ABB Motion CFO on embedding ESG, AI & hyper-local strategy across 100 countries

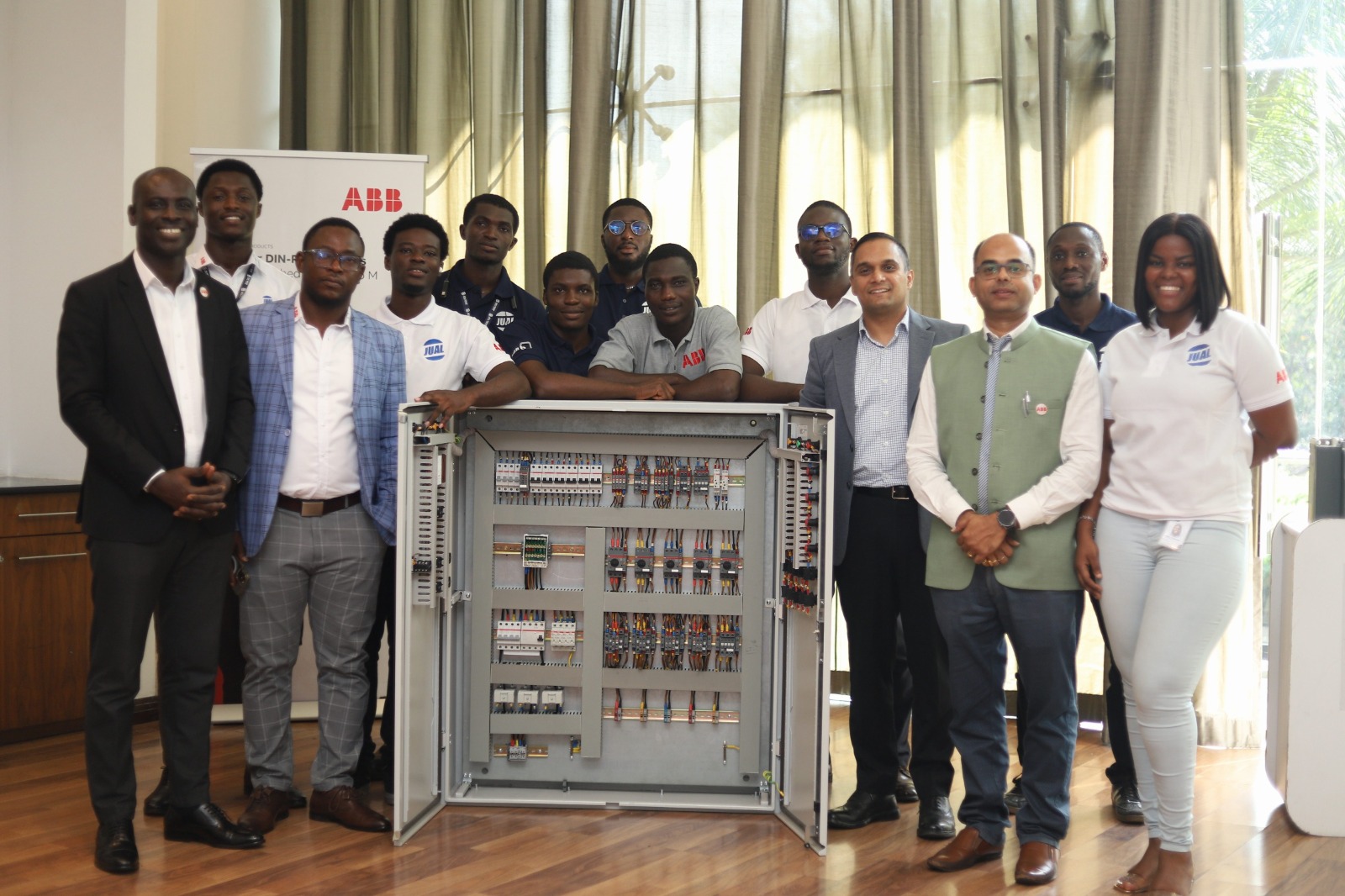

ABB Motion, a global leader in motors and drives, is at the core of accelerating a more productive and sustainable future. Operating across 100 countries with ~$8B revenue, its finance function navigates the complex interplay of global standardisation, digital transformation, ESG imperatives, and hyper-local manufacturing strategies.

At CFO India, we recently had the opportunity to sit down with Bernd Krainick, CFO, ABB Motion (MO) Business Area, to discuss how he is navigating standardisation, cultural intelligence, talent transformation, and ESG imperatives across diverse geographies.

Below are the edited excerpts:

Q. ABB operates in nearly 100 countries. How do you reconcile global financial standardisation with local cultural practices?

Bernd: At ABB, we combine the best of local and global best practices through the “ABB Way” – a globally standardised operating model executed with local agility. Core financial processes like data harmonisation and reporting are unified worldwide, yet local teams adapt implementation to respect cultural and regulatory nuances. For example, in India, financial planning aligns with local festival calendars, improving forecast accuracy and employee engagement. In Sweden, carbon pricing models are embedded directly into financial plans; a practice not yet adopted globally. Besides, regional CFOs collaborate with local finance leaders to interpret global policies through a local lens, ensuring compliance without compromising cultural integrity.

Q. As automation reshapes finance, how do you preserve critical thinking skills within your teams?

Bernd: We consciously shift talent from transactional tasks to strategic roles. Previously, 80% of finance time was spent on data collection and backward-looking reporting; just 20% focused on analysis. Now, automation handles routine work (e.g., AI tools like Microsoft Copilot condense reports), freeing capacity for business partnering. We’re retraining accountants as advisors who embed with R&D, sales, and operations teams using data to guide capital allocation or R&D investments. While AI aids efficiency (e.g., predictive maintenance in our products), human judgment remains irreplaceable. A controller who understands local market nuances and maintains cross-functional relationships will outperform pure algorithmic forecasting, especially where data quality varies.

Q. ABB’s India Global Capability Centre (GCC) is now a ‘finance center of excellence.’ How has its role evolved?

Bernd: The India GCC has transformed from transactional bookkeeping to a strategic partner. Initially focused on basic accounting, it now houses specialised teams dedicated to regions (e.g., Europe, Americas) or divisions. These teams co-lead predictive analytics, risk modeling, and ESG reporting, supporting controllers with forecasting and compliance. To deepen integration, there is extensive cross country talent engagement with immersive experiences by collaborating onsite and building personal connections. This in turn helps talent mobility providing opportunity to work on global projects. This anchors the GCC as an innovation hub, leveraging India’s talent ecosystem for advanced analytics while enhancing global decision-making.

Q. Geopolitical and supply chain volatility is intensifying. How does ABB adapt its financial models to hedge sector-specific risks?

Bernd: Our ‘local-for-local’ manufacturing footprint is central to resilience. Over 80% of products sold in India are made there; similarly, China supplies China, and the U.S. supplies the U.S. This insulates us from trade barriers or semiconductor shortages. Complementing this, our enterprise risk management process identifies top-five global risks quarterly; from cybersecurity to tariffs; and cascades analysis to business areas, divisions, and country levels. When geopolitical shifts take place (e.g., sudden U.S. tariffs), cross-functional risk councils (finance, operations, compliance) convene within 24 hours to model scenarios. We also embed ESG-linked risk metrics into capital allocation, ensuring long-term resilience aligns with stakeholder values.

Q. How is artificial intelligence accelerating finance’s evolution into a strategic advisory function? What safeguards govern its use?

Bernd: AI enhances productivity but isn’t a standalone solution. Tools streamline workflows, and AI-driven ‘offer generators’ draft customer proposals from specifications, though human validation remains essential. For forecasting, AI provides supporting analytics, but we prioritise human-business partner relationships for contextual insights. Our safeguards start with the finance transformation itself; cleaning data and harmonising ERP systems globally before scaling AI. Ethically, we restrict AI in sensitive areas like compliance judgments to human oversight. The priority is augmenting and not replacing critical thinking.

Q. ESG commitments vary across regions. How does ABB balance global targets with local expectations?

Bernd: We commit to global standards while respecting regional realities. For example, Scope 1 & 2 emissions are tackled via solar panels, energy-efficient lighting, and transitioning vehicle fleets to electric; accelerated in markets where infrastructure allows. In harder-to-decarbonise industries and rapidly growing markets, we develop localised solutions. Scope 3 emissions pose complexity: our high-efficiency motors and drives reduce energy consumption by up to 50% globally, but accounting rules count new product sales as emissions increase. Despite this, we prioritise impact: our Energy Efficiency Movement alliance (588 members, 23% from India) shares best practices to scale reductions. We uphold non-negotiable global targets but adapt tactics to local contexts like adjusting ESG communication in Sweden versus the U.S.

Q. Modern CFOs now oversee ESG, technology, and talent. How have you redefined this role?

Bernd: The CFO’s core mandate remains enabling strategic capital allocation guiding where to invest Capex, R&D, or acquisitions. But today, this expands into three pillars: First, technology stewardship, ensuring financial systems and data integrity underpin decision-making. Second, ESG integration, embedding sustainability metrics into risk and supplier assessments. Third, talent leadership, attracting digital-native finance professionals (especially in GCCs) and developing business-partner competencies. Crucially, modern CFOs must master strategic storytelling. At ABB, this includes intercultural sensitivity; leveraging our 100-country footprint to enable an open, adaptive culture.