ABEL SITHOLE | Mandate, not mismanagement: PIC clarifies position on unlisted investments and Daybreak Foods

There are ongoing allegations that the Public Investment Corporation (PIC) has “squandered R33bn” of pensioners' money on politically motivated investments. The PIC strongly denies these claims, arguing they misrepresent and oversimplify a complex investment process aimed at identifying opportunities in a broad market, where outcomes cannot be guaranteed.

While acknowledging the inherent risks associated with these investments, the PIC asserts that it remains committed to seeking opportunities with the highest likelihood of positive results. This issue has come to public attention recently due to the challenges faced by Daybreak Foods, which the PIC acquired in 2015 for R1.2bn. This investment was intended to achieve long-term sustainable returns while contributing to food security in the country and supporting economic transformation.

The PIC emphasises that the claims against it oversimplify the complexities of long-term developmental investing and the inherent risks that come with it.

The PIC manages more than R3-trillion in assets, with about R2.5-trillion allocated for public servants through the Government Employees Pension Fund (GEPF). The remainder of the assets represents clients whose beneficiaries are contributing workers across the country.

The PIC acknowledges the seriousness of its responsibilities and operates under a clear mandate that goes beyond simply maximising financial returns. This mandate includes making investments that foster economic development, industrialisation, job creation and broader transformation in South Africa.

Unlisted investments, such as Daybreak Foods, play a crucial role in our developmental mandate. Though there are operational and governance challenges at Daybreak Foods — currently undergoing business rescue — the PIC believes the criticism it has received presents an incomplete and misleading view of the situation. The PIC asserts that the ongoing business rescue process should not be seen as a sign of impending liquidation or a total loss. Rather, they view it as a strategic and legally sound method to stabilise the company, preserve more than 3,000 jobs and ultimately recover value for its clients, primarily government pensioners. Daybreak Foods supplies 7% of South Africa's poultry, making its ongoing operations essential for national food security.

In response to the concerns raised, the PIC emphasises its proactive measures at Daybreak Foods. These actions include a complete overhaul of the board, replacing members with individuals who have strong financial expertise. The PIC is also working with the Daybreak board to enhance management practices to ensure efficiency and accountability. The PIC asserts that these efforts reflect a hands-on approach to safeguarding investments and maximising recovery. While the PIC acknowledges that previous interventions have not yielded the desired results, it believes this should not be a reason to abandon the investment prematurely.

Daybreak Foods is one of more than 700 entities in the PIC's unlisted portfolio. The PIC asserts that its investments, both listed and unlisted, have played a significant role in the strong financial standing of the GEPF, which has a funding level exceeding 110%. This counters any claims of financial instability and ensures that pension benefits will continue to be paid to retirees.

The PIC’s mandate, as established by its founding act and its clients, goes beyond just achieving financial returns. It emphasises creating social impact, particularly by focusing on marginalised communities and projects that are often overlooked by traditional capital markets. This includes investments in township economies and infrastructure development in underserved areas.

The PIC remains firm in its commitment to pursue what it considers “high-risk” investments, emphasising the importance of supporting transformation that aligns with both client interests and the government's objectives. The Isibaya Fund is specifically designed to address gaps in capital markets by financing projects that have significant developmental potential, despite their inherently higher risk.

While the PIC acknowledges some impairments within the Isibaya portfolio, it stresses that these impairments do not reflect the performance of the entire portfolio. Despite experiencing some losses, the overall returns of the fund remain positive, and it has made substantial contributions to job creation, infrastructure development, and increased black ownership in key sectors.

Any failure in its investments is unacceptable. However, it is unclear what constitutes a comparable “acceptable” failure rate of 1% for private company investments, especially in relation to the PIC's investment universe in accordance with its mandate.

The PIC strongly reaffirms its commitment to the responsible management of public funds. Its investments, both within South Africa and throughout the continent, are designed to promote economic and social development while staying true to its mandate. This approach often includes what may be considered risky, unlisted investments that contribute directly to the economy. These unlisted investments also offer an opportunity to support BBBEE entities that show potential but do not have the established presence of more entrenched organisations in economic activities.

The PIC will continue to support viable unlisted entities and help them remain competitive in the market, as these entities have the potential for high returns and significant social and economic impact. The ultimate goal is to achieve sustainable long-term returns to benefit the clients and their beneficiaries.

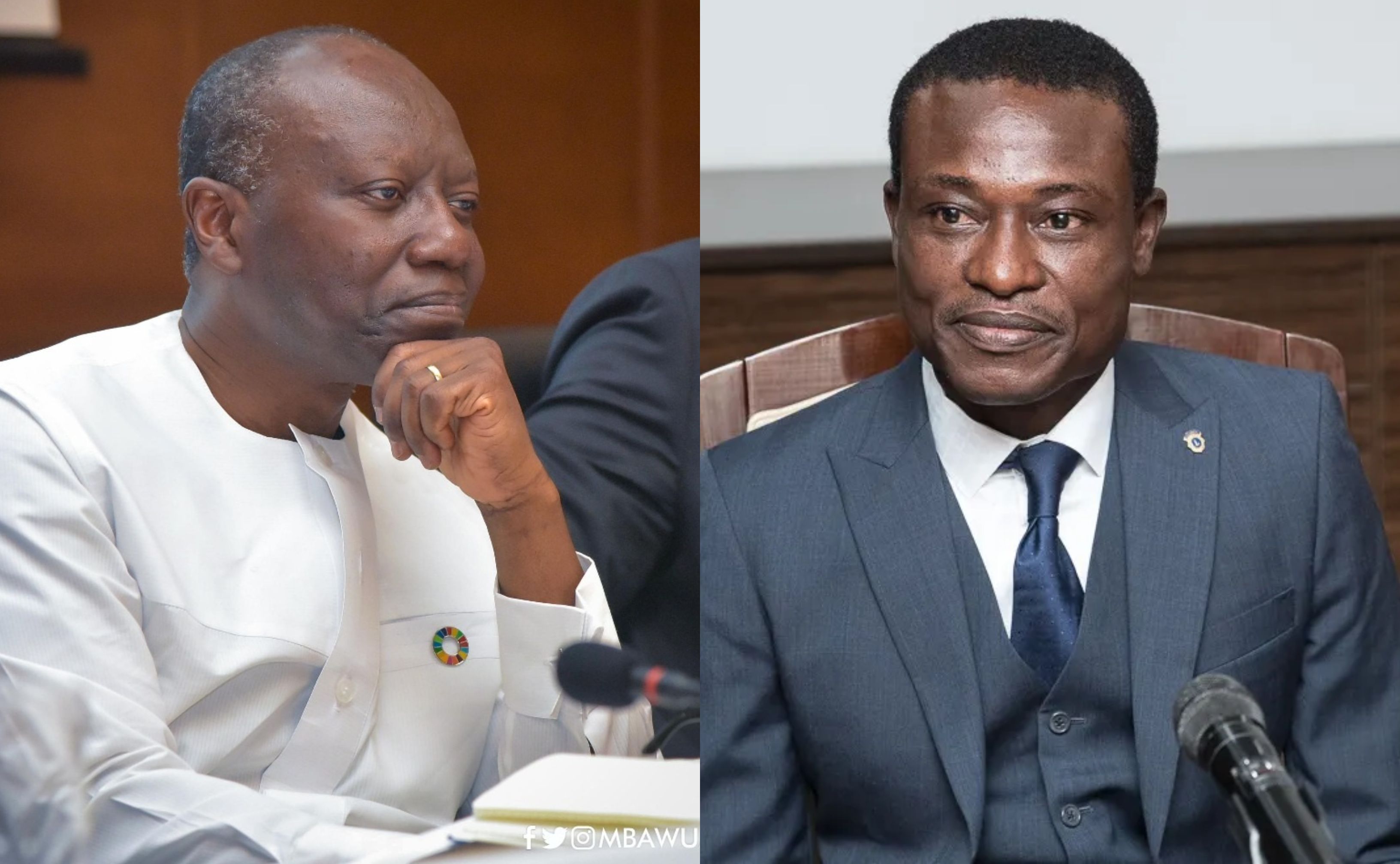

Abel Sithole is the CEO of the Public Investment Corporation