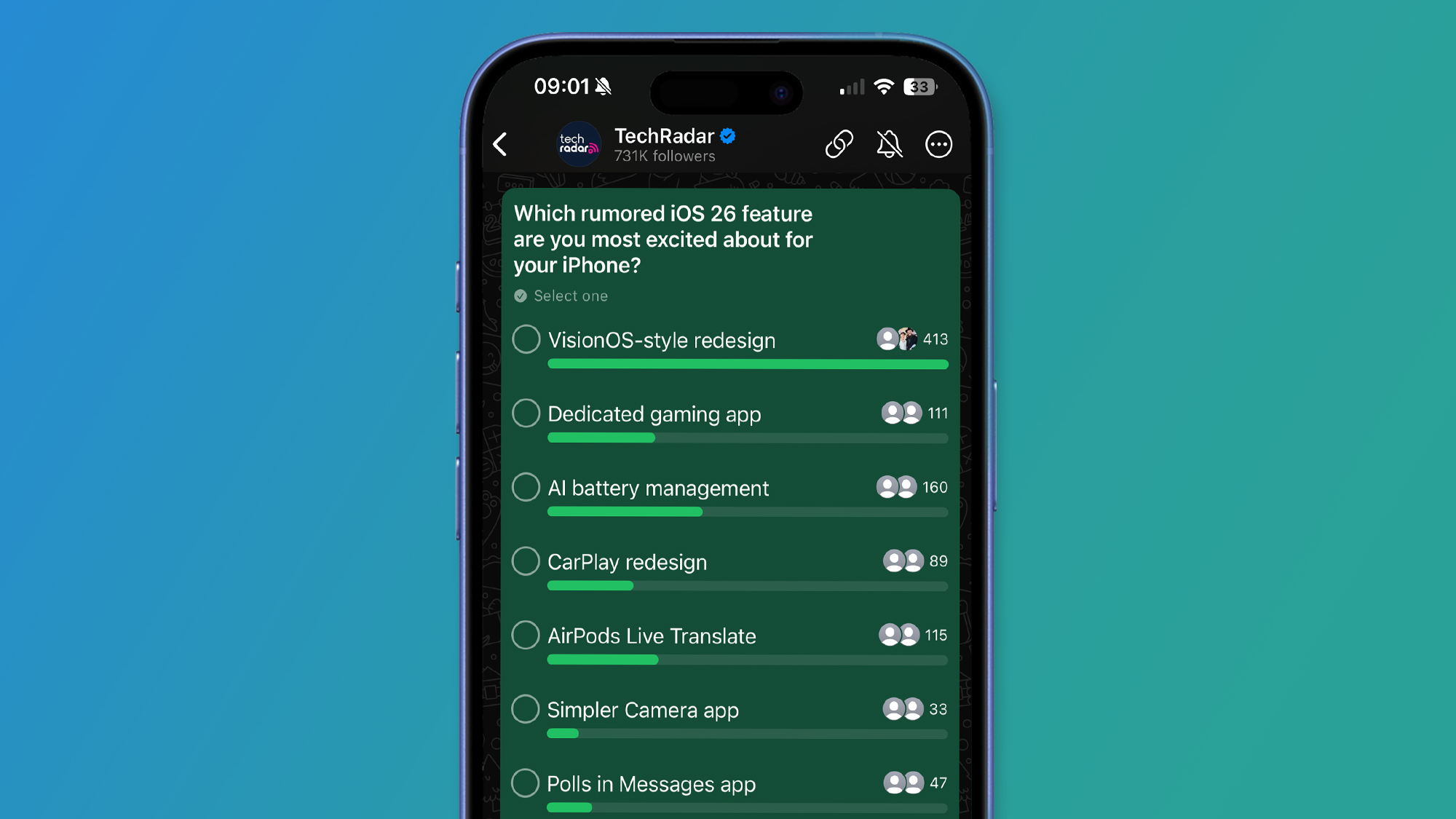

Apple’s big tech peers now use their own annual developer events almost exclusively to tout their progress in AI. But Apple’s conference this year is expected to mainly demonstrate how far behind the company is in what is considered a once-in-a-generation technological shift. The Apple Intelligence service introduced at last year’s conference is still a work in progress, and the Siri digital assistant is still awaiting a promised AI makeover. That won’t be coming next week, at least based on a rare admission Apple made three months ago that its planned Siri upgrade was taking longer than expected.

“Apple will be much more cautious about overpromising and will refrain from showing features that aren’t yet ready for prime time," Craig Moffett of MoffettNathanson predicted in a report Thursday.

But AI is only one of the significant problems Apple is facing now. Tariffs threaten the profit margins of the company’s hardware business. And the president of the U.S. is openly pressuring Apple to effectively undo its two-decade-old business model of exclusively producing its devices overseas.

Then there is services, which drive an outsize portion of Apple’s bottom line. Legal challenges hang over the fees the company earns from app developers, as well as the payments it receives from Google to make the search engine the default option on Apple’s devices. Those fees and payments together comprise a substantial part of Apple’s services arm that generates annual gross profit margins of 74%—twice the margins the company’s device business commands.

“We caution that Apple has material risks to its revenue growth, margins, and valuation multiple," Needham analyst Laura Martin wrote in a report on Wednesday, where she downgraded the stock to a “hold" rating.

Against the risk of tariffs, App Store fee reductions and the loss of Google payments, Apple’s slow start in AI seems almost a minor worry. The company hasn’t been marketing Apple Intelligence as a premium service that would cost users extra—a notable contrast to the approach of Amazon.com, Microsoft and Alphabet’s Google, which are charging money for most of the generative AI tools sold to their customers.

But Apple needs to give customers more reasons to buy its devices, and upgrade them more frequently. Its flagship iPhone business has been in a rut, with revenue growth relatively flat over the past two years and expected to be flat again for the current fiscal year ending in September. The lack of new AI offerings is expected to weigh on the next cycle as well, with Wall Street expecting iPhone revenue growth of only 3% in fiscal 2026, according to FactSet estimates.

“We believe that, for this stock to work, it must have the catalyst of an iPhone replacement cycle, which we do not foresee in the next 12 months," Needham’s Martin wrote in her report.

Apple has a lot of very loyal customers—more than 2.35 billion active devices make up its installed base—who won’t necessarily bail over a single piece of missing software.

But the company that disrupted the smartphone market could be disrupted itself if generative AI creates a new class of devices that obviate the need for a touch screen slab in everyone’s pocket. OpenAI just nabbed Jony Ive, the famed Apple designer who crafted the original versions of most of Apple’s current product line, as part of an ambition to eventually ship 100 million “AI companions." The first devices are expected to come out next year.

The famously secretive Apple could very well spring some of its own surprises by then. But it will have to do so while juggling its global supply chain and deftly navigating the legal challenges to its App Store fees and Google payments. Apple isn’t even officially a party to the Google case, which might limit its options to shape the outcome. Apple’s slow start in AI is a problem, but compared to its other challenges, at least it is more under its control.

Catch all the Technology News and Updates on Live Mint. Download The Mint News App to get Daily Market Updates & Live Business News.

more